Statistics show a sharp surge in smartphone sales in Japan and India, pushing the global average phone price beyond $400 for the first time amid a memory chip shortage impacting the smartphone market worldwide.

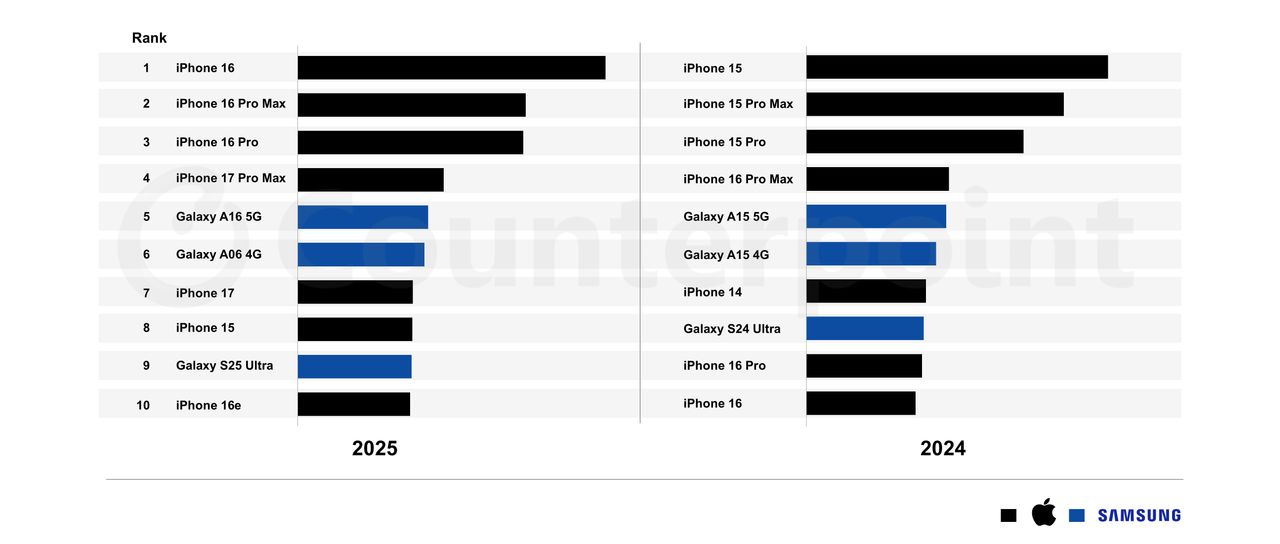

Counterpoint Research revealed global smartphone sales data for 2025, showing the market shifting significantly toward Premiumization, or higher-priced models. While the iPhone 16 and iPhone 16 Pro continue to hold the top three global sales spots firmly, Samsung's Galaxy S25 Ultra has made a new mark as the leading premium Android flagship, ranking ninth overall. Notably, the Galaxy S25 Ultra has narrowed the sales gap with the more affordable Galaxy A Series over the past year, indicating that consumers worldwide are increasingly willing to invest in advanced technology despite the higher price differences.

The success of the Galaxy S25 Ultra last year was primarily driven by strong growth in key markets such as Japan, where sales more than tripled compared to the same period the previous year.

Meanwhile, the large Indian market maintained consistent double-digit growth, helping Samsung’s S Series smartphones remain in the global top 10 for the second consecutive year. This contributed to the global average smartphone selling price in Q4 2025 exceeding $400 (approximately 13,500 baht) for the first time in mobile industry history.

Beyond changing consumer behavior, the prolonged shortage of memory components (RAM) has been another critical factor creating market disparities. Premium-focused manufacturers like Apple, Google, and Samsung have managed rising costs better than brands targeting budget smartphones because flagship models offer wider profit margins. This has lessened the impact of volatile component prices compared to European and Asian brands focusing on markets below $250 (about 8,000 baht).

The overall picture in 2025 clearly shows that demand for premium smartphones is not a passing trend but a new market norm, prompting global smartphone brands to focus more on flagship models amid ongoing supply chain constraints that hinder entry-level smartphones. This development is a key step influencing the 2026 smartphone market competition, where professional-grade technology will become central to consumers’ purchasing decisions worldwide.