"Money is considered a junior, gold a senior," a Thai proverb many readers have heard since childhood. It conveys a societal value placing greater importance on wealth than kinship, showing that gold has long symbolized prosperity and riches since ancient times.

However, this proverb may need updating for today's era to say, "Silver is the senior, gold the junior," because silver prices in 2026 continue to rise strongly from 2025. Since the start of 2026, silver has returned about 44.4% compared to gold's 15.5% (as of 23 Jan 2026).

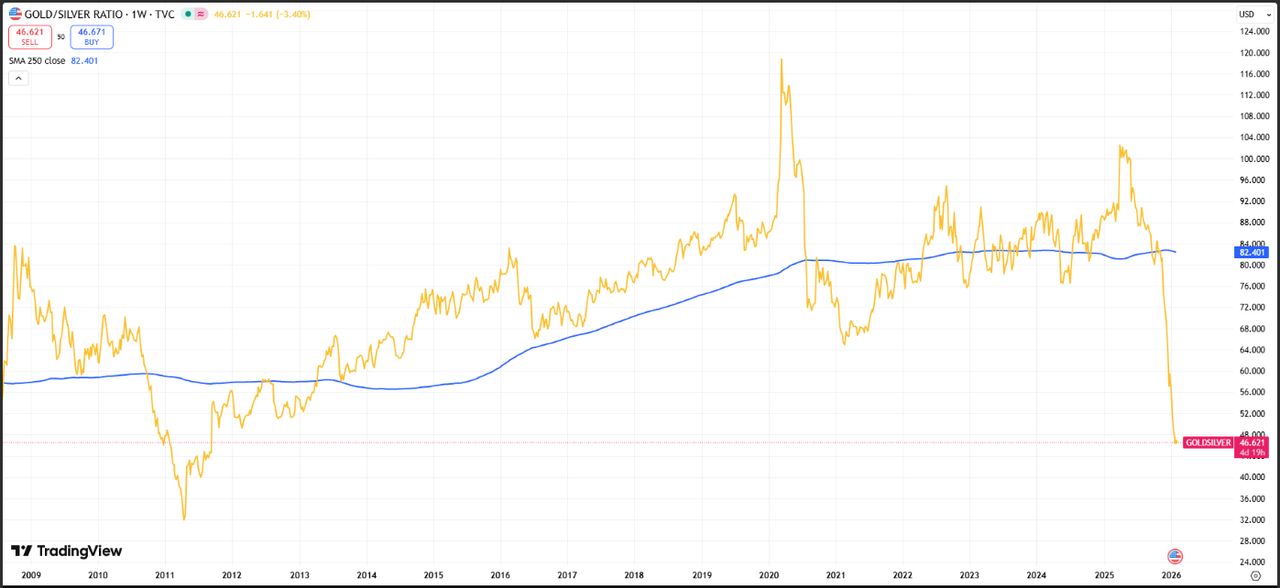

In the past, to assess the relative value of gold and silver prices at any time, the Gold/Silver Ratio was used, calculated by dividing gold's price by silver's price. Since April 2025, the Gold/Silver Ratio has dropped from above 100 times to below 50 times (as of 23 Jan 2026), the lowest level since March 2012. This rapid decline reflects a strong surge in silver prices relative to gold.

The five-year average of this ratio is around 82 times. However, historically, in 2011, it fell as low as 32 times, indicating silver still has potential to outperform gold.

Chart of the Gold/Silver Price Ratio.

In 2026, silver prices climbed to a high of $103.4 per troy ounce (as of 23 Jan 2026). This rise is supported by strong industrial demand, mainly from clean energy sectors such as electricity and electronics, as well as the AI trend, combined with speculative interest. On the TFEX market, there are futures contracts linked to silver prices available for trading and speculation, called Silver Online Futures (SVF).

The key features of Silver Online Futures are as follows:

Although silver’s recent strong price gains have made it shine brighter than gold, and many may think prices have risen too high, this does not mean silver’s outlook for the rest of the year is dim. The Gold/Silver Ratio shows that during times of high interest in silver, the ratio has dropped even lower than now, implying silver still has room to shine.

This article does not aim to predict the direction of gold or silver prices but rather to present historical data illustrating movements in the Gold/Silver Ratio and silver’s potential to outperform gold. It also highlights opportunities to speculate on silver via futures contracts and the advantages of trading these products on TFEX, Thailand’s derivatives exchange. For those interested in learning more about trading gold and silver, see the method here.https://www.bualuang.co.th/article/silvervsgold

Read stock market and investment news with Thairath Money athttps://www.thairath.co.th/money/investment

Follow the Facebook page: Thairath Money at this linkhttps://www.facebook.com/ThairathMoney