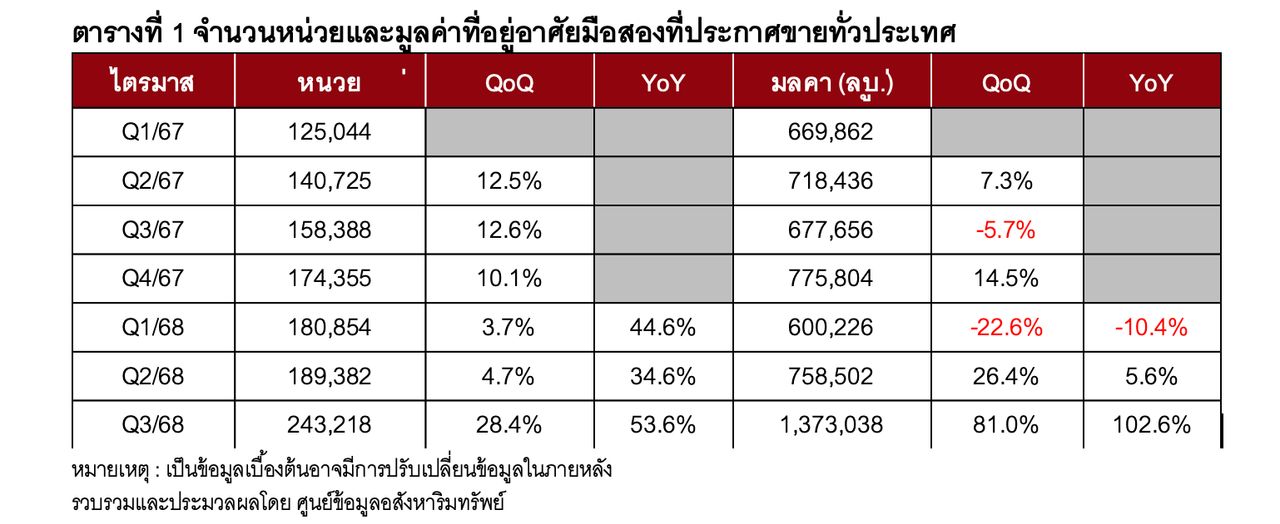

Amid economic figures seemingly awaiting recovery, the second-hand real estate market for houses and condominiums in Q3 2025, according to the latest report from the Real Estate Information Center (REIC), sends a highly noteworthy signal.

With the value of listings soaring by over 102% compared to the previous year, this figure goes beyond normal transactions and may well reflect financial strain across all levels of Thai society.

The clearest sign of this debt crisis is the surge in supply from the Department of Legal Execution (foreclosed homes), with 74,813 units listed for sale—a 55.9% increase year-on-year—representing 30.8% of all second-hand homes on the market.

This reflects "forced sales" due to long-accumulated debt problems, leading financial institutions and the Department of Legal Execution to auction off assets at one of the highest proportions nationwide, especially in the under 1 million baht price segment, which remains the only group with buyer demand.

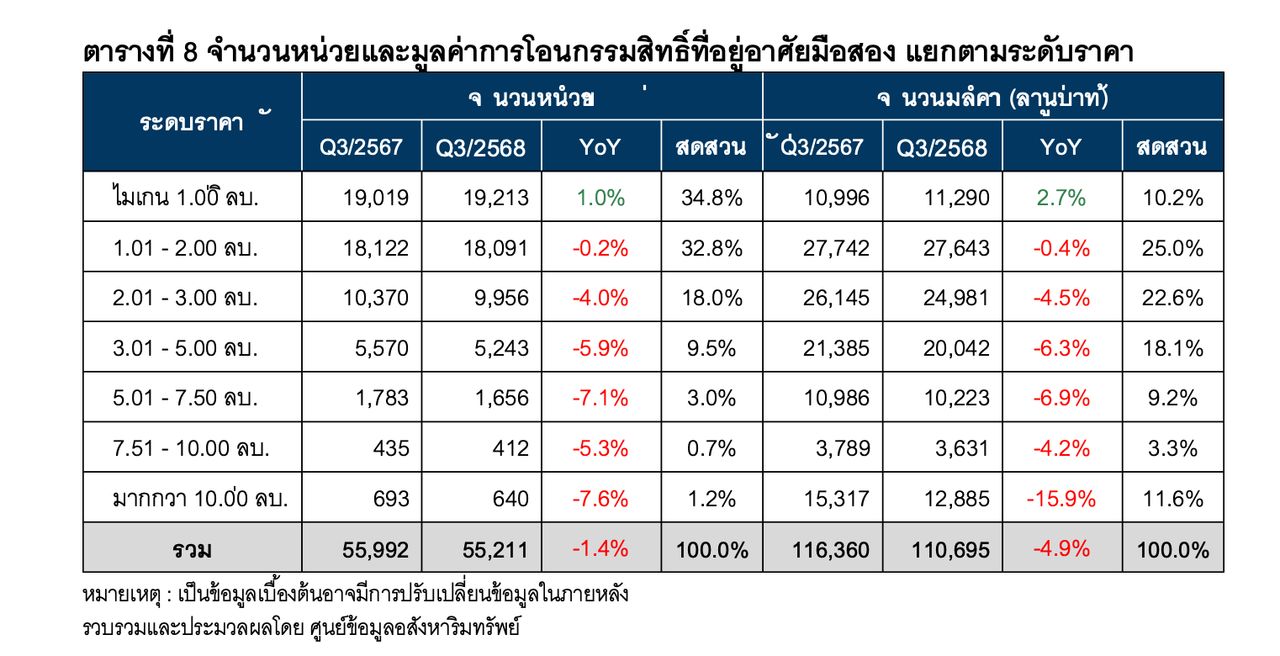

While the grassroots are forced to sell, high-income groups and investors are also facing tight liquidity. Data shows that listings for high-end homes (priced over 10 million baht) increased dramatically by 124.4%.

What is concerning is the "selling without buyers" situation, as ownership transfers for homes over 10 million baht declined by -15.9% in value, indicating the wealthy are trying to convert assets to cash but find it difficult because demand in the upper market is saturating and spending is becoming more cautious.

However, the housing type that most clearly reflects "dumping" is condominiums, with listing values abnormally increasing by 219.3%, mostly high-priced units flooding the market in significantly higher proportions.

Meanwhile, ownership transfers of condominiums dropped by -13.4%, creating an oversupply condition where owners must reduce prices or hold onto properties with difficulty.

Amid nearly all negative figures, only the price segment under 1 million baht shows increased ownership transfers—both in number of units (1%) and value (2.7%).

These numbers indicate that the real demand for housing among Thais today is squeezed by the economy to just the cheapest segment, which remains the only group able to access loans or with genuine housing needs, supported by relaxed LTV measures and reduced transfer and mortgage fees that the government is trying to uphold.

The Q3 2025 second-hand housing market situation serves as a reminder that Thailand’s economy is undergoing a major "portfolio adjustment." Bangkok has become the center of this sell-off, with listing values surging by 162.7%. The average market price rose to 5.6 million baht from 4.3 million, not due to price increases but because high-priced homes are flooding the market overall. This reflects the fragility of Thai households forced to relinquish homes for survival amid the sluggish economy.

Source: REIC

Follow economic data and government policies with ThairathMoney at

Follow the Facebook page: Thairath Money at this linkhttps://www.facebook.com/ThairathMoney