“Tourism Declines” “Foreign Tourists Visiting Thailand Plunge” — These phrases may explain the situation in Thai tourism, where despite government and private sector efforts to collaborate, the overall industry recovery remains uneven. Particularly in 2024, although tourist numbers increased, total revenue fell below expectations. The fragile demand structure is evident as Thailand's heavy reliance on the main market, China—which once accounted for over 10 million visitors annually—has now clearly slowed. This slowdown is due to reduced purchasing power, budget travel habits, and fierce competition from other Asian destinations like Japan, Vietnam, and Singapore. Additionally, the Chinese government's efforts to encourage domestic tourism have significantly boosted travel within China itself.

Moreover, major markets like Russia and parts of Europe have been economically affected, leading to reduced spending. Meanwhile, Thailand faces systemic challenges such as rising prices for goods and services, safety image concerns, transport delays, and labor shortages in the service sector. These factors have prevented per capita tourism revenue from reaching targeted growth.

This article points out that, amid the slowdown of traditional markets, it is a crucial time for Thailand's tourism sector to seek new opportunities and routes, essentially 'resetting the mindset' from competing over the same tourist groups to targeting new, higher-quality markets that generate greater economic value.

Introducing GIFT+: The High-Quality Tourist Group Thailand Must Capture

the "GIFT+" group, an acronym for GIFT+ = Gulf + India + Far East Plus. This group consists of Gulf (Middle Eastern countries): Tourists with high purchasing power who spend 70–125% more per capita than the average tourist. India: Tourists from the world's most populous country.

