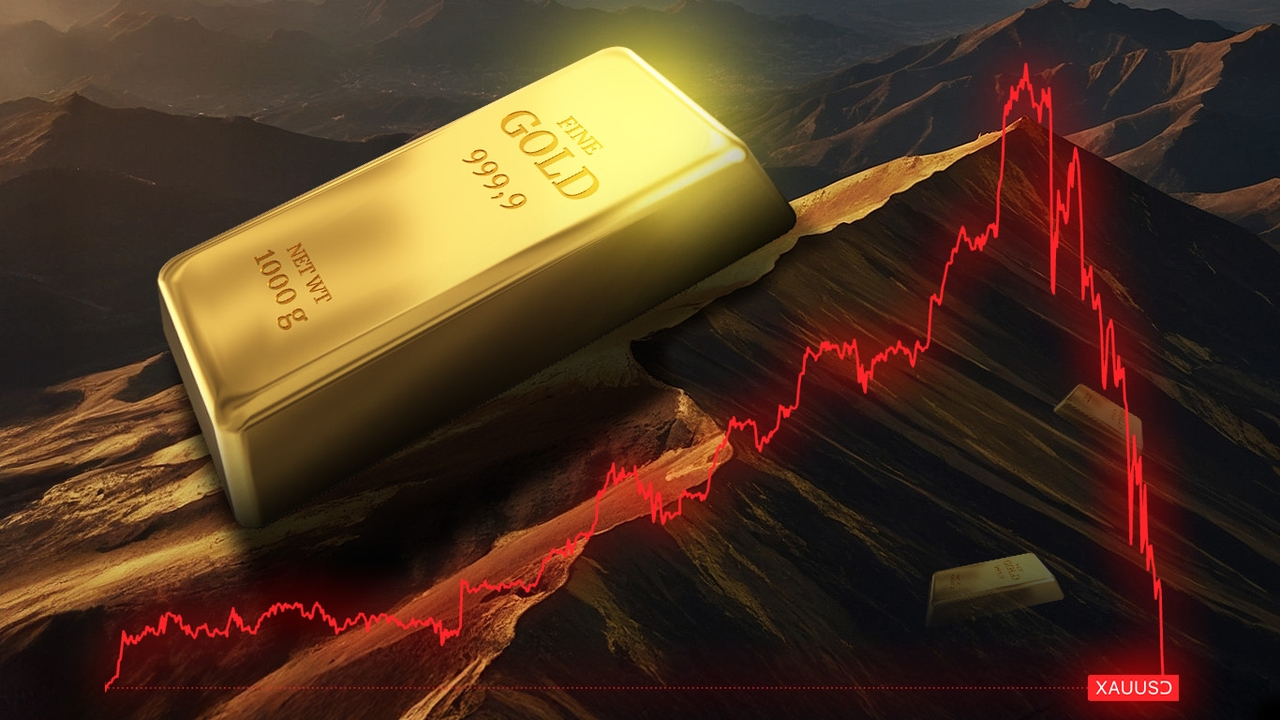

The gold market experienced heavy volatility today after the global gold price (Gold Spot) dropped below $4,440 per ounce at 13:28, a decline of over 26% from the peak of $5,595.46 per ounce reached on 29 Jan 2026 GMT+7.

This caused significant fluctuations in Thailand's gold prices, prompting the Gold Traders Association to adjust prices 36 times by 13:23, cumulatively reducing prices by more than 5,200 baht. The gold bar selling price is now 69,000 baht per baht-weight, and gold ornaments sell at 69,800 baht per baht-weight.

Those who bought gold chasing prices earlier are now likely stuck "on the mountain." However, analysts agree that gold is currently in a correction phase and may continue to decline if it fails to hold key support levels.

The current wave of heavy selling stems from renewed concerns triggered simultaneously. It began when Donald Trump announced Kevin Warsh as the nominee for the next Federal Reserve (FED) chairman, which the financial market immediately interpreted as likely to support maintaining high interest rates, creating strong downward pressure on gold prices.

Additionally, the market was already fragile due to the strong rally in gold prices, and the final straw was the CME Futures market raising margin requirements from 6% to 8% last Friday night, forcing investors to sell to reduce risk.

From an analyst's perspective, the situation still requires close monitoring. Pheeraphong Wiriyanukroh, a gold investment analyst at Ausiris Company Limited, stated that the overall gold market is still in a "correction" phase, with prices likely to continue drifting downwards.

He advised watching the critical support zone between $4,500 and $4,600; if prices can hold above this area, a rebound to $4,800-$5,000 could be possible. But if support fails, prices may fall to test the 100-day moving average as low as $4,300.

Sirilak Pakotiprapa, director of analysis at Hua Seng Heng Gold Futures Company Limited, assessed that although the long-term outlook for gold remains positive, short-term selling pressure is intense. She identified $4,600 as an important support level.

This level served as a strong base in mid-month; if breached, the next support to watch is the worst-case scenario at $4,500, where buying interest is expected to help stabilize prices.

The biggest concern is the very high cost, especially for those who bought gold above 80,000 baht per baht-weight and are now stuck. Pheeraphong recommended that these investors "need to average down" because without lowering their average cost, they will have to wait a long time for prices to return. He also recommended a "Buy on Dip" strategy during sharp corrections.

Meanwhile, Sirilak advised both long-term and short-term investors to gradually accumulate gold when prices dip into the $4,500-$4,600 range, equivalent to the Thai gold bar support zone between 69,000 and 70,300 baht.

For speculative traders in the futures market, if prices fall below $4,600, cutting losses is advised. Additionally, abnormal premiums of up to $130 (normally $40) were observed in Gold Online Futures, suggesting that opening short positions could offer an advantage.

Read stock and investment news with Thairath Money at

Follow the Facebook page: Thairath Money at this link