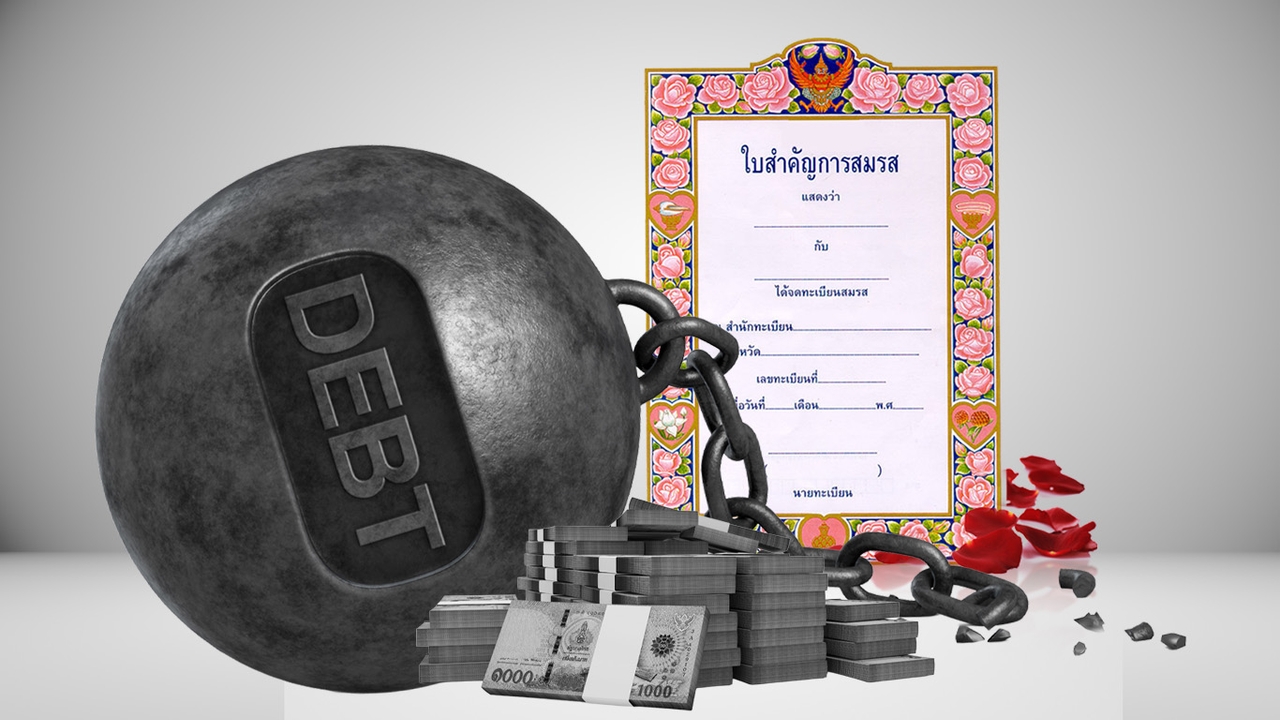

Many couples believe that a marriage certificate symbolizes love, but from the legal and economic systems' perspective, this document is a comprehensive financial contract that binds the assets, debts, and risks of two individuals together.

While marrying without registration might leave emotional scars someday, registering without understanding financial matters can have heavier consequences, including loss of property, legal rights, and long-term financial stability in the relationship.

Viewed through the lens of "finance" rather than just the heart, legally, a marriage certificate officially recognizes the couple's relationship, immediately granting the spouses legal rights and obligations, which extend beyond family matters to include "assets, debts, and money."

According to information from Thammaniti Law Office, the immediate consequences after registering a marriage include:

1. Financial duties toward each other: husband and wife are obliged to support one another, which includes not only care during illness but also shared expenses and living costs.

2. Rights to joint assets: any assets acquired during the marriage—whether salary, bonuses, additional income, stocks, or purchased property—are legally considered "marital property" and jointly owned by both parties; in case of divorce, they must be divided equally unless otherwise agreed.

3. Inheritance rights: registered spouses are first-order legal heirs, automatically entitled to inherit from each other, unlike unmarried partners who may have no such rights.

4. Protection rights: if the relationship ends due to fault by one party, the aggrieved spouse can claim alimony and damages from the spouse and third parties if the divorce worsens their financial status.

5. Child-related rights: registration legally recognizes the husband as the father with joint parental authority, and the child is automatically acknowledged; it also includes other financial and legal rights such as tax deductions, medical benefits, spousal welfare, government service transfers, and decision-making authority during serious illness.

All this reflects that a marriage certificate is not just a document of love but a full "package of financial rights and obligations."

Many mistakenly believe that "separate money" still applies after marriage; in reality, after registration, newly earned money no longer belongs to just one person.

are all legally regarded as joint property, even if the other spouse did not contribute labor or decision-making. A fact many couples avoid openly discussing is that from the moment of registration, your money also carries your spouse's name.

This is often most apparent when problems arise, such as...

1. Debt: debts incurred during the marriage may become joint liabilities even if one spouse did not personally borrow. This explains why news often reports couples or celebrities quietly divorcing amid legal or business debt issues to separate financial risks.

2. Taxes and inheritance: being married grants tax rights but also links assets and liabilities in unexpected events; inheritance is handled immediately according to marital status.

3. Business and stocks: profits from businesses conducted during marriage are marital property. It is no coincidence that major news often shows "technical divorces" to prevent all assets from being affected simultaneously when business troubles arise.

All this shows that a marriage certificate is not romantic on sweet days but is truly discussed when financial stability begins to waver.

If asked which is riskier financially—registered marriage or not—the answer is that each carries different risks.

However, the greatest danger is not the choice itself but making it without understanding these conditions. Before signing your name on any document, ask yourself and your partner clearly:

Can we openly discuss financial matters together for a lifetime, including prenuptial agreements? Because in the financial world, love alone may not suffice if you do not understand the conditions you are agreeing to.

Sources: Thammaniti Law Office, Siam Commercial Bank, Thai Life Insurance

Read personal finance news and financial planning with Thairath Money to help you "achieve good finances and a good life."https://www.thairath.co.th/money/personal_finance

Follow the Facebook page: Thairath Money at this linkhttps://www.facebook.com/ThairathMoney