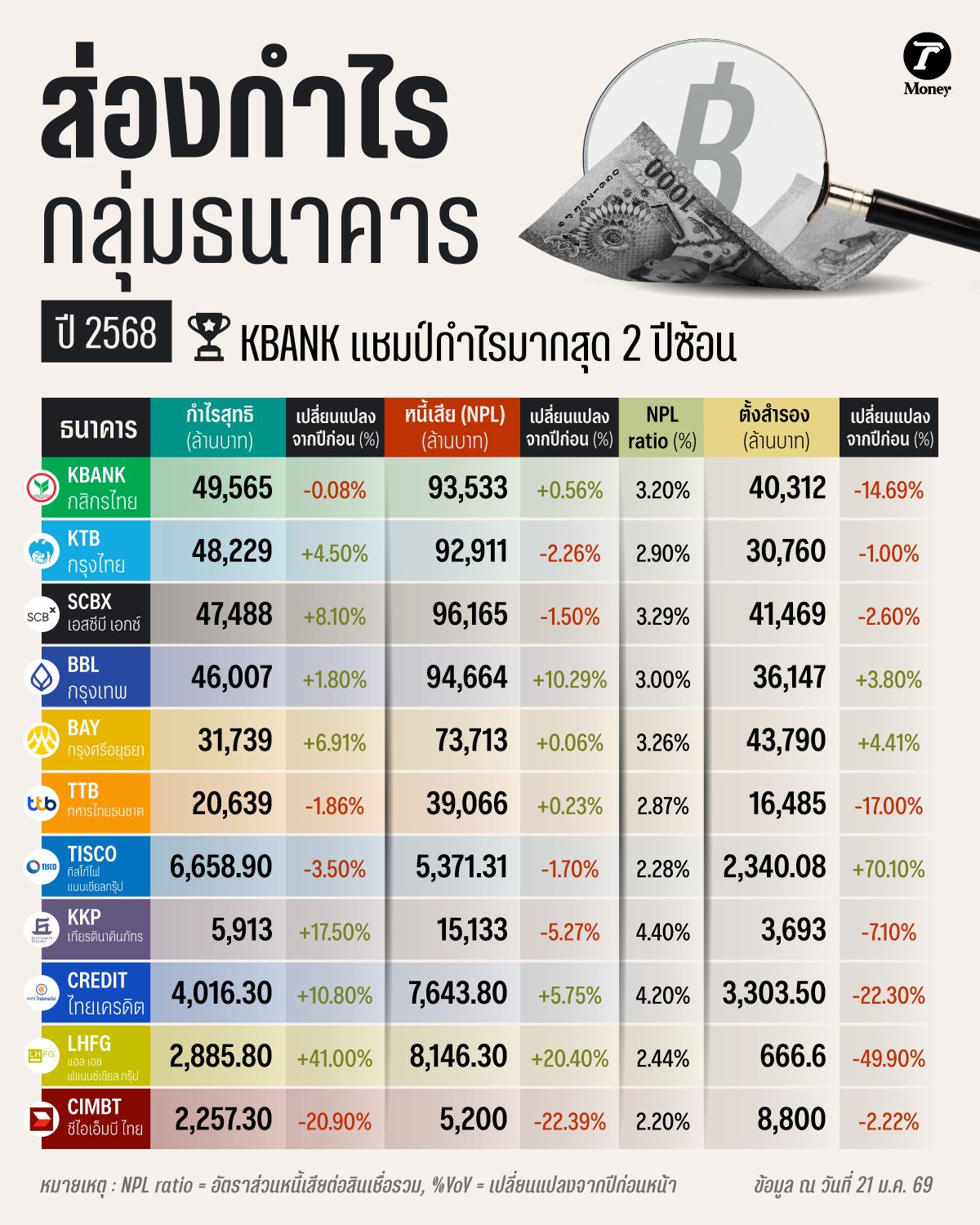

Banking Group Profits in 2025: KBANK Tops for Second Consecutive Year

The 2025 annual financial results for commercial banks have been announced amid Thailand's economic environment that continues to face multiple challenges and a downward trend in interest rates. These factors are significant pressures on the industry's ability to generate profits and manage net interest margin (NIM). The NIM is a key income measure for the banking sector.