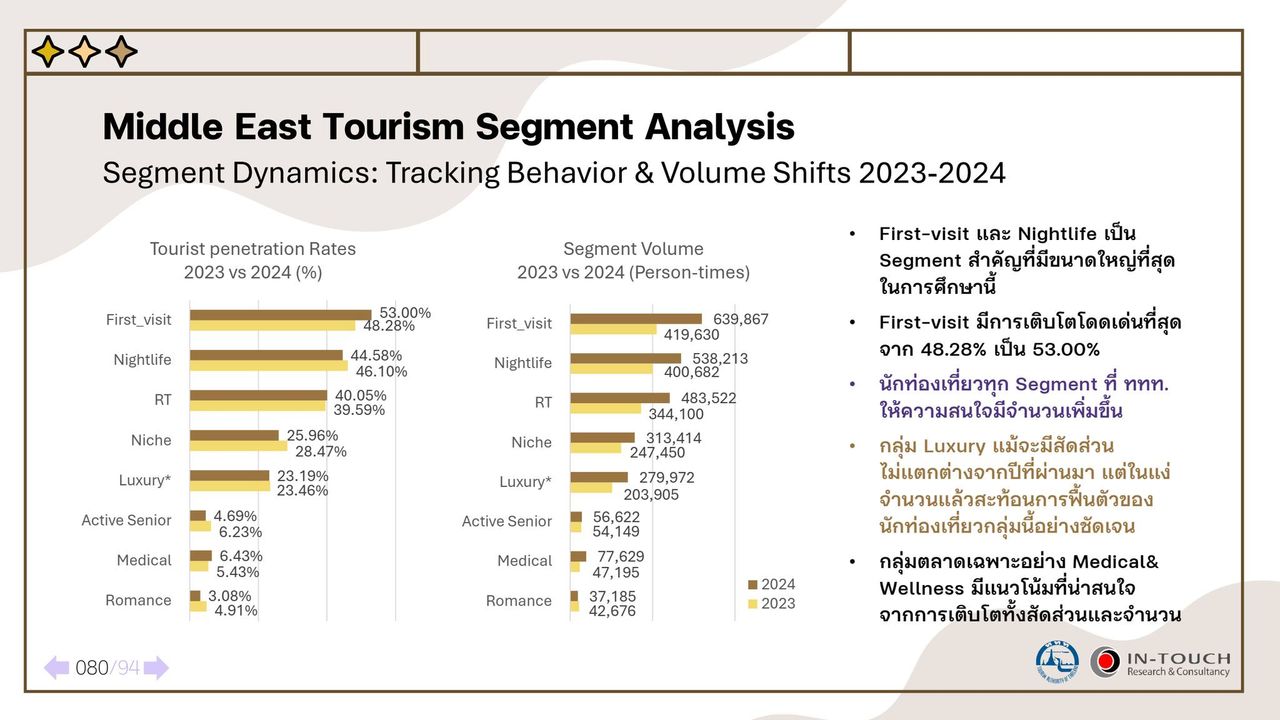

The number of GIFT+ tourists visiting Thailand during 2023-2024 is estimated at 12.2 and 18.5 million respectively, accounting for 45-50% of all foreign tourists. This shows that half of Thailand's foreign tourists are a rapidly growing, high-spending segment. Among GIFT+ tourists, one group has grown remarkably and plays a key role as the “Thailand Tourism New Curve.” Thailand's tourism sector is focusing on revenue from quality (Quality Tourism) rather than sheer volume, and that group is tourists from the Middle East (Gulf), which is replacing the Chinese market and growing faster than expected.

The "Middle East Market": The New Engine of Thai Tourism

Looking at the global market, the fastest-growing and most prominent players from 2024 to 2026 are tourists from the Middle East or Gulf Cooperation Council (GCC) countries: Oman, Qatar, Kuwait, Bahrain, Saudi Arabia, and the United Arab Emirates (UAE). This group is considered the "highest-quality" tourists overall for Thai tourism, with distinctive characteristics that businesses should understand.

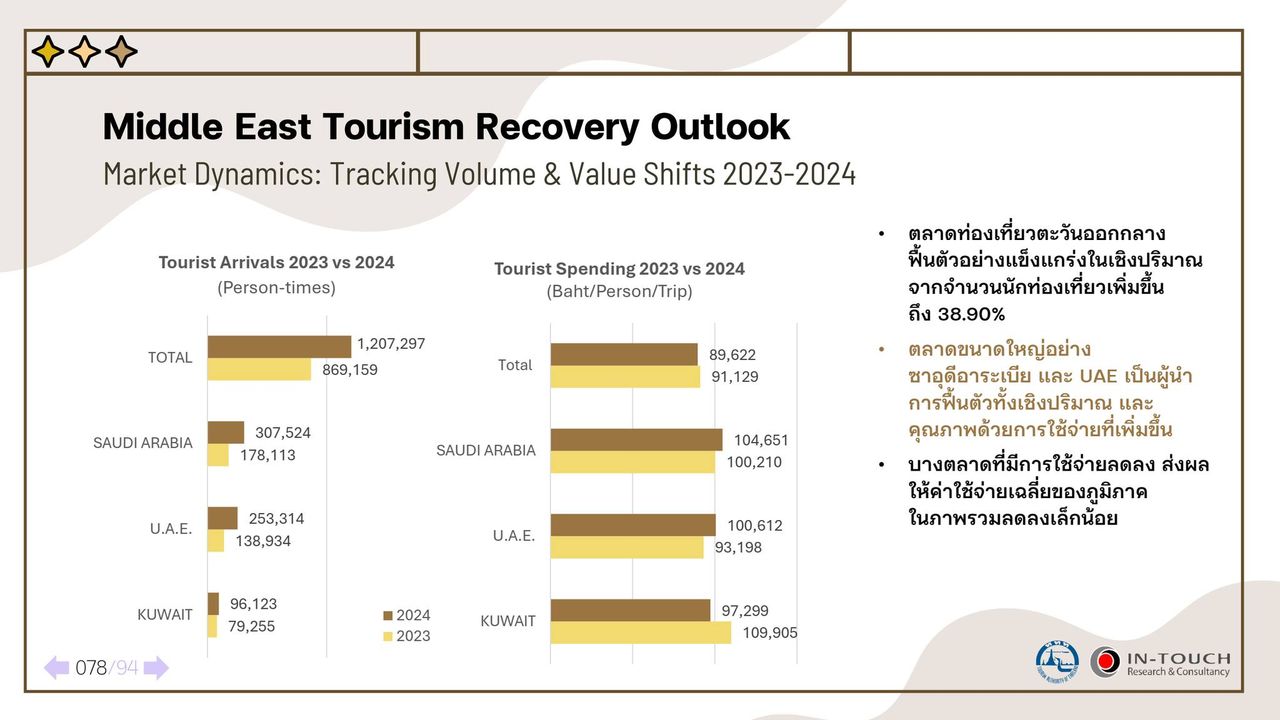

this group spends on average 2 to 3 times more per trip than East Asian tourists. Data from the Tourism Authority of Thailand (TAT) Intelligence Center shows that in 2024, Middle Eastern tourists spend an average of approximately 89,622 baht per person per trip, with the UAE, Saudi Arabia, and Kuwait leading, and UAE topping the list at about 100,612 baht per person per trip.

These tourists are family-oriented, usually traveling in groups of 5-10 people, requiring spacious, private accommodations that cater to Muslim lifestyles—such as halal restaurants, prayer spaces, Arabic-speaking staff, and family-friendly facilities focused on comfort. They typically stay in 4- to 5-star hotels or private pool villas, resulting in very high income per family.

They seek wellness tourism and have a special fondness for Thailand.

This group tends to spend on premium travel experiences, including high-end dining and lifestyle activities, especially medical and wellness tourism aimed at enhancing quality of life and long-term health recovery. Thailand is renowned for its advanced, reliable specialized medical care and holistic health services, making it a favored destination for luxury relaxation, spas, aesthetic medicine, and anti-aging treatments.

TAT aims to generate 80 billion baht in revenue.

Thailand is currently one of the top Asian destinations favored by Middle Eastern tourists, surpassing competitors like the Maldives, Turkey, and Indonesia in sectors such as wellness, medical, and luxury travel.

According to the latest data from the Ministry of Tourism and Sports as of 22 Apr 2025 GMT+7, the number of Middle Eastern tourists visiting Thailand reached 162,790, with Saudi Arabia leading growth at 15.26% compared to the same period last year. For the entire year 2025, TAT targets attracting 1.1 million tourists from the Middle East and Africa, generating over 98 billion baht for Thailand.

Following the restoration of diplomatic relations with Saudi Arabia, tourist numbers and revenue surged dramatically. Gulf airlines such as Emirates, Etihad Airways, Qatar Airways, and Saudia Airlines have expanded routes to Thailand, signaling strong long-term demand.

The Thai tourism sector has set ambitious goals to position Thailand as ASEAN's travel hub and increase tourism revenue under the policy

“Value over Volume.”

Key measures include expanding direct flight routes and increasing flight frequencies through partnerships with airlines to connect secondary cities directly to tourist destinations in Thailand. Recently, a major campaign was launched, “Amazing Thailand Grand Tourism and Sports Year 2025.”

A Memorandum of Cooperation (MOC) was signed with global partners such as Dnata Travel, a major travel service provider in the Middle East, and two leading airlines—Emirates and Etihad Airways—to expand travel networks linking the Middle East and Thailand, attracting more premium tourists. The initiative also includes organizing business promotion events, associations, and Thai operators to showcase products and services, and developing national halal-friendly standards to establish Thailand as a “Muslim Friendly Destination Hub.” In summary, although Middle Eastern tourists are fewer in number, they generate "more than double" the revenue compared to traditional main markets. Many GCC countries have average trip spending of 80,000-90,000 baht, enjoy long stays, favor high-value services, and are a customer base that helps spread benefits to secondary cities and niche businesses that Thailand aims to promote.

This all reflects that the Middle East market is no longer just a "supplementary" market but is becoming the "heart" of Thailand's new tourism strategy, essential for revenue stability, risk diversification, and driving tourism income to new highs in the coming years.

Source Information

TAT Intelligence Center , TAT Follow the Facebook page: Thairath Money at this link -

https://www.facebook.com/ThairathMoney