It's now the "tax filing season" for the 2025 tax year (filing in early 2026). One common problem faced annually by salaried employees and freelancers alike is "lost documents," whether pay slips for the whole year or receipts for deductions, causing much frustration.

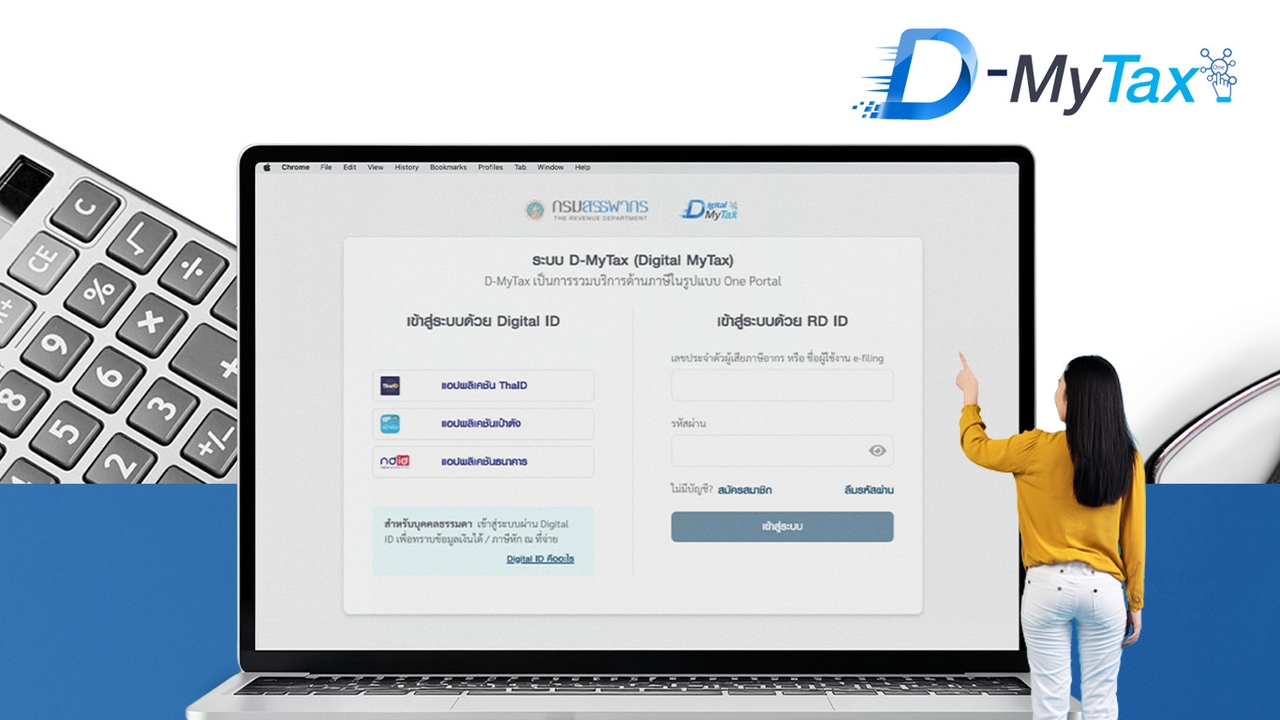

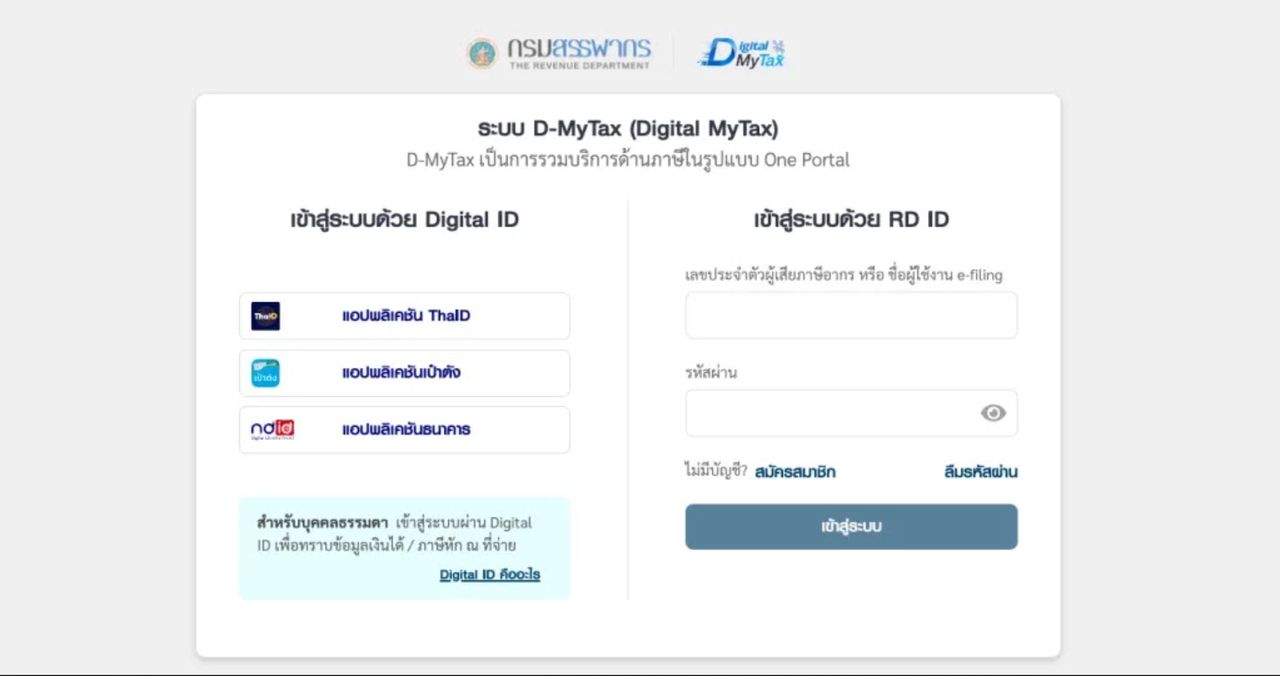

However, did you know that nowadays you don't have to rummage through drawers for documents? The Revenue Department offers a tool called D-MyTax (Digital My Tax), which acts like a "personal tax ledger" that gathers your information in one place, making this year's tax filing much easier and saving you a lot of time.

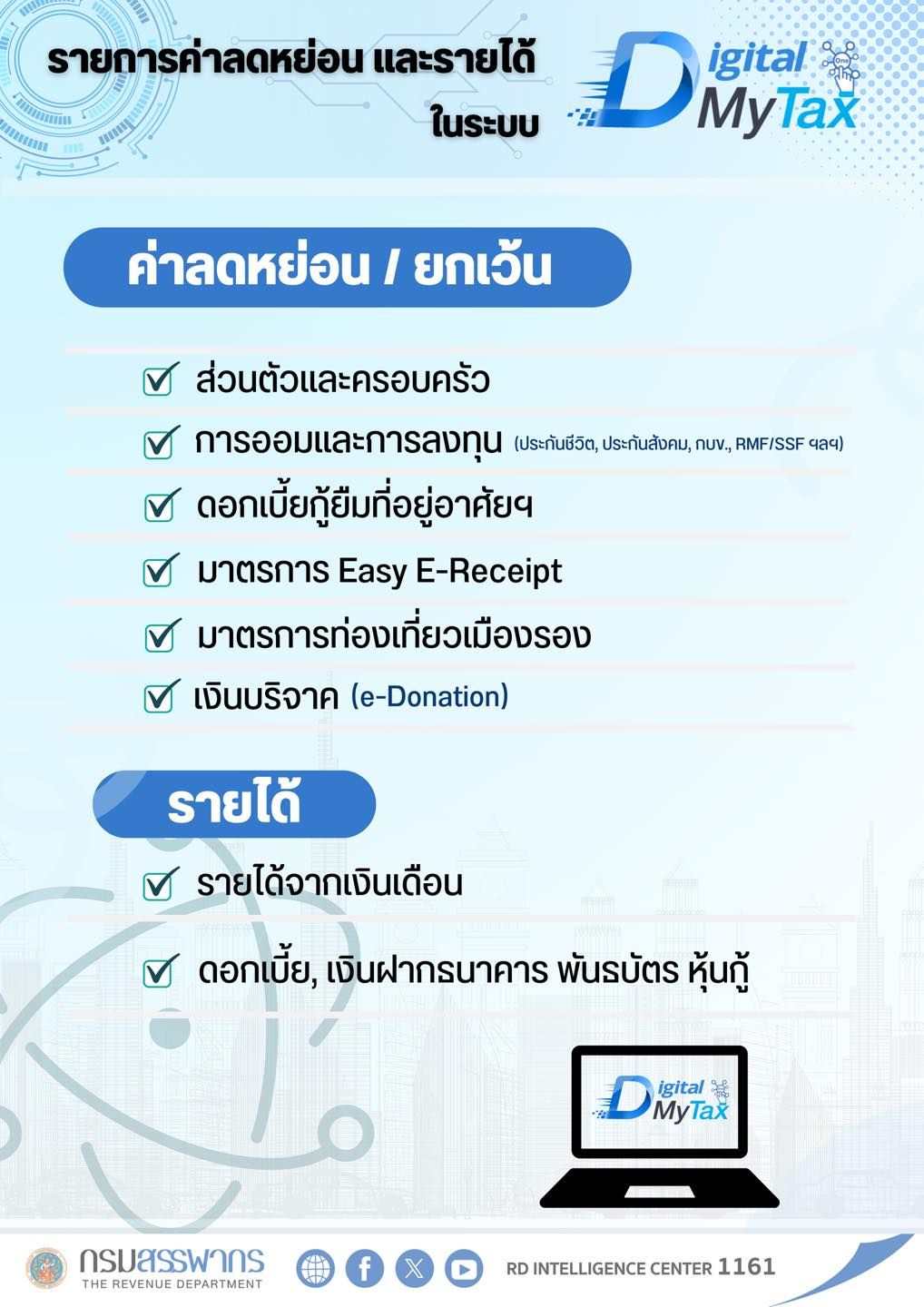

D-MyTax is a system developed by the Revenue Department to link income and deduction data from various agencies into an online platform. Its key features include:

1. Reducing complexity by eliminating the need to fill in all information manually; the system automatically pulls data already held by the Revenue Department.

2. Immediate checking to see preliminary income, eligible deductions, and whether you "owe more" or will "get a refund" this year.

To check your data before filing, you can go tothe Revenue Department's websiteselect the My Tax Account menu, and log in using the Digital ID system (such as the ThaID or NDID app) for security. Once logged in, review the following four key sections:

1. Income verification: The system will display income from salaries or other employment provided by employers.

However, a caution: in early January, data may be incomplete since employers have until 15 February to submit salary/wage data. If data is missing when you check, don't worry; it should be most accurate by late February.

2. Checking deductions: The system displays data from previous years' filings. This is where you "must be most careful" because this information is based on past data and must be manually corrected if your status has changed.

For example,

if last year you could only deduct for caring for your father with no income, but this year your mother has turned 60, the system may not automatically add your mother’s name. You need to add this yourself when filing.

3. Savings, investments, and life insurance: Data for RMF, Thai ESG, Thai ESGX, and life insurance premiums are usually sent automatically if you consent for securities firms or insurers to share this data with the Revenue Department.

If data is missing but you have the documents, you can enter the figures yourself during filing without waiting for system updates.

4. Special deductions (such as Easy e-Receipt 68): For specific economic stimulus measures in the year, data often starts appearing; check if totals match your electronic tax invoices.

Despite D-MyTax’s convenience, many tax experts caution against immediately submitting your tax return based solely on the figures shown in the system.

This is because D-MyTax is just a "checking tool," but the responsibility for accurate and complete tax filing rests 100% with the taxpayer. If the system misses or misreports data (such as forgetting some extra income) and you submit as is, you cannot later claim, "The system showed it this way" if audited.

To avoid missing rights and penalties,

In conclusion, using D-MyTax helps you get a "big picture" view of your taxes faster and estimate whether you will have money left to spend or need to prepare additional tax payments. However, always double-check the accuracy yourself before pressing "Confirm" for a correct and worry-free tax filing.

Source: Revenue Department

Read personal finance news and financial planning with Thairath Money to help you achieve "Good Finances, Good