Nevertheless, the overall performance reflects the strength of Thailand's financial institutions. Most banks have adjusted their strategies to focus on cautious growth, prioritizing customer quality over loan volume. They have also managed costs and controlled expenses effectively, enabling many to sustain themselves and achieve profit growth.

Overview of Commercial Bank Profits for 2025

1. Kasikornbank Public Company Limited (KBANK)

- Net profit of 49.565 billion baht, a decrease of 0.08% from the previous year.

- Non-performing loans (NPL) totaled 93.533 billion baht, up 0.56% from the previous year, resulting in an NPL ratio of 3.20%.

- Provisions set aside amounted to 40.312 billion baht, down 14.69% from the previous year.

2. Krung Thai Bank Public Company Limited (KTB)

- Net profit of 48.229 billion baht, up 4.50% from the previous year.

- NPL stood at 92.911 billion baht, down 2.26% from the previous year, with an NPL ratio of 2.90%.

- Provisions totaled 30.760 billion baht, a decrease of 1.00% from the previous year.

3. SCB X Public Company Limited (SCB)

- Net profit of 47.488 billion baht, up 8.10% from the previous year.

- NPL amounted to 96.165 billion baht, down 1.50%, with an NPL ratio of 3.29%.

- Provisions were 41.469 billion baht, down 2.60% from the previous year.

4. Bangkok Bank Public Company Limited (BBL)

- Net profit of 46.007 billion baht, up 1.80% from the previous year.

- NPL was 94.664 billion baht, an increase of 10.29%, with an NPL ratio of 3.00%.

- Provisions increased by 3.80% to 36.147 billion baht.

5. Bank of Ayudhya Public Company Limited (BAY)

- Net profit of 31.739 billion baht, up 6.91% from the previous year.

- NPL totaled 73.713 billion baht, a slight increase of 0.06%, with an NPL ratio of 3.26%.

- Provisions rose by 4.41% to 43.790 billion baht.

6. TMBThanachart Bank Public Company Limited (TTB)

- Net profit of 20.639 billion baht, down 1.86% from the previous year.

- NPL increased by 0.23% to 39.066 billion baht, with an NPL ratio of 2.87%.

- Provisions decreased by 17.00% to 16.485 billion baht.

7. TISCO Financial Group Public Company Limited (TISCO)

- Net profit of 6.6589 billion baht, down 3.50% from the previous year.

- NPL stood at 5.37131 billion baht, down 1.70%, with an NPL ratio of 2.28%.

- Provisions increased significantly by 70.10% to 2.34008 billion baht.

8. Kiatnakin Phatra Financial Group Public Company Limited (KKP)

- Net profit rose 17.50% to 5.913 billion baht from the previous year.

- NPL decreased by 5.27% to 15.133 billion baht, with an NPL ratio of 4.40%.

- Provisions fell by 7.10% to 3.693 billion baht.

9. Thai Credit Retail Bank Public Company Limited (CREDIT)

- Net profit increased by 10.80% to 4.0163 billion baht.

- NPL rose 5.75% to 7.6438 billion baht, with an NPL ratio of 4.20%.

- Provisions decreased by 22.30% to 3.3035 billion baht.

10. LH Financial Group Public Company Limited (LHFG)

- Net profit surged 41.00% to 2.8858 billion baht.

- NPL increased by 20.40% to 8.1463 billion baht, with an NPL ratio of 2.44%.

- Provisions dropped sharply by 49.90% to 666.6 million baht.

11. CIMB Thai Bank Public Company Limited (CIMBT)

- Net profit declined by 20.90% to 2.2573 billion baht from the previous year.

- NPL fell 22.39% to 5.200 billion baht, with an NPL ratio of 2.20%.

- Provisions decreased by 2.22% to 8.800 billion baht.

For more stock and investment news, visit Thairath Money at

Follow the Thairath Money Facebook page at this link