The Disneyland Thailand buzz has revived, fueled by statements from government officials and communications from the Thai embassy in the U.S. discussing the "possibility" seriously. Although Disney has yet to confirm anything, what's more interesting is the context of the Eastern Economic Corridor (EEC) infrastructure, which is gradually meeting the "criteria" used by a global company like Disney to select countries for investment or long-term licensing deals.

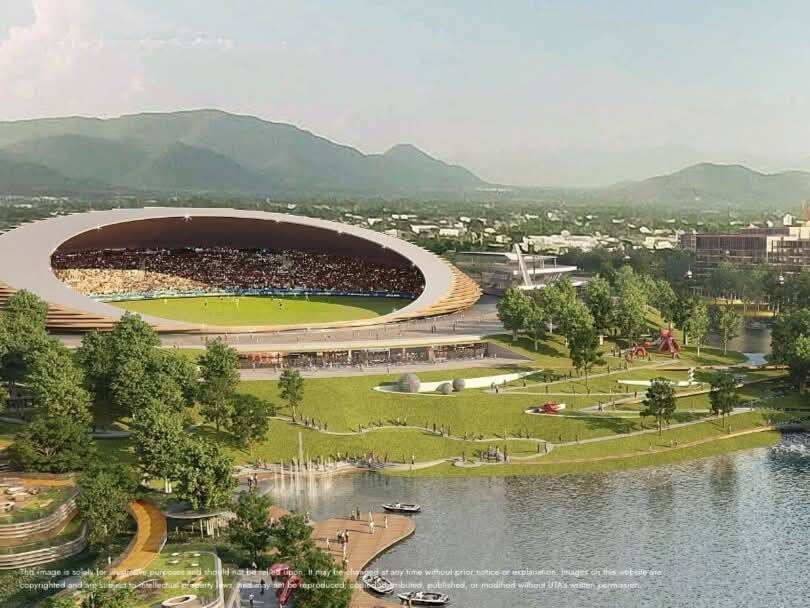

Recent remarks by Phiphat Ratchakitprakarn, Deputy Prime Minister and Minister of Transport overseeing the EEC, went beyond Disneyland as merely a theme park. He spoke of an Entertainment & Lifestyle Hub featuring a concert hall, an 80,000-seat world-class stadium, and venues for international events, emphasizing that a casino is not necessary.

Similarly, a recent post from the Royal Thai Embassy in Washington, D.C., conveyed the same message: Thailand is positioning itself as Southeast Asia's first choice for Disneyland by leveraging the readiness of the EEC area as its main selling point.

Although all this remains at the "concept" stage, analyzing Disney’s perspective reveals that the company doesn’t select countries based on aesthetics or government intentions alone. Instead, it applies mega project criteria requiring long-term payback over 20–30 years. The most important factors are population base and purchasing power within a 3–4 hour travel radius, convenient infrastructure including airports and rail systems, and large land parcels of several thousand rai with room to expand.

Also critical are political stability, intellectual property protection laws, and partnership models with local governments such as joint ventures or licensing, as Disney has used in Tokyo, Hong Kong, and Shanghai. When applying these criteria to what’s happening in the EEC, the possibility emerges.

It is well known that Thailand's eastern region will feature U-Tapao Airport as an aviation city, a high-speed rail linking three airports, motorways, a deep-sea port, and tourism hubs like Pattaya.

Recently, major investor Asset World Corp Public Company Limited (AWC) announced advancing the Aquatique project, a flagship mixed-use mega project aimed at boosting Pattaya’s potential as Thailand’s premier tourist destination. A highlight is the debut of The Ritz-Carlton hotel in Pattaya, a luxurious and modern 224-room facility covering approximately 34,505 square meters, located on a beachfront site within the 27-2-75 rai Aquatique development.

The Aquatique project also includes

On 29 January 2026, the EEC Office and U-Tapao International Aviation Company Limited (UTA) signed a joint venture management agreement to officially launch the aviation city project. UTA waived some conditions linked to the high-speed rail to enable development to begin sooner. This is a signal foreign investors often see as "infrastructure moving beyond just plans on paper."

The area attracting the most attention as a possible Disneyland location in Thailand is called EEC Capital City or EECiti in Bang Lamung, Chonburi—a new city covering nearly 15,000 rai with a project value of about 1.34 trillion baht. It is planned as a future smart business hub.

The first-phase master plan clearly allocates zones for services, tourism, sports, logistics, and mixed residential areas. This has made EECiti frequently mentioned in analyses because a key Disney requirement is a large expandable area situated in a newly designed city, not an old one.

The EECiti project is aimed at becoming the “business center of the future” or Capital City of the EEC, with the ambitious goal of ranking among the world’s top 10 most livable cities by 2037.

It also opens the door for private sector investment in infrastructure and utilities through Public Private Partnership (PPP) models, totaling over 74.465 billion baht by 2026, expected to be a pivotal turning point for the EEC.

However, a key point not to overlook is that Disney will not open a park where it would cannibalize customers from existing locations. Hong Kong and Shanghai Disneyland primarily serve the Chinese market, while a Thai park would target different demographics: ASEAN countries, southern India, the Middle East, and international tourists already visiting Thailand. This geographical distinction means Thailand "might" not overlap with Disney’s existing parks as much as some fear.

This does not guarantee Disneyland Thailand will happen, but it explains why the EEC and especially EECiti are the most discussed locations now—not due to government promotion but because the factors Disney uses to decide investments are gradually aligning here in a significant way.

The question is not whether Thailand will soon have Disneyland, but rather, if Disney seeks a new stronghold in Southeast Asia, which area in Thailand currently meets its criteria best? Many point to the new city under development in the EEC. Although still in the study phase, the possibility discussed today appears more fact-based than ever before.

Sources: eeco.or.th, UTA

Follow marketing news with Thairath Money athttps://www.thairath.co.th/money/business_marketing

Follow the Facebook page Thairath Money at this linkhttps://www.facebook.com/ThairathMoney