When mentioning sportswear brands familiar to Thai people since childhood, PUMA is likely among the first names many recall, from high-performance sports shoes like studded football boots to street-style sneakers worn casually. The leaping puma logo has become an iconic image representing speed, agility, and sportiness across many eras.

It was one of the first sportswear brands to connect "sports" with "lifestyle" ahead of others, going through prosperous times, periods of confusion, and multiple ownership changes. It is one of the most colorful brands with a rich and eventful story in the industry.

Following recent developments that shook the entire sports industry, BrandStory Column this time, I want to take everyone through PUMA's 78-year journey, from its German origins, to French ownership, and now entering the embrace of the Chinese sports giant Anta Group, which acquired a 29.06% stake with an investment of $1.8 billion, approximately 56 billion baht.

How did PUMA arrive at this point? Why did Anta dare to purchase PUMA at its weakest moment, and why is this investment more than a simple takeover but a new legendary chapter for the iconic tiger brand?

Many may know PUMA as an old sports shoe brand, but not everyone knows that PUMA and Adidas originated from the same home. Before World War II, two German brothers, Rudolf Dassler and Adolf Dassler, jointly founded their own shoe factory named Gebrüder Dassler Schuhfabrik, which means Dassler Brothers Shoe Factory, located in Herzogenaurach. However, after severe conflict, they permanently parted ways.

In 1948, Rudolf founded PUMA—initially considering the name 'Ruda' (from Rudi + Dassler) but changed to Puma to convey speed and sportiness. Adolf established Adidas (from Adi + Dassler) in 1949. Since then, two sports shoe brands were born in the same town, sparking an endless rivalry.

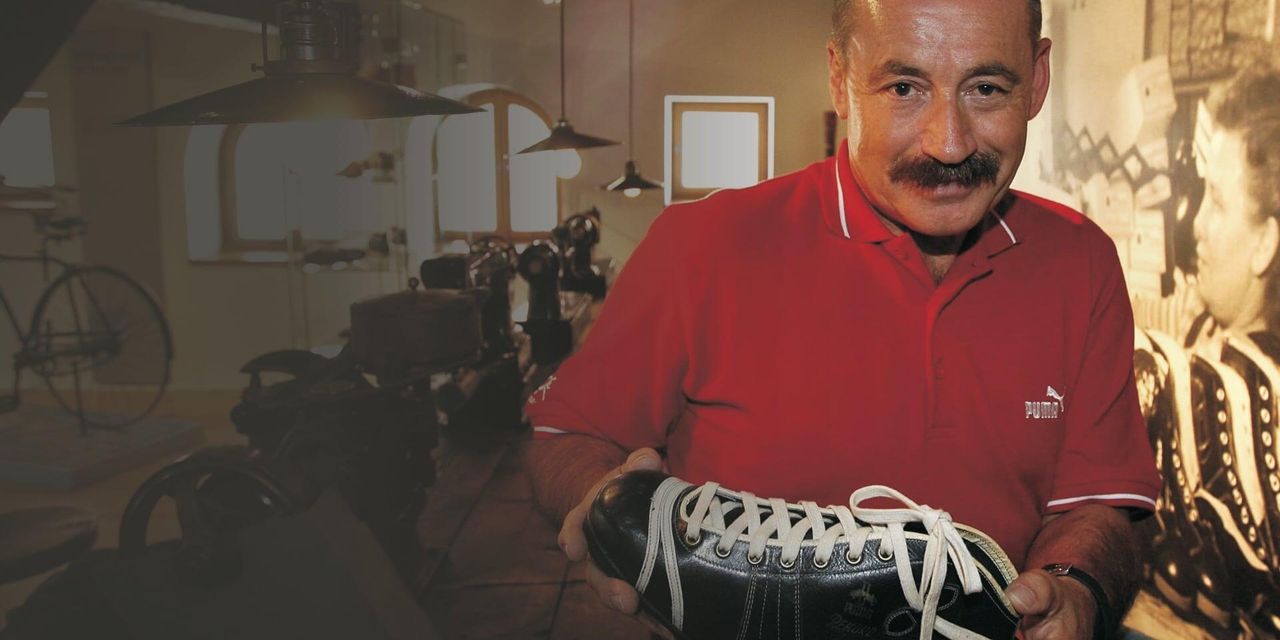

Initially, PUMA achieved great success in sports, especially football. One legendary shoe was the “Super Atom,” one of the world's first studded football boots that made PUMA well-known among professional athletes and became the brand worn by some of history's greatest sports figures, from Pelé in the World Cup to Tommie Smith, who raised the Black Power salute at the 1968 Olympics.

This era can be called PUMA's golden age because the brand was recognized for performance and was a genuine challenger to Adidas in its early years. PUMA also introduced the idea that stylish sports shoes could be worn daily by launching the "Puma Clyde" in 1973 for basketball star Walt Frazier. This marked a significant step in bringing sports shoes into street fashion and hip-hop culture, making PUMA a symbol of coolness distinct from competitors.

However, decline began creeping in the late 1980s when PUMA lost strategic direction after the death of Rudolf, with his son, Armin Dassler, taking over. At this time, the sports shoe market became fiercely competitive: Adidas grew stronger, U.S. brand Nike expanded rapidly, and Reebok's aerobics shoes gained popularity, making PUMA seem outdated.

As a result, PUMA's sales dropped, the company suffered losses, and accumulated heavy debt, leading to a financial crisis by 1992 when bankruptcy loomed. The company bore huge costs and lacked clear management, becoming a brand few wanted to wear.

Armin decided to list PUMA on the Frankfurt Stock Exchange to raise funds and stabilize the business, but it was insufficient. In 1989, the Dassler family sold PUMA shares to Swiss investment group Arosa Holding temporarily, marking the official end of the founding family's era.

After becoming a public company and recovering from the 1990s financial crisis, in 2007 the French luxury giant PPR (now Kering), owner of Saint Laurent and Balenciaga, acquired about 86% of PUMA's shares.

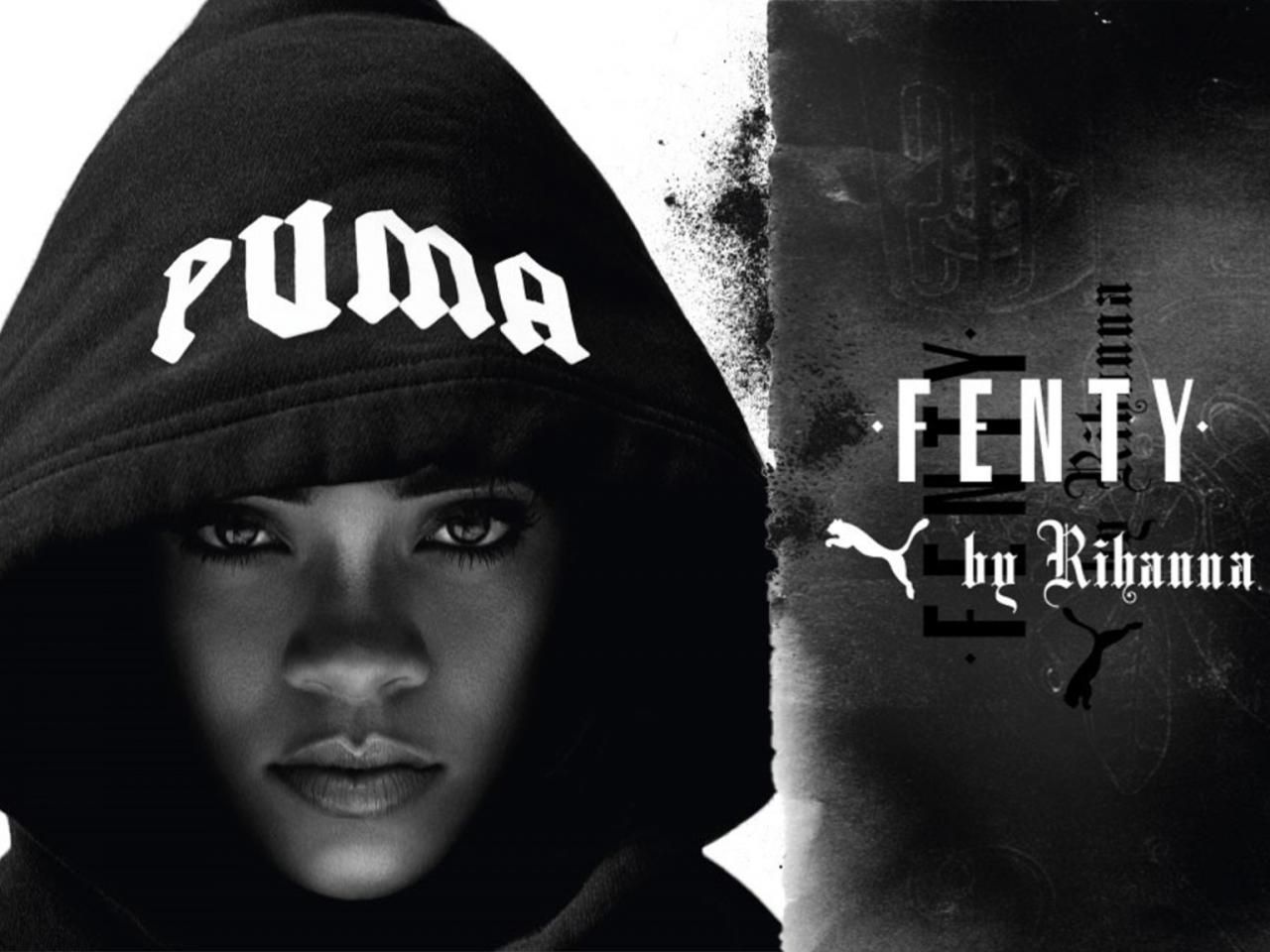

Under French ownership, PUMA was rebranded with a stronger "Sport-Lifestyle" identity. The brand shifted from competing solely on speed to entering fashion markets, appearing on runways and collaborating globally with designers like Jil Sander, and entering Formula 1. This revival made PUMA popular among urban consumers, especially after hiring Rihanna as Creative Director under Fenty PUMA, boosting sales and enhancing its luxury, female-friendly image.

However, during this period, PUMA gradually lost its "athletic credibility," leading to declining popularity and sales. Consequently, Kering decided to spin off PUMA in 2018, distributing shares back to former shareholders and partially to the parent company Artémis Holding of the Pinault family, which took about 29%. This was because PUMA could not match the profitability of other luxury brands in the group, while Kering refocused fully on luxury businesses.Artémis Holding(Pinault family investment company)

Up to this point, one may ask why PUMA needed to be sold again, despite continuous revenue growth from 2021 to 2024 (1 euro = 37.4 baht).

However, PUMA's stock price fell over 80% from its 2021 peak, reflecting the capital market's view that PUMA is losing ground in the industry—losing to Adidas in lifestyle markets, Nike globally, new brands like On and Hoka in performance, and increasingly to Chinese brands in Asia. PUMA has become a brand that is "neither here nor there" in the eyes of investors and consumers.

On 27 January 2026, Anta Group officially announced the acquisition of 29.06% of PUMA SE shares, over 43 million shares at €35 per share, from Artémis (the Pinault family's investment firm), in a deal worth approximately €1.5 billion or about $1.8 billion (56 billion baht). Since holding these shares since 2018, this acquisition made Anta the largest shareholder of PUMA immediately, marking the third ownership change for the 78-year-old German sports brand.

Anta's interest in PUMA is not new. Since late 2025, rumors circulated that PUMA was seeking new major shareholders amid slowing sales, steep stock declines, and increased competition in sportswear.

Meanwhile, the Pinault family, the major shareholder, faced its own pressures from the underperformance of Kering's luxury brands. Interested parties included Chinese companies Anta and Li Ning, Japan's Asics, and even Adidas, which might have sought to reunite with its "brother" brand.

The 29% stake is significant because German law requires a mandatory takeover offer if an investor exceeds 30%. Anta stopping just below 30% is a deliberate strategy, consistent with this leading Chinese sports group's long-standing approach.

Anta clearly stated it does not intend to spend vast sums to buy the entire company but aims to be a "strategic partner" without dominating or erasing PUMA's identity. PUMA will remain listed on the German stock exchange and operate independently to preserve its European brand image.

Regarding Ding Shizhong, Chairman of Anta Group, he said he believes PUMA's recent stock price does not reflect the brand's true potential. Anta aims to help PUMA realize its full brand potential and long heritage to create lasting value for consumers and shareholders.

Looking at Anta's real strategy, its core is not to build one giant brand but to create a multi-brand empire. Anta's network includes brands covering every global segment:

This strategy avoids internal brand competition, allowing each brand to excel in its own path. Acquiring a unique, historic brand like PUMA enhances Anta's image and competitiveness in the global performance segment.

Another main reason Anta supports PUMA is that the brand has room to grow in the Chinese market. PUMA is a legendary brand known in China but has never been seriously promoted there. Under Anta, PUMA can access retail networks and major markets like China, especially leveraging Chinese strengths in production and marketing. Anta insists it will not rush or pressure short-term sales but give management time to revive the brand properly.

Confidence in Anta is not unfounded. In 2019, when Anta acquired Amer Sports, instead of controlling it, Anta supported its growth, helping brands like Salomon and Arc'teryx flourish globally. They understood modern consumers and matched sports lifestyle trends well. This is the model Anta intends to apply to PUMA.

After the deal news was announced,PUMA'sstock, which had long slumped, surged 21% in one day—not due to changed earnings but because the market began to believe PUMA had found an owner focused on and understanding the sports brand for the first time in decades.

Anta's major shareholding is seen as more than a financial deal; it is a bet on PUMA's future, especially in the Chinese market where PUMA had weakened. The story of PUMA is now awaited by sports fans and the sportswear industry to see whether under this strong new owner, the brand's influence, sales, and image can be revived for the tiger to leap back to its peak.

Click to read the BrandStory Column for more.

Sources: Bloomberg, , Reuters, , Anta, , PUMA