Investment is the most crucial "leg" of Thailand's Social Security Fund, and currently, this leg is under the harshest societal scrutiny in decades. Controversies have arisen over funds being invested in assets perceived to yield low returns, such as the overpriced old SKYY9 Centre building and the unleased TU DOME.

The question is not just whether these investments were right or wrong, but what mindset governs the management of this 2.8 trillion-baht fund. Reviewing the Social Security Fund's portfolio over the past 35 years reveals a nominal growth of +65%, but when converted to annual returns, it averages only 1.44% per year—below Thailand's inflation during many periods.

This leads to a fundamental question: "If the fund continues to yield returns at this rate, will insured persons’ pensions truly suffice through their lifetimes?"

At the "Looking Ahead: Investing in Social Security" seminar organized by the Progressive Social Security Group, economists and financial experts intensely analyzed the "fate" of our collective contributions. They sought to answer whether the money we contribute monthly is growing for retirement or dwindling toward bankruptcy within 25 years, as predicted by various economists.

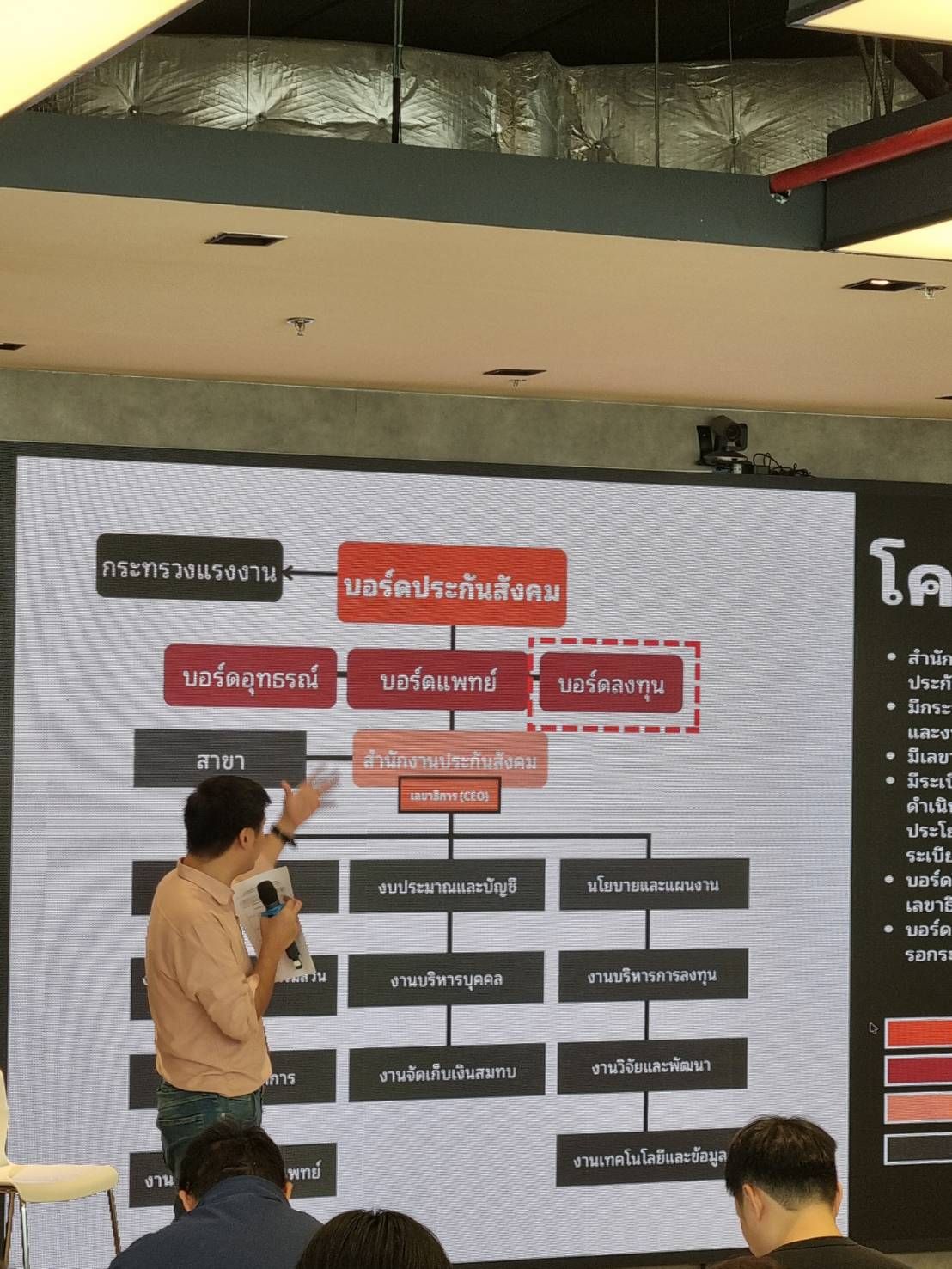

One major "knot" hindering the Thai Social Security Fund’s agility is its structure, which remains 100% tied to the bureaucratic system. Currently, the Social Security Office (SSO) holds the status of a "department" under the Ministry of Labor.

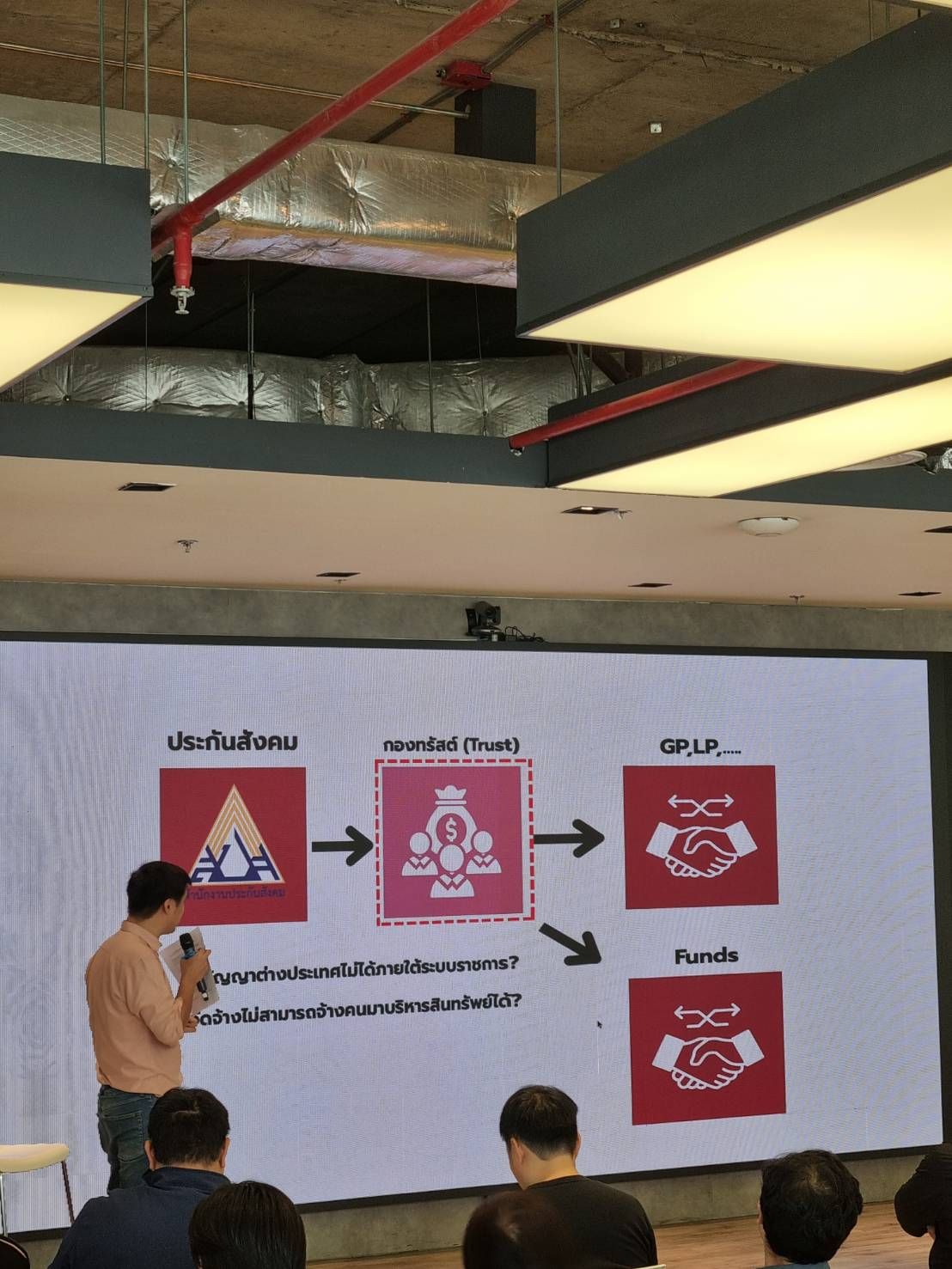

Associate Professor Dr. Sattharam Thammabusadee, a Social Security board member representing insured persons, highlighted the contradiction that past investment decisions were made by rotating civil servants rather than by international-level investment experts. This results in procurement delays, preventing the fund from contracting global asset management firms or foreign funds (GP/LP) efficiently.

This excludes administrative expenses spent on "tailoring suits, making calendars, and renovating cafeterias," which, if saved, should instead flow back into the investment portfolio to generate higher returns for the insured.

"Each year, the fund receives over 200 billion baht, sourced from employees contributing 5% (on a 15,000-baht base), employers matching 5%, and the government adding 2.75%. These contributions fund seven benefit types and pensions totaling around 20 billion baht, with the remainder flowing into investments. Unlike other government budgets, any surplus goes to the central fund for further investment. Therefore, savings on expenses like cafeteria renovations, calendar production, or staff tailoring should increase the investment portfolio’s size."

Examining the 2.85 trillion-baht portfolio at the end of 2025 reveals the fund’s extreme "play-safe" investment approach.

Although cumulative profits appear high at 1.1 trillion baht, calculating average returns over 35 years shows growth of only 1.44% annually.

Financial experts unanimously agree this is "below the inflation rate." If the fund continues with this formula yielding less than 2% profit, Dr. Kobsak Pootrakool and several academics warn that amid an aging society with fewer contributors and more pensioners, insolvency could occur by 2051—only 25 years away.

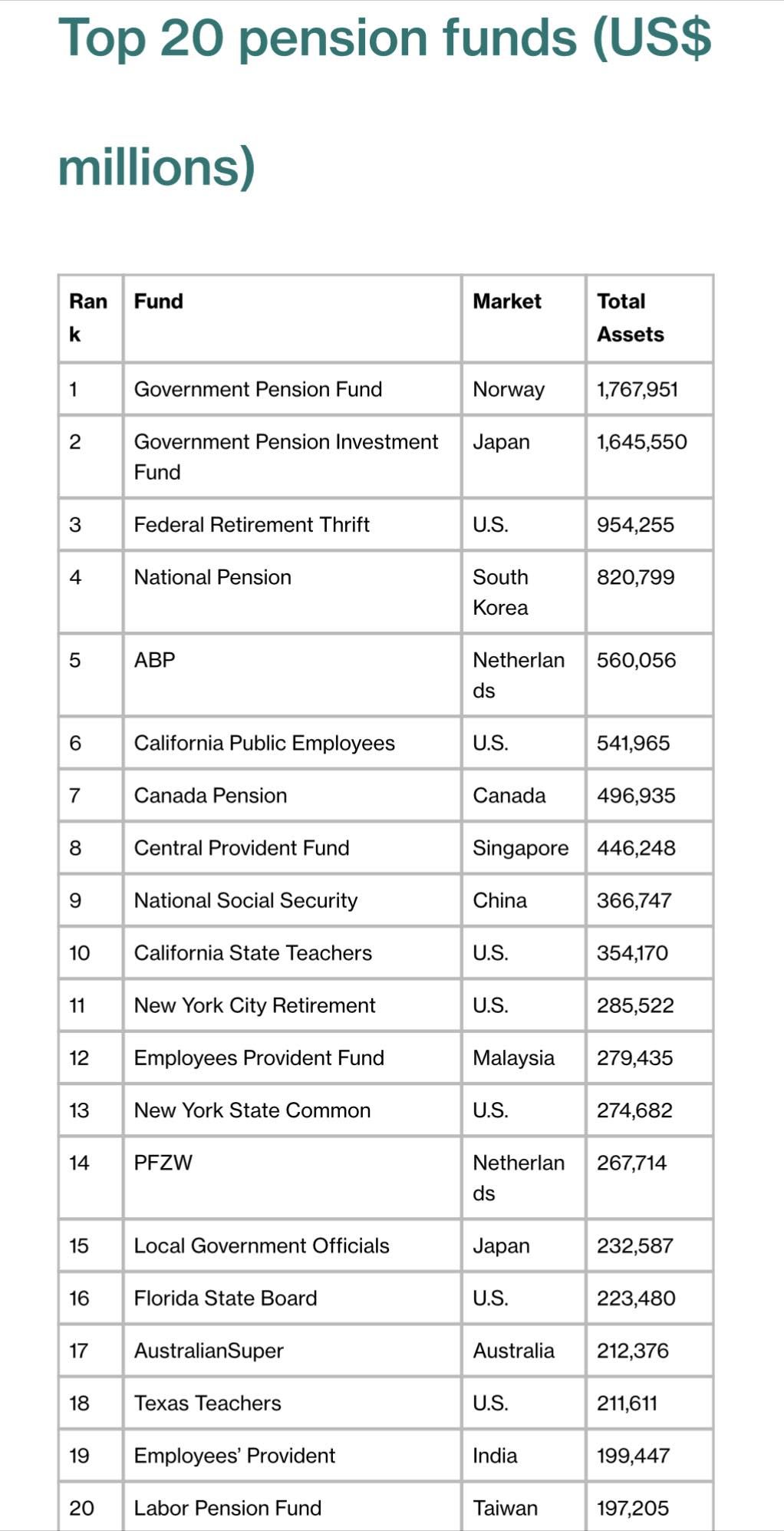

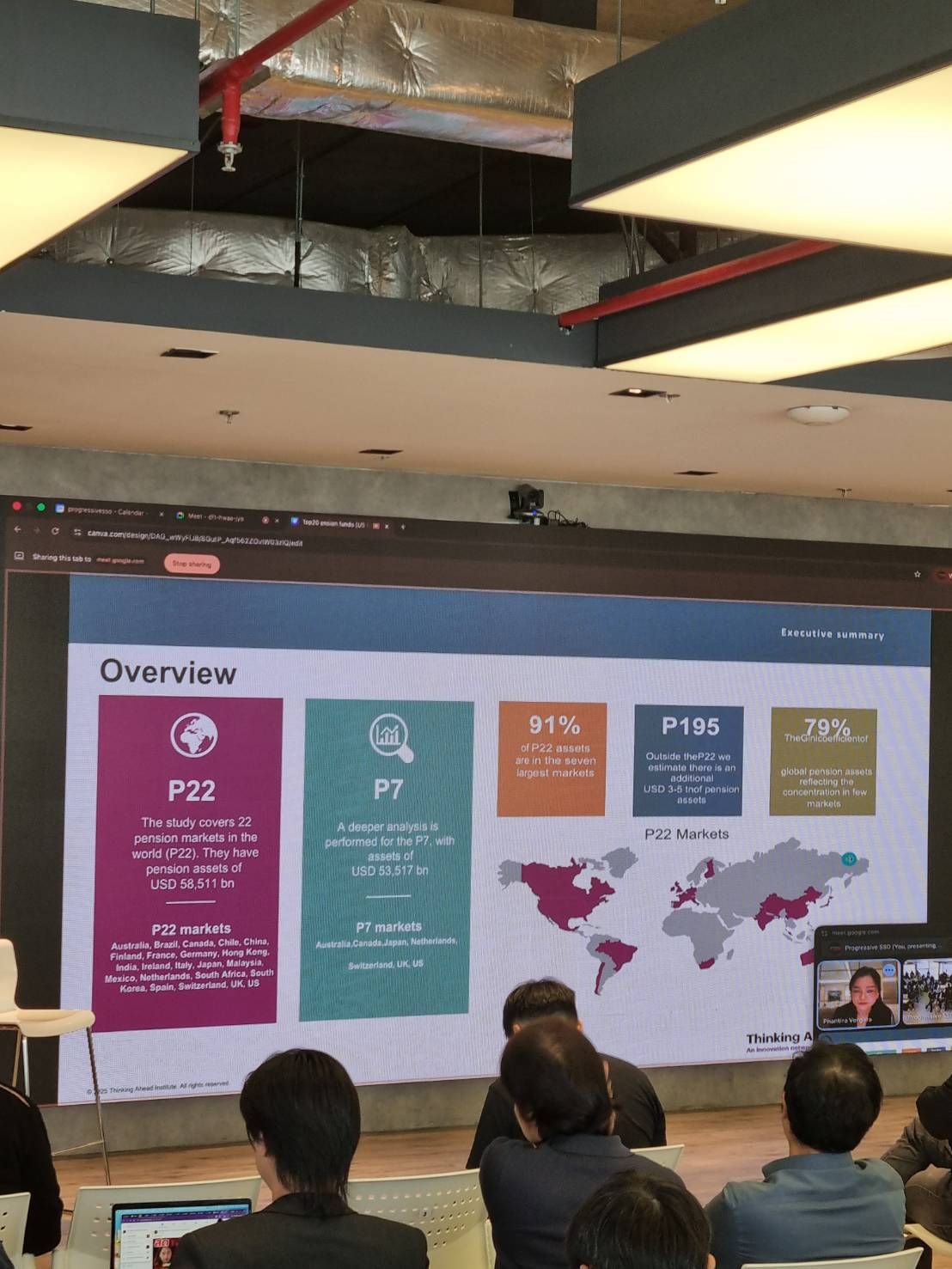

While Thailand remains concentrated in domestic stocks, leading global pension funds have taken a radically different approach.

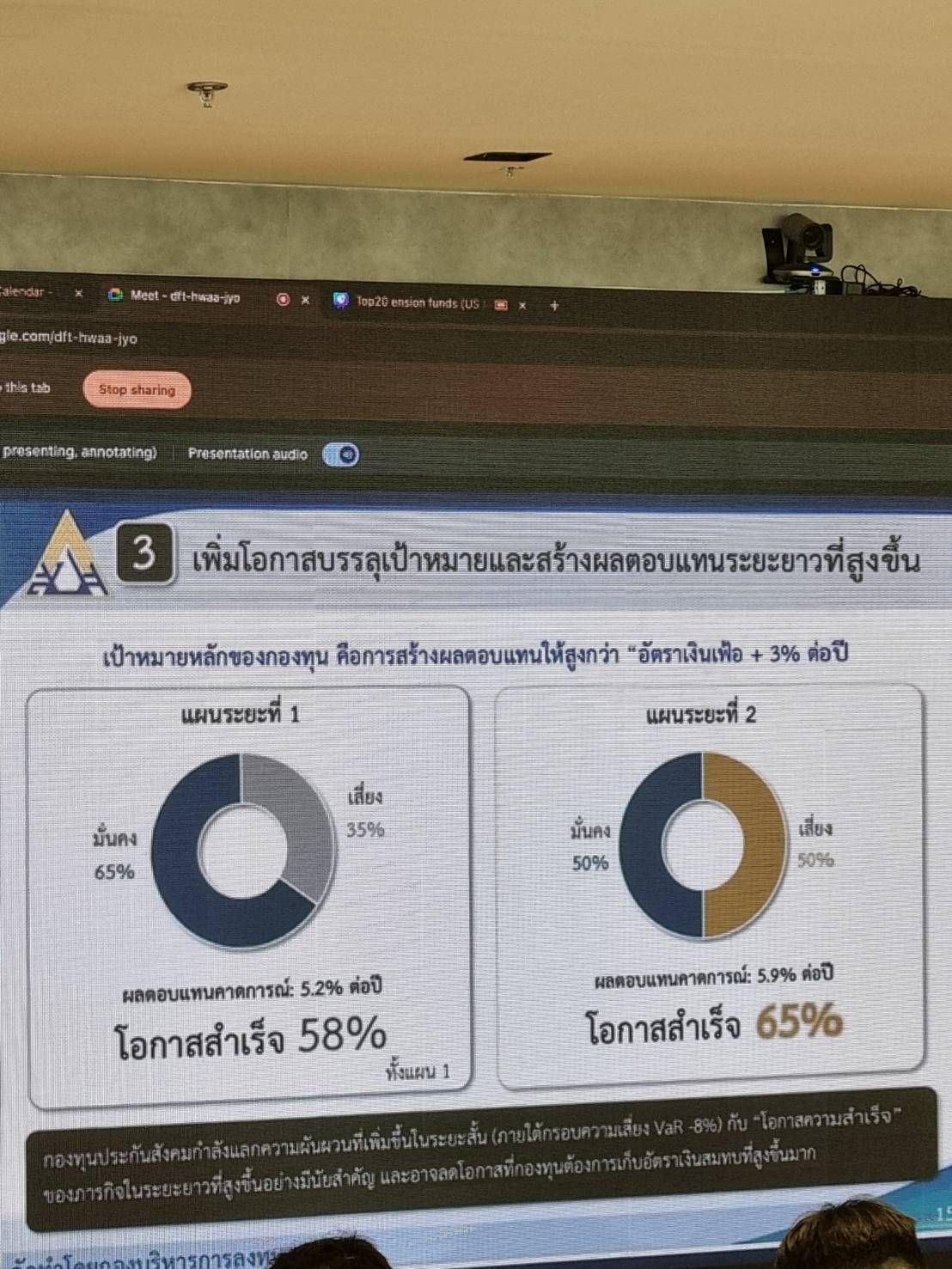

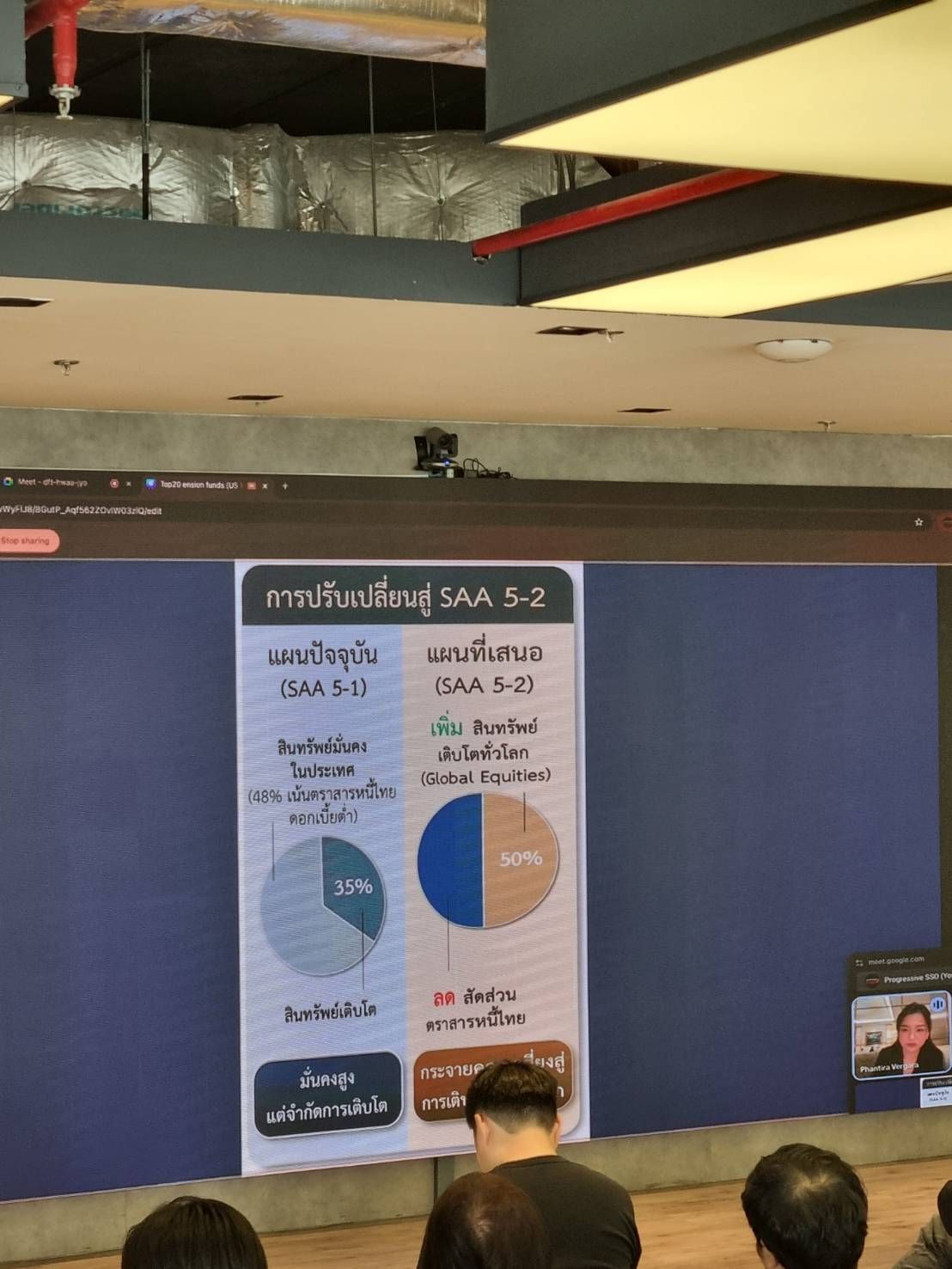

On this matter, Pantira Vergara, a private asset investment consultant, stated that the "opportunity cost" of debating without portfolio adjustment amounts to 300 million baht daily! Global funds commonly use the SAA 5-2 formula (reducing bonds, increasing global equities) to invest in global infrastructure, clean energy, and even Formula 1 to generate substantial returns, whereas Thailand remains trapped in low-income domestic investments with limited growth potential.

This shows that the secret to wealth is more than just stocks; it’s investing in "innovation." Leading funds like Norway’s GPF and South Korea’s NPS look beyond annual dividends to seek "capital gains" from global mega-trends.

Proposals from this seminar involve not just changing held stocks but "changing the system" to enable the fund to move forward, such as:

The conclusion is clear: if we allow the Social Security Fund to continue in slow motion under the old bureaucratic vision, the finish line of retirement security for Thai people may never exist. It is time to "reform" before it is too late.

For stock news, gold news, investment and finance updates, visit Thairath Money at

Follow the Facebook page: Thairath Money at this linkhttps://www.facebook.com/ThairathMoney