At the start of 2026, global stock markets and oil prices faced strong simultaneous shocks from escalating geopolitical tensions due to US military operations in Venezuela and the firm stance of OPEC+ not to increase production.

For Thai investors, the biggest concern is likely the "refinery and energy sector stocks," which hold significant weight in the SET Index. Today, Thairath Money delves into whether this seemingly severe situation truly represents a crisis or an opportunity.

A world-shocking event occurred on the night of 3 January 2026, when the US military launched air strikes targeting multiple locations in Venezuela, especially in Caracas and strategic areas like Miranda, Aragua, and La Guaira.

The operation lasted only two hours but had global repercussions, leading to the arrest of leader Nicolás Maduro to face trial in the US. Worldwide attention now focuses closely on the verdict's outcome.

Meanwhile, the major global oil producers group, OPEC+, decided to "maintain the status quo" by suspending plans to increase oil production for another two months (February–March 2026), supporting their previously announced plan.

It is important to note that the US invasion of Venezuela directly affects refinery stocks because this business sits between crude oil and refined products. Conflict in a major oil reserve country like Venezuela directly impacts crude oil costs and refining margins, which determine refinery stock profits.

Moreover, energy and refinery stocks account for about one-third of the Thai SET Index, so even small fluctuations can inevitably affect Thai investors' portfolios.

Although war or attacks typically push oil prices up, benefiting energy stocks, analysts offer a cautious and interesting perspective in this case.

Asia Plus Securities' research team assesses that the heightened geopolitical risks from the Venezuela attack have caused short-term volatility in global risky assets.

However, the impact on Brent crude oil prices this week may be limited to a $1–2 increase, since Venezuela produces less than 1% of the world's oil, and the US has record-high production capacity supporting the market.

A bigger concern is the long term: if Donald Trump pushes US oil companies to rebuild Venezuela's infrastructure, enabling the world’s largest oil reserves there to return to the market,

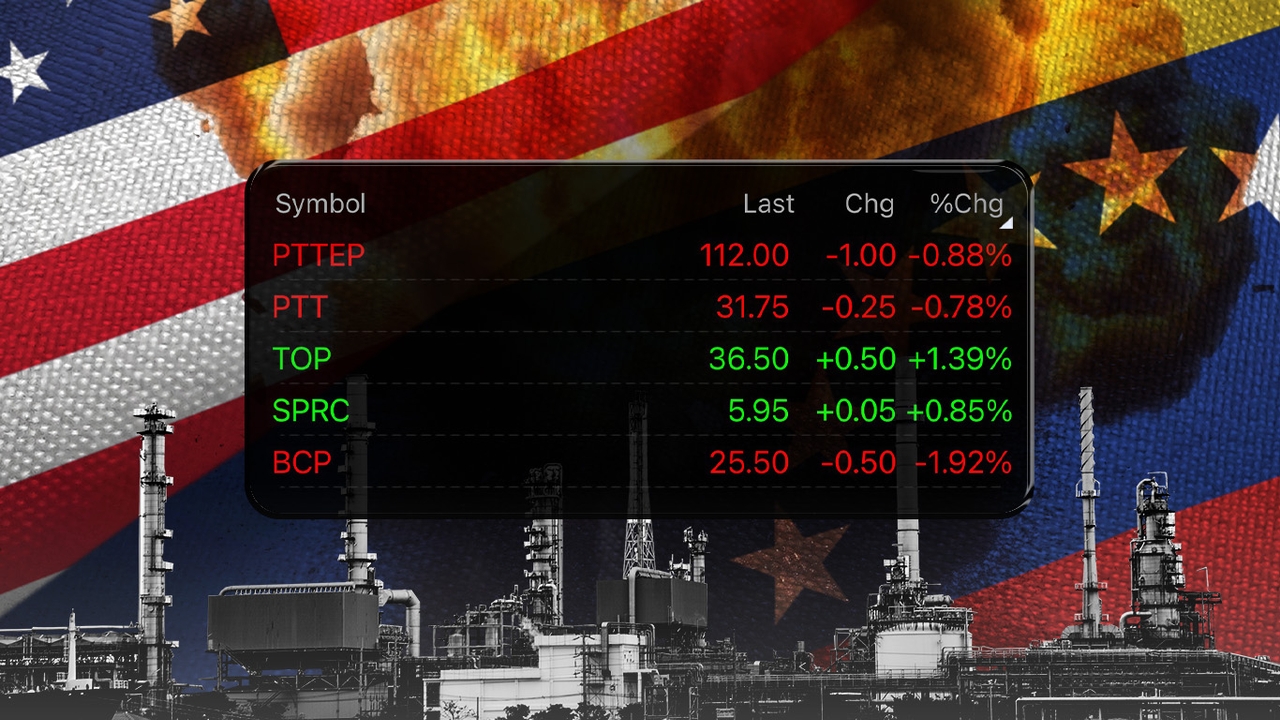

global oil prices could drop by up to 4% due to market mechanisms. For this reason, Thai refinery stocks—comprising a third of the market such as PTTEP, PTT, TOP, SPRC, and BCP—may seem unattractive in the short term.

Dao Securities (Thailand) analysts note that OPEC+'s decision to extend the production freeze until March 2026 is just following the original plan, so it did not cause a strong rally in crude oil prices.

Regarding the Thai stock market in the first week of the year, uncertainty remains. Investors are advised to focus on defensive positions and selective stock buying. If the market rallies, they can follow for short-term profits.

A safer main strategy is accumulating fundamentally strong stocks that have seen significant price drops or focusing on dividend-paying stocks, with flagship targets like PTTEP and PTT, which remain fundamentally strong.

Read more stock and investment news with Thairath Money at

Follow the Facebook page: Thairath Money at this link