JMART Group Holdings Public Company Limited, or JMART shares, reported a net loss of 161.8 million baht for the year 2025, reversing from a net profit of 1,140.8 million baht the previous year. The performance was heavily pressured by numerous accounting loss items.

In particular, there was a fair value adjustment on investment properties amounting to 569 million baht, along with increased credit loss provisions (ECL) in the debt management business. Meanwhile, profit share from joint ventures slowed, especially from “Suki Teenoi,” which reported profit of 258 million baht, down 26% from the prior year.

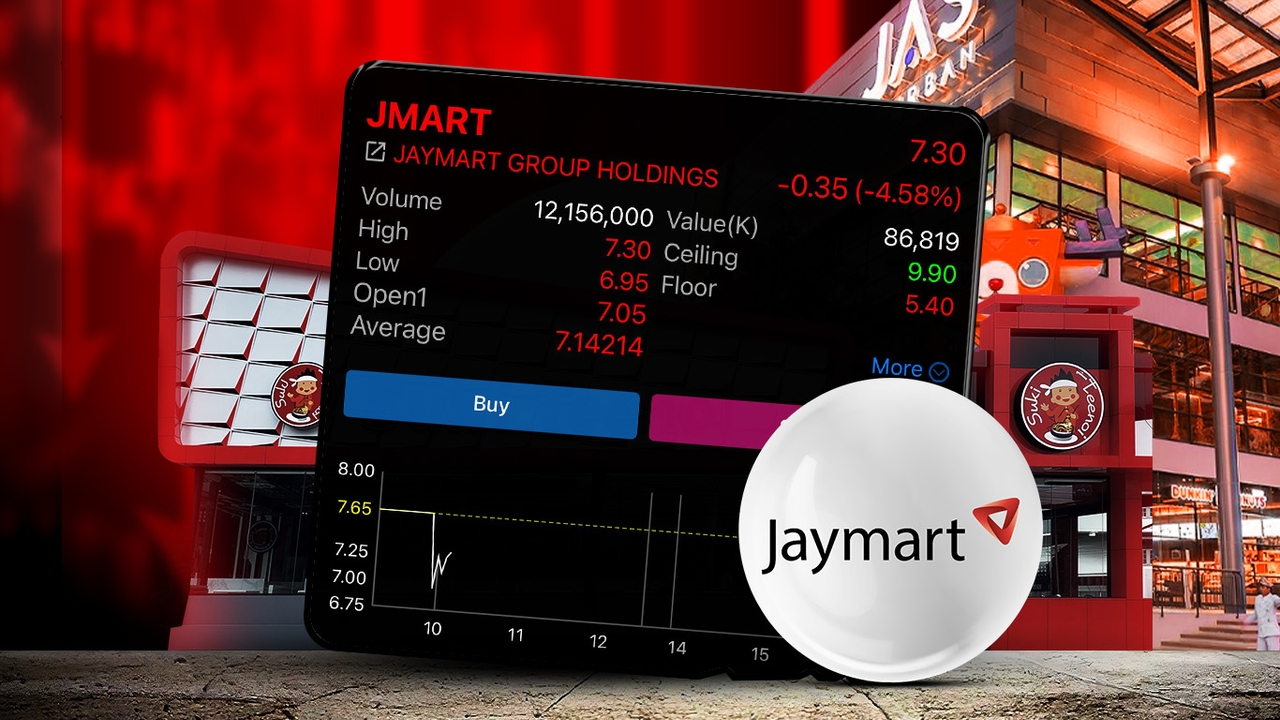

As a result, at market open this morning (12 Feb 2025), JMART shares at 10:11 a.m. were priced at 7.30 baht, down 0.35 baht or -4.58%.

For the full year 2025, the company reported total revenue of 15,402.6 million baht, up 9% from the previous year, mainly supported by mobile phone distribution business growth due to expansion of the Jaymart Network and a strategy of selling phones bundled with credit. However, the company posted a net loss attributable to shareholders of 161.8 million baht, a 114.2% decline compared to a net profit of 1,140.8 million baht in 2024.

The significant decline in performance was mainly due to special non-cash accounting items, particularly in the non-performing debt management business where cash collection slowed. This led to higher credit loss provisions (ECL) to cover future risks.

Additionally, there was a recorded loss from fair value adjustments of investment properties amounting to 569.3 million baht, along with impairment losses on land, buildings, and equipment totaling 114.1 million baht.

At the same time, the company recognized unrealized losses from financial assets (Mark to Market) of 104.2 million baht, resulting from fair value measurement based on market prices of investments at the period end. The company emphasized these are accounting entries only and do not directly affect operating cash flow.

Regarding investments, the company recognized a significant drop in profit share from joint ventures, recording only 204.4 million baht, down 55.9% from the previous year. This was mainly due to increased loan loss provisions (ECL) by JK Asset Management Company Limited (JK AMC), reducing profit shares.

For “Suki Teenoi,” under BNN Restaurant Group Company Limited, in which JMART holds a 30% stake, the company recognized a profit share of 258 million baht in 2025, down 26.43% from 350.7 million baht the prior year.

As of the end of 2025, Suki Teenoi had a total of 103 branches (including new brands Teenoi BBQ and Teenoi Gold). The company is a strong business partner with Suki Teenoi in various aspects to foster future business growth together.

A closer look at JMART Group’s business segments, structured as an ecosystem covering retail, finance, and real estate, reveals a clear divergence in 2025 performance as follows.

Read stock and investment news with Thairath Money at

Follow the Facebook page: Thairath Money at this link