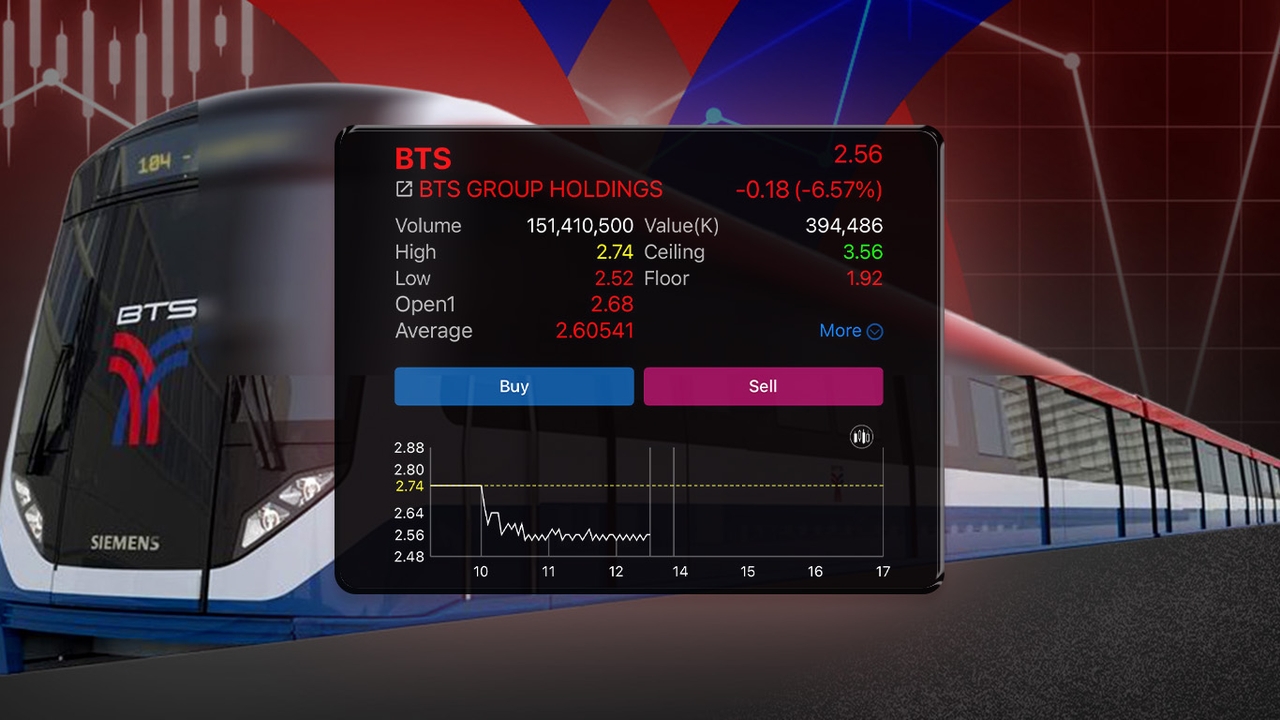

The share price of BTS Group Holdings Public Company Limited, known as BTS shares, plummeted sharply today, closing the morning session at just 2.56 baht, down 0.18 baht or -6.57% from the previous closing price.

This followed the company reporting a net loss of 958 million baht in the third quarter of fiscal year 2025/26, due to a decline in EBITDA, increased financial costs, and further worsened by the loss of interest income from Bangkok Metropolitan's outstanding debt.

Meanwhile, operations of the Yellow and Light Pink metro lines remain weak amid high financial costs, prompting the company's board to decide to suspend the interim dividend payment.

BTS Group Holdings Public Company Limited (BTS) reported its operating results for the third quarter of fiscal year 2025/26 (ending 31 December 2025) to the Stock Exchange of Thailand, stating that

the company had total revenue of 7,614 million baht, down 27.7% compared to the same period last year, and recorded a net loss attributable to shareholders of 958 million baht, mainly due to reduced EBITDA and higher financial costs.

The significant decline in total revenue was primarily due to the absence of one-time gains this quarter, unlike the same period last year which included gains from changes in investment status in RABBIT and ROCTEC valued at over 3,368 million baht.

Additionally, the company was impacted by a 638 million baht decrease in interest income, resulting from Bangkok Metropolitan completing full payment of outstanding debts related to operation and maintenance (O&M) contracts on 30 October 2025, eliminating further interest income recognition from those debts.

Core businesses MOVE and MIX remain challenged, with only MATCH helping to support performance.

Recurring EBITDA reached only 1,979 million baht, down 27.8% from the previous year, reflecting challenges in the core businesses.

Besides the revenue drop, the company faced increased expenses, recognizing a 207 million baht share of losses from investments in joint ventures and associates, mostly from losses in international schools and operations of J Mart Group Holdings Public Company Limited (JMART), coupled with rising financial costs.

For the nine-month period of fiscal year 2025/26, BTS reported total revenue of 21,847 million baht, a slight increase of 2.9% due to consolidation of new subsidiaries, but higher financial costs and tax expenses led to a net loss attributable to shareholders of 1,085 million baht.

Following these results, the company's board meeting on 13 February 2026 resolved to "suspend the interim dividend payment" for operations from 1 April 2025 to 30 September 2025.

Analysts at Bualuang Securities Public Company Limited indicated that BTS Group Holdings' core business performance in Q4 2025 (January–March 2026) is expected to decline from both the previous year and the prior quarter, due to decreased revenue from MOVE business, lower interest income, and seasonally higher selling and administrative expenses.

They raised the net loss forecast for 2025 to 2,021 million baht (up from 751 million baht), reflecting disappointing Q3 2025 results and weaker expectations for Q4 2025.

However, the weak Q3 2025 performance may lead to short-term negative market sentiment and an uninspiring outlook for Q1 2026. With no clear price catalysts, they recommend "hold" with a target price of 5.40 baht.

Within the transportation sector, they prefer Asia Aviation Public Company Limited (AAV) due to strong expected results in Q4 2025 and Q1 2026 supported by Thailand’s high tourism season, and Bangkok Expressway and Metro Public Company Limited (BEM) for its strong profit outlook.

Read stock and investment news at Thairath Money

Follow the Facebook page: Thairath Money at this link