As the New Year approaches, many are likely enjoying shopping or planning holiday celebrations for their bonuses. But hold on! Pause your quick scrolling for a moment, because the bond market looks interesting right from the start of January 2026.

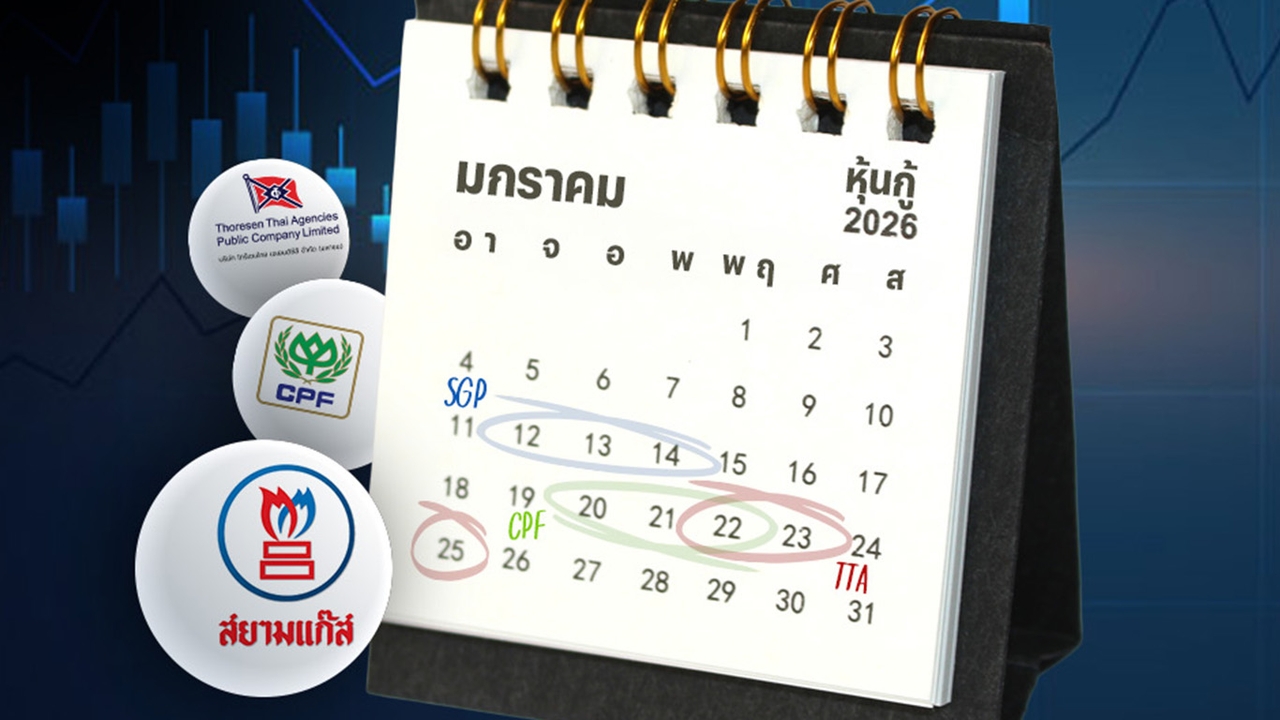

Three major companies—SGP, CPF, and TTA—are preparing to launch new bond offerings for retail investors like us to add to our portfolios. This could be a great opportunity to allocate part of your bonus to lock in long-term returns.

Thairath Money invites you to consider setting aside funds for these two deals, as the chance to lock in interest rates around 3-5% early in the year doesn't come often. Especially with global interest rates on a downward trend, holding quality bonds in your portfolio might be an appealing option.

Starting with Siam Gas and Petrochemicals Public Company Limited (SGP), which plans to issue and offer unsubordinated, unsecured bonds to the general public (individual institutional investors may apply as general investors) with the following details:

Term: 3 years and 1 month

Interest rate: 4.40% per annum, paid quarterly

Subscription period: 12-14 January 2026

Bond distribution managers: CGS-CIMB Securities (Thailand), Krungthai XSpring Securities, Krungsri Securities, DAO (Thailand), Bluebell Securities, Yuanta Securities (Thailand), Maybank Securities (Thailand), Beyond Securities, Asia Plus Securities

Bondholders’ representative: Asia Plus Securities

Credit rating (Tris Rating): Issuer BBB, Bonds BBB

Purpose: To repay debt from previous bond issuances

Next are bonds from Charoen Pokphand Foods Public Company Limited (CPF), expected to issue and offer unsubordinated, unsecured bonds paying interest semiannually, offered to the general public (individual institutional investors may apply as general investors).

These bonds are divided into three series as follows:

Series 1

Term: 4 years, maturing in 2030

Interest rate: 2.02%-2.27% per annum

Series 2

Term: 6 years, maturing in 2032

Interest rate: 2.45%-2.70% per annum

Series 3

Term: 8 years, maturing in 2034

Interest rate: 2.95%-3.20% per annum

Subscription period: 20-22 January 2026

Bond distribution managers: Kiatnakin Phatra Securities, Asia Plus Securities, Yuanta Securities (Thailand), Krungthai XSpring Securities, TMBThanachart Bank

Bondholders’ representative: Krungsri Bank

Credit rating (Tris Rating): Issuer A, Bonds A

Purpose: Pending announcement

Next are bonds from Tori-Sen Thai Agencies Public Company Limited (TTA), expected to issue and offer unsubordinated, unsecured bonds to general and/or institutional investors.

Term: 2 years and 6 months

Interest rate: 5.10%-5.25% per annum, paid quarterly

Subscription period: 22-23 and 26 January 2026

Bond distribution managers: Bluebell Securities, Asia Plus Securities, Yuanta Securities (Thailand), CGS-CIMB Securities (Thailand), Krungthai XSpring Securities, DAO (Thailand)

Bondholders’ representative: Asia Plus Securities

Credit rating (Tris Rating): Issuer BBB, Bonds BBB

Purpose: To repay debt from previous bond issuances

For more news on stocks and investments, visit Thairath Money at

Follow the Facebook page: Thairath Money at this link