Many have heard from various sources that 2026 will be the year of a "real burn" for the Thai economy. Every industry will be affected—government, manufacturing, food, even services. Everything will undergo a real burn in all dimensions of Thai business. In 2025, we saw warning signs from foreign policy, uncertain Thai politics, and consumers delaying spending on "non-essential" goods and services, choosing only what is "necessary," "important," and "worthwhile" in today’s era.

The question I want to pose to all family business entrepreneurs, based on over 10 years of experience advising family business strategies, is this: Is this year (2026) truly the year of the economic real burn? Or will it more clearly reflect that the businesses being burned are those in non-essential industries? And an even more important question: How can our family businesses prosper in an era where everything is volatile and directionless?

From my experience helping more than 50 family businesses with strategy, governance, structure, and succession, I want entrepreneurs to understand one principle: for a family business to prosper, it must operate in an industry with continuously growing markets, have innovation capabilities, and possess competitive cost structures.

This means our business must be in a market trend that is "necessary" for the future world, where consumers are motivated to use products or services continuously, with growth likely to increase over time. Even with short-term factors (such as Covid-19, natural crises, or conflicts between government and private sectors) that temporarily impact expansion, our business (management or existing operations) must have the capability to develop products or services that meet market demands and have resources to drive efficient, sustained growth.

Regarding capability, our organization must have skills to innovate in response to changing markets, as well as resources—management, products, and personnel—ready to meet new market demands. Costs must remain competitive, using available funds strategically for cash burn to explore new waters, markets, or funding sources, or to produce products and services that justify costs and generate profits.

Conversely, if we remain stagnant in a declining or "non-essential" industry—as reflected by decreasing purchasing power from the government sector (B2G), business sector (B2B), or consumers (B2C), along with changing regulations—such industries will inevitably shrink, forcing our business to close. Thus, current short-term factors act merely as catalysts accelerating this slowdown.

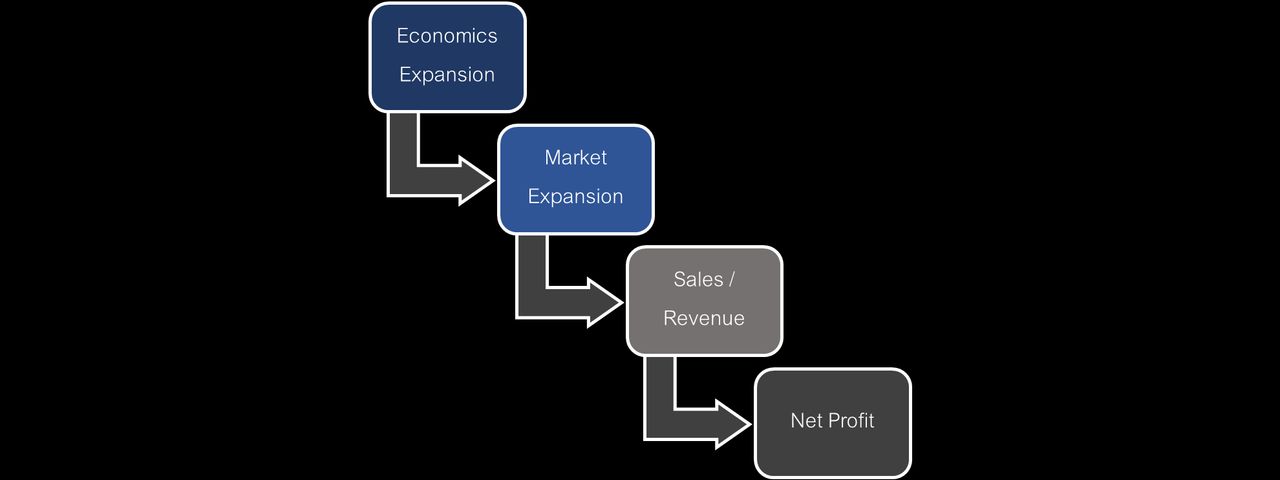

Returning to the original question: how can our family business prosper amid volatility and lack of direction? The answer is that the new world does have its directions; the question is whether our business grows with or against these trends. This can be simply assessed using four financial indicators: two external to our business and two internal.

Factor 1 (External): Economic growth rate. - Looking at the big economic picture, how is the Thai market growing? For example, Thailand's estimated economic growth rate in 2025 was about 2.2% (according to the Bank of Thailand). This is the first important benchmark to consider.

Factor 2 (External): Growth rate of the specific product or service market (Market Trend). - The year-over-year growth rate of our product or service, or compound annual growth rate (CaGR). For example, rapidly growing industries like wellness have a continuous average growth rate of 7.9% (according to Bangkok Bank's Bnomics, 2025). This is the second benchmark for businesses to analyze themselves.

Factor 3 (Internal): Sales revenue. - This can be seen from company financial statements (or consolidated group sales). Those with "two sets of books" may find this difficult. If total sales grow beyond the economic growth rate and market growth, it may be a positive sign of strong market share expansion.

Factor 4 (Internal): Net profit. - This indicator determines who will survive in the market. If your business or group’s profit exceeds the previous three factors, it reflects a trend toward building lasting wealth for your family business.

Therefore, if your business analysis of these four factors is positive, your business can create wealth for your family. If any factor, especially factors 2 or 3, is lacking, it may signal the need to diversify and expand into new areas to spread risk and build wealth beyond shrinking original markets.

Ultimately, "sustainable wealth" means continuously expanding or diversifying the business into fresh waters. Like a cake, as one slice grows, another shrinks; this is the natural business cycle. Our role as entrepreneurs and family business heirs is to adapt ourselves and our businesses to be ready for new sources of wealth consistently, rather than relying on drying wells.

Do not comfort yourself by blaming poor economy or crisis as reasons for poor sales. Such excuses are merely justifications for not changing. As a family business consultant advising leading organizations, I can say that prosperous family businesses always ask themselves, "How can our business adapt to continue meeting the changing needs of both existing and new customers?" Asking the right questions, consulting the right people, and you will find strategies to lead your family business to wealth and survive every "real burn" year.

"The most serious decision is to decide to do nothing at all."