Today, Phuket is no longer merely regarded as a tourist city but is being repositioned as an international strategic city on the Andaman coast. This shift is driven by megaprojects, large-scale investments, and the influx of branded residences from global luxury brands.

Research and communication data from Colliers Thailand clearly indicate that over the past five years (2021–2025), Phuket's residential market has launched over 45,066 units, with investments totaling more than 469.72 billion baht. In the past year alone, 8,372 new condominium units were introduced across 23 projects, totaling 47.35 billion baht.

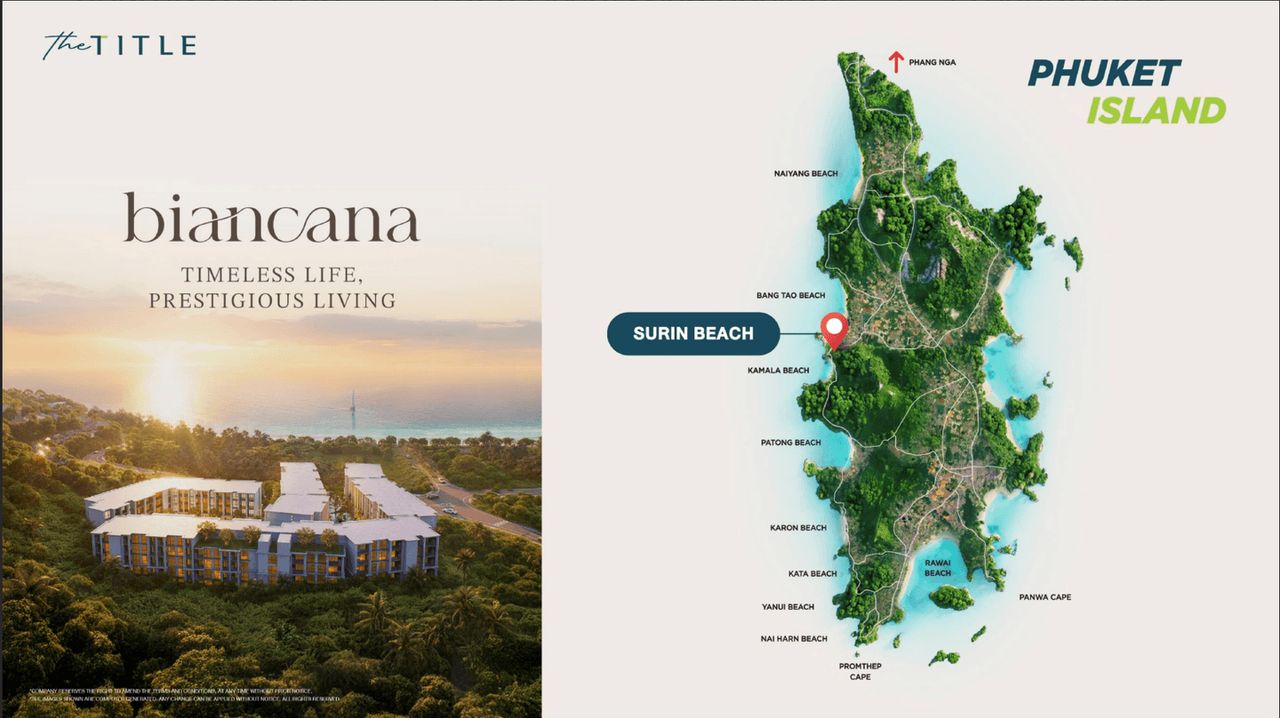

Popular locations such as Bang Tao, Kata, Karon, Rawai, the city center, and key beachfront areas have become destinations targeted by nearly every developer.

The driving factors are not short-term demand but reflect changing global behaviors. Over 10 million repeat tourists annually are transitioning into long-stay visitors and second-home owners. At the same time, 16 international schools highlight the presence of multinational families establishing permanent residence.

Colliers assesses that infrastructure support, megaprojects, and premium investments—such as the recent ICONSIAM PHUKET announcement—may push Phuket's real estate prices in 2026 closer to Bangkok's and other leading global cities. This rising city status means those who read the market early gain a strategic advantage.

While many companies were just beginning to enter Phuket, AssetWise Public Company Limited (ASW) chose a different path from the start by investing in Rompo Property Company Limited (TITLE) and becoming its major shareholder several years ago.

This was not merely an investment in a subsidiary but a connection to one of Phuket's strongest local developers, possessing land banks, agent networks, market insight, and a solid foreign customer base.

The results followed swiftly, within just over two years.

One notable strategy is a sales system that mitigates stock risk, requiring payments of 25%, 25%, and 25% before transfer, preventing units from returning to inventory as in typical developer models. While many companies are "testing the Phuket market," ASW is confident this is a primary market for the future and acts accordingly.

In a year when Thailand's economy is forecast to grow below 2%, the real estate sector faces multiple pressures including purchasing power constraints, household debt, financial institution concerns, and geopolitical uncertainties. Yet ASW has clearly announced plans to launch new projects and expand investments in Phuket.

ASW CEO Kromchet Wiphanpong views the situation differently.

"The real estate business in 2026 remains stable, continuing from the previous year. We see positive signs from improved market balance. Developers focus on managing inventory and carefully study markets before launching new projects, reducing severe price competition. At the same time, real demand purchasing power is gradually recovering."

He believes that market volatility is not a reason to stop but rather a reason to read the market more precisely than before.

ASW entered the stock market during the COVID-19 pandemic in 2021 and has grown amid ongoing uncertainty, requiring business plans to continuously assess factors such as war, trade, taxation, oil prices, interest rates, elections, and household debt.

"In a highly specialized market, developers who see opportunities and truly understand the market can still achieve strong growth."

For ASW, sustainability in the new world comes not just from launching more projects but from four main pillars.

This is why Phuket is not only a growing location but also perfectly aligns with this strategy.

In 2026, ASW plans to launch 11 new projects valued at 17.555 billion baht, six of which are in Phuket totaling 10.1 billion baht. New expanded locations include Surin Beach and Koh Kaew, in addition to main areas like Kamala, Nai Yang, Rawai, and Karon.

Highlighted projects include:

A case study showing clear demand is a 26-unit pool villa at Nai Yang Beach that sold out in two weeks. Including all new projects, THE TITLE will have 21 projects in Phuket this year, valued at over 54 billion baht, reflecting a comprehensive footprint across all high-demand beaches.

The significant difference in this game is not the number of projects but the ecosystem built around the customer. Executives point out that ASW offers not only residences but a full lifestyle ecosystem including:

All of these reflect a clear concept that ASW is not selling "units" but offering "living experiences in Phuket." At a time when the national real estate market is stable, some companies' growth arises not from favorable market timing but from having understood the city years ahead. Phuket is the clearest reflection of this today.

Follow market news with Thairath Money at:

Follow the Thairath Money Facebook page at this link:https://www.facebook.com/ThairathMoney