If one were to define the Thai real estate market over the past 1-2 years in a single sentence, it would not be an exaggeration to say, "This is the true battleground for all businesses."

From a market in Bangkok and its metropolitan area where annual sales of houses and condominiums once reached 100,000 units around 2025, actual sales figures have dropped by more than 50,000 units.

This is said to be the lowest level in over 20 years, resulting in a loss of economic circulation worth at least 100 to 150 billion baht. This impact has directly reflected in a contraction of the construction sector's GDP, an unavoidable decline amid an overall picture many describe as a "real burn" following last year's mere "false burn."

The key question is not just how the industry will move forward but also who will remain standing and who will start to pull ahead.

One of these is Supalai Public Company Limited, the top net profit earner among Thai real estate groups, which made 6.189 billion baht profit in 2024 from revenue of about 31.985 billion baht. Although profits slowed in 2025 (2.677 billion baht in nine months) due to market conditions, what’s more interesting is their "mindset" in planning for 2026.

At a press conference announcing their major 2026 business plan "Driven for Tomorrow," Dr. Prateep Tangmatitham, Supalai's Chief Executive Officer, described the 2026 economic outlook as a year of both positive signs and difficult challenges.

On one hand,

On the other hand,

Hence, the phrase for this year is that Supalai "must be accurate" in every aspect—from product, location, and price to financial management—because half of the market’s purchasing power has disappeared. Therefore, those who will succeed are not those with the most inventory but those who position their products most strategically. This has led Supalai to "choose its field" more clearly.

Meanwhile, Traitecha Tangmatitham, Managing Director of Supalai Public Company Limited, stated clearly that 2025 was truly a year of volatility—economically, in confidence, and with unforeseen events like earthquakes shaking business plans across the industry—but he believes 2026 will be different.

"The market has already shrunk. The question is how to live with it."

This is why Supalai calls 2026 the Year of Strength—not a year of hollow hope, but a year of "playing the game knowing the field size" by implementing the following plans:

On the financial side, the company still holds advantages over many competitors.

Importantly, management notes that as mid-size and smaller players begin to exit due to bond and liquidity issues, the game is shifting to those with cash and low costs.

"Strong operators will pull away from others during times like these."

"From land that once had to be fiercely competed for, now sellers are approaching us themselves."

This is a classic signal that "crisis equals opportunity" for those with strong balance sheets.

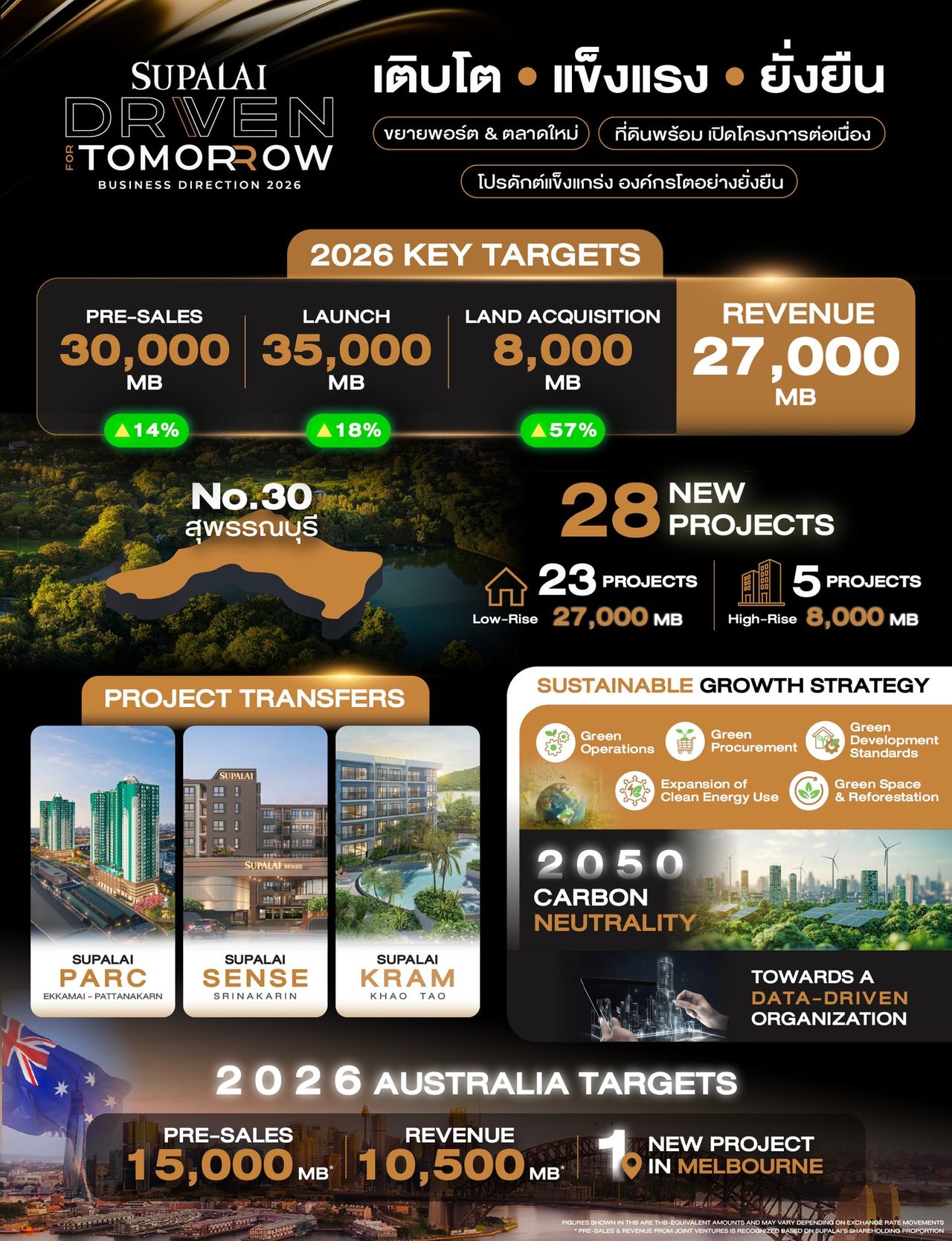

Another key move allowing Supalai not to rely solely on the Thai market is its Australian portfolio. Currently, Supalai has 25 investment projects in Australia across 4 states and 6 cities, totaling more than 176.5 billion baht, and plans to open new projects in Melbourne this year.

The sales target from Australia for 2026 is 15 billion baht, out of a total group target of 45 billion baht. The real highlight is not just the numbers but the market structure, which is completely different from Thailand due to Australia's systematic government housing support policies, such as:

The result is a continuous influx of new, low-risk demand in the market—something Thai markets lack. Veteran executive Dr. Prateep still insists that if Thailand wants to stimulate its economy, it must support the housing market. Assuming construction accounts for 10% of GDP, even a 1% increase in construction growth would significantly boost GDP because this industry employs labor, uses building materials, and has broad business linkages.

"For the six million salary earners and their families in Bangkok and its vicinity who want homes—annual sales of 100,000 units have lost 50,000 units. Valuing each unit at 3 million baht means 150 billion baht has disappeared from the economy. If the government stimulates this, it could bring back 150 billion baht to boost the economy."

In 2025, Supalai sold out 21 projects worth 35.47 billion baht, including 13 housing projects and 8 condominium projects. For 2026, Supalai targets sales in Thailand of 30 billion baht and revenue recognition of about 27 billion baht.

Follow market news with Thairath Money athttps://www.thairath.co.th/money/business_marketing

Follow the Facebook page: Thairath Money at this linkhttps://www.facebook.com/ThairathMoney