Although financial planners and experts advise salaried workers and investors to start tax planning early and gradually purchase tax-relief funds rather than waiting until the last day of the year, this allows for choosing funds that align with goals, age, and expected returns.

However, many people rush to buy funds in the final month of the year without selecting carefully. When investment advisors recommend or sell any fund, they buy it to avoid missing out on tax benefits.

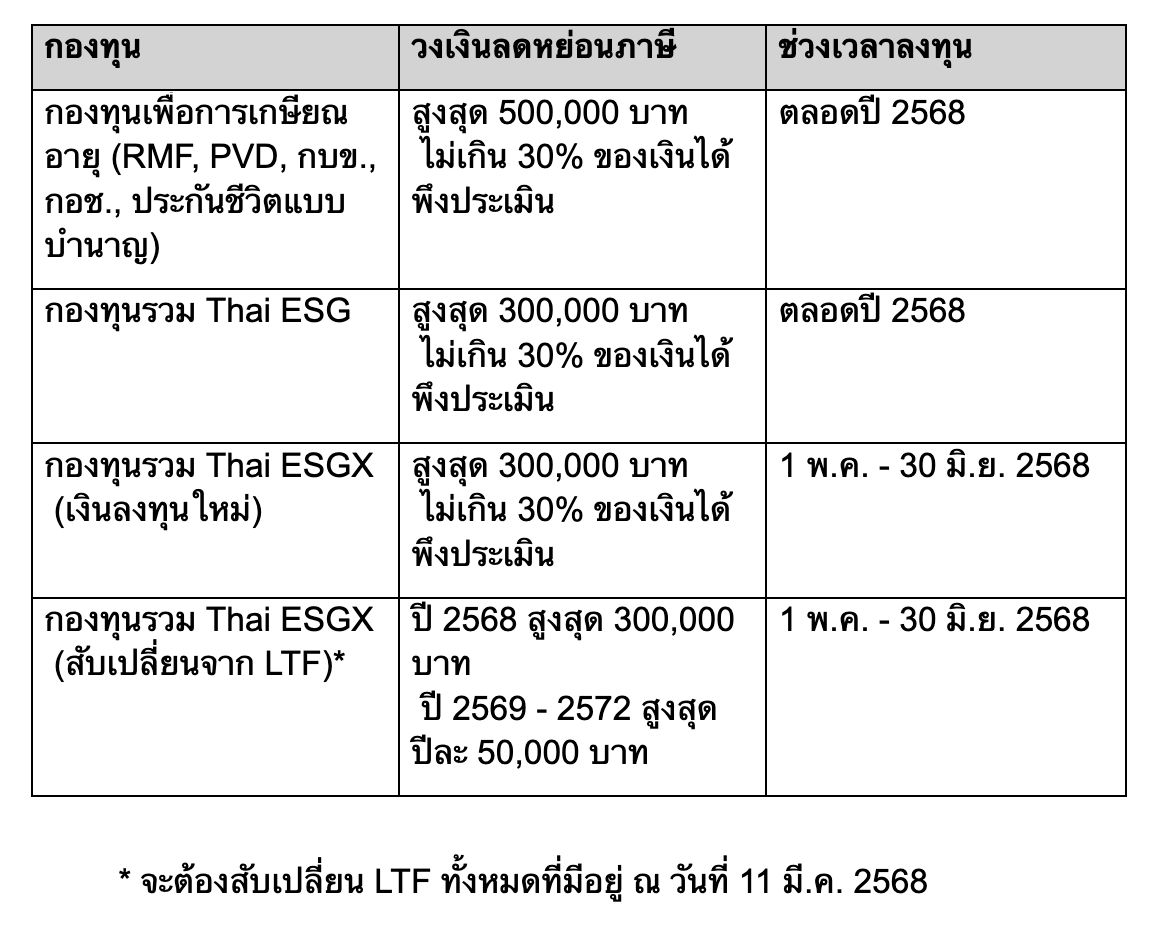

For 2025, similarly, the deadline to purchase RMF and Thai ESG tax-relief funds is 30 December 2025.

Therefore, it is important to reiterate and understand that in 2025, investors can claim tax deductions from savings and investments totaling 800,000 baht, plus up to 300,000 baht from Thai ESG mutual funds and 300,000 baht from Thai ESGX funds, totaling 1,400,000 baht in total, with eligible investments as follows.

1. Life insurance with a pension component can be deducted up to 200,000 baht. Combined with investments in Retirement Mutual Funds (RMF), Provident Funds (PVD), civil servant funds such as the Government Pension Fund (GPF), the National Savings Fund (NSF), and Private School Teachers’ Welfare Funds, total deductions can reach up to 500,000 baht, but not exceeding 30% of assessable income.

2. Investment in Thai Sustainability Mutual Funds, or Thai ESG funds, which started in 2023, can be deducted up to 300,000 baht, also capped at 30% of assessable income.

3. Special Thai Sustainability Mutual Funds or Thai ESGX (new investments) can be deducted up to 300,000 baht, within 30% of assessable income (investments must have been made between 1 May and 30 June 2025).

4. Thai ESGX funds swapped from matured LTF funds can be deducted up to 300,000 baht (invested between 1 May and 30 June 2025).

Here is a simple example shown in the following table.

This table illustrates that in 2025, investors can claim total tax deductions from savings and investments amounting to 1,400,000 baht.

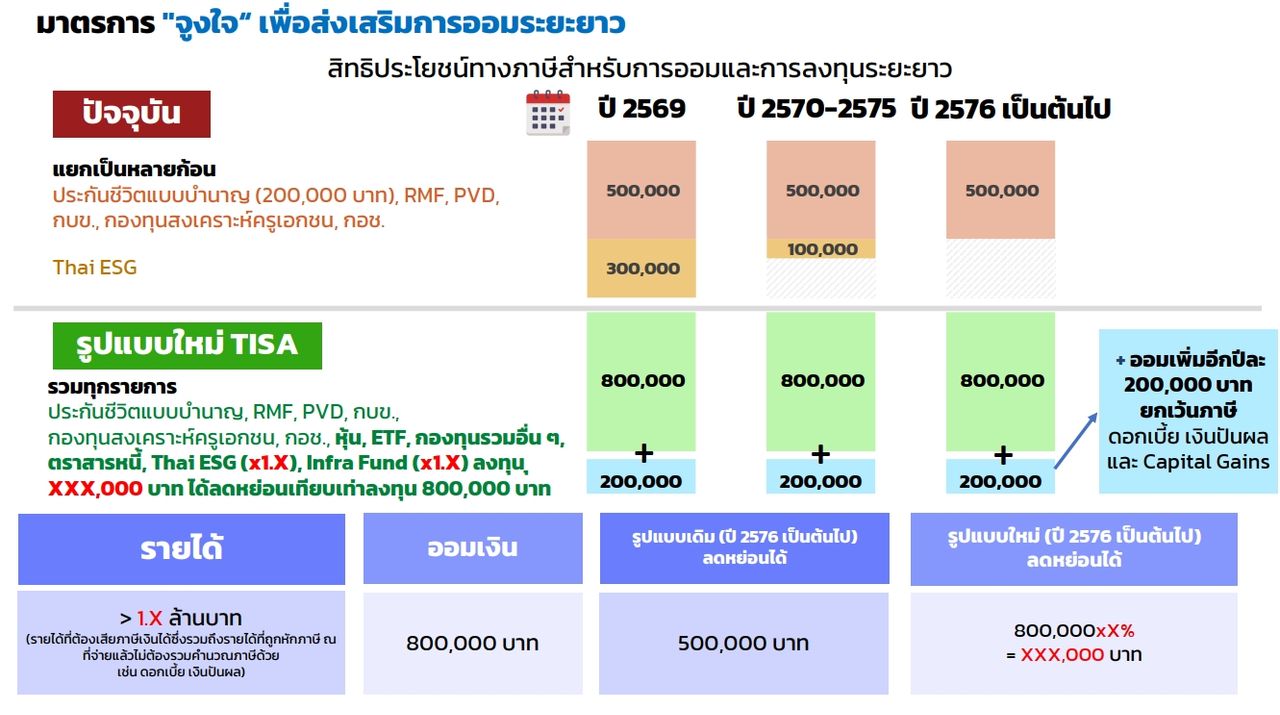

For TISA (Thailand Individual Savings Account), the government encourages investors to buy individual Thai stocks directly to promote long-term savings. Investments through TISA can be deducted directly based on actual investment, up to 800,000 baht, without needing to invest via mutual funds like RMF or SSF as before. Stocks held in TISA can be deducted up to 800,000 baht, sharing the same deduction limit as other investments such as Provident Funds, GPF, pension insurance, RMF, and Thai ESG, combined with other tax-relief funds as in points 1 and 2.

The conditions require holding securities in the account for at least five years, with withdrawals allowed upon reaching age 55. The goal is to increase direct investment capital in the stock market and promote financial security for an aging society.

Initially, the principle for personal income tax deduction is as follows.

1. For assessable income not exceeding 1.5 million baht, deductions can be claimed at 1.3 times the investment amount, up to a maximum of 1.04 million baht.

2. For income exceeding 1.5 million baht, deductions can be claimed at 0.7 times, up to a maximum of 560,000 baht.

However, these principles are preliminary and await review by the Ministry of Finance before submission to the Cabinet for approval by the end of 2025, to take effect in 2026. Due to political changes with the "Anutin Charnvirakul" government dissolving Parliament, clarity is still pending.

Finally, financial planners and experts warn that investing in tax-relief funds should not focus solely on tax benefits but also on long-term financial planning.

Selecting RMF funds for retirement should be done carefully and aligned with personal life goals. Although many funds are available, understanding investment principles and objectives is essential.

Choosing suitable funds helps investors hold them long-term to achieve good returns aligned with their goals, without worrying about losses, such as those experienced with LTF funds in the past, which caused distress for many salaried workers.

Read stock and investment news with Thairath Money at

Follow the Facebook page: Thairath Money at this link