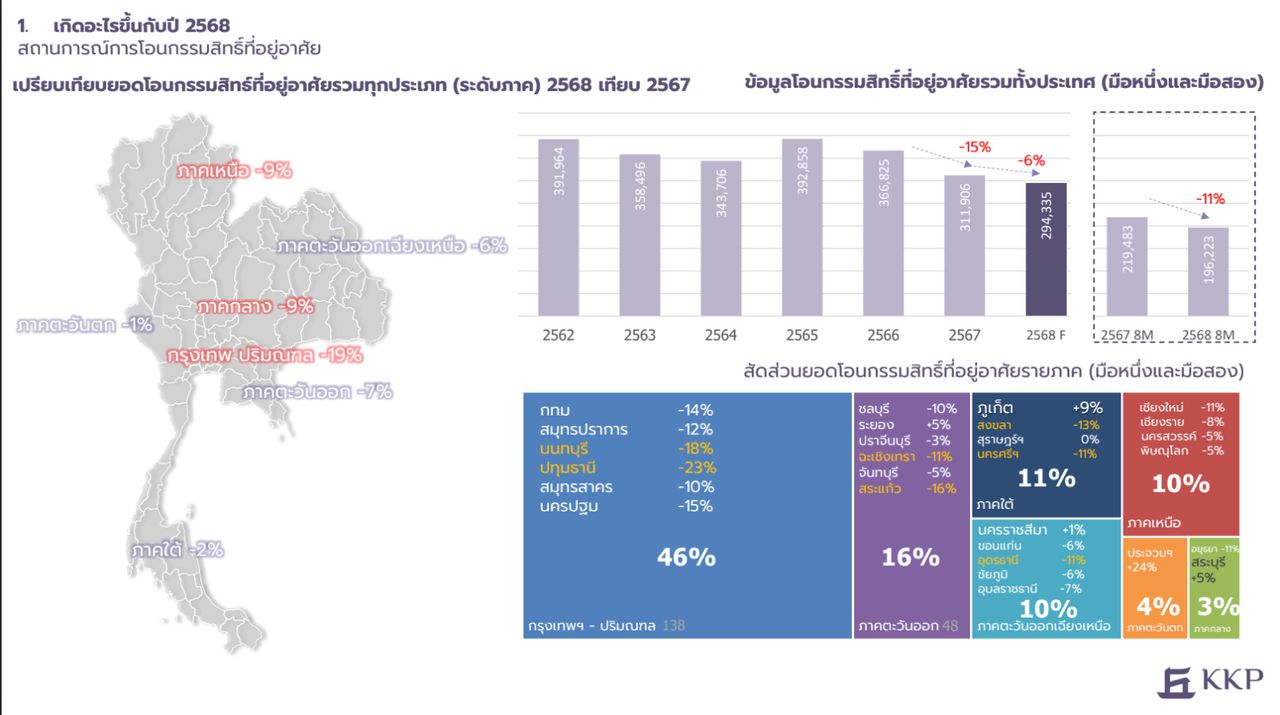

KKP Bank’s business loan division presents an overview of Thailand's real estate market in 2025 and the outlook for 2026, noting a significant downturn this year. Research data show that prior to the COVID-19 pandemic, nearly 400,000 house and condominium ownership transfers occurred annually nationwide.

However, since 2023 the market has continuously slowed, with only 311,906 transfers recorded in 2024. This year, transfers are projected to fall below 295,000 units, as only 196,223 units were transferred in the first eight months (Jan-Aug), marking an 11% decline compared to the same period last year.

Focusing on the large Bangkok metropolitan area market, total housing transfers—including new and resale homes—declined from 107,130 units in 2024 to 90,837 units in the first eight months of this year, a roughly 15% decrease. Specifically, new home sales by corporate developers fell 20%, hitting the lowest level in seven years. KKP warns this is a concerning indicator to monitor closely.

KKP’s research further identifies three major challenges facing real estate in 2025:

1. Household debt reaching a high level equivalent to 90% of GDP.

2. Accumulated housing inventory totaling approximately 220,000 units.

3. Market saturation in the luxury housing segment.

An important issue is the broader economic strain extending to lower- and middle-income consumers, including civil servants, salaried employees, and large factory workers with stable jobs. These groups are increasingly affected by organizational restructuring, workforce reductions, and cost-cutting measures, leading to a slowdown in housing purchasing power.

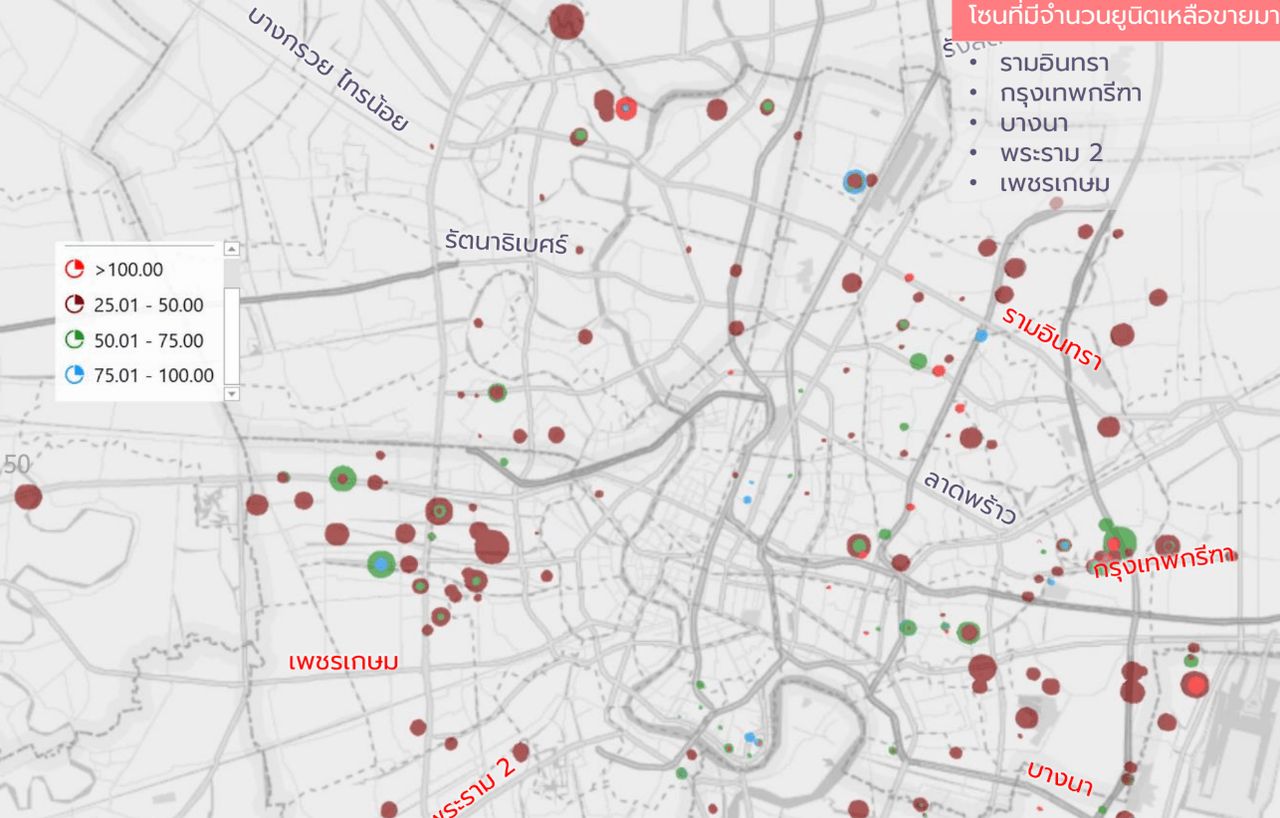

At the same time, overspending has significantly reduced home buying demand. Increased loan rejections have led to homes being put back on the market repeatedly after buyers fail to secure financing. This has caused inventory levels to rise in multiple areas. Stricter credit policies by financial institutions have resulted in the phenomenon of homes being sold multiple times, known as "failed down payment resales."

This means buyers purchase a home but fail to get loan approval, so the home is resold and the loan application rejected again, forcing repeated resales of the same unit. Some projects have experienced homes being sold three to five times. Consequently, many developers have delayed launching new projects or shifted focus to developing condominiums targeted at investors or foreign buyers.

Additionally, the luxury detached home segment priced between 25 and 50 million baht—previously considered a strong seller—now shows a significant increase in units available for sale over the past one to two years, reaching around 3,000 units. These units are expected to take 5 to 6 years to clear. Examples of locations include...

As for townhouses, substantial inventory accumulation is observed in various zones such as...

KKP forecasts the real estate market in 2026 will continue to slow, with new project launches likely to decrease steadily. The high remaining inventory indicates an oversupply condition. Nonetheless, markets reliant on real demand (actual home occupancy) are expected to slowly rebound, supported by new government measures following the recent election.

These measures will be key to revitalizing the country’s real estate sector, alongside supporting factors like large-scale infrastructure investments, which will stimulate new project development. Developers must adapt by downsizing projects to specifically target niche buyer groups to survive.

Many locations still offer growth opportunities, especially those benefiting from new metro lines such as the Purple South, Pink, and Orange lines, and areas popular with foreigners, including Ratchadaphisek, Ladprao, Sukhumvit, Bang Na, as well as tourist provinces like Phuket and Prachuap Khiri Khan, which demonstrate strong sales.

Zones with international schools, office buildings, hospitals, and shopping centers that are new or under renovation often experience surrounding business expansion and sales growth distinct from other areas.

Accordingly, KKP Bank must adjust its operational strategy. Wisarut Panyapinyopon, Director of Real Estate Business Loans at KKP, stated that overall lending to real estate developers will differ from previous years. In 2025, the loan portfolio is expected to contract about 20%, to 12 billion baht from 15 billion baht in 2024, due to market challenges and a slowdown in new project launches.

KKP’s main clients, medium and small developers, are exercising greater caution in acquiring land and starting new developments. Many are postponing project launches pending economic recovery, which is positive in terms of prudently managing risk aligned with actual market demand.

Approximately 85% of KKP’s loan portfolio to developers is concentrated in Bangkok and its vicinity, followed by Chonburi and Phuket. The condominium loan portfolio has adjusted according to market conditions and currently comprises about 15%, with the remainder in low-rise housing. The bank is balancing liquidity support evenly between small and large developers at a 50:50 ratio.

For 2026, KKP maintains a credit policy aligned with economic conditions, avoiding aggressive lending against market trends. The target loan disbursement to real estate developers remains at 12 billion baht, focusing on existing strong corporate and SME clients.

KKP works closely with clients through Relationship Managers who provide advice informed by the bank’s deep market insights. In this environment, developers must carefully select locations and design products tailored to specific demand segments, such as proximity to workplaces, schools, or major shopping centers. Projects lacking such locational advantages should consider downsizing to mitigate investment risk.

For ongoing updates on economic and government policies, visit ThairathMoney at

Follow the Thairath Money Facebook page at this linkhttps://www.facebook.com/ThairathMoney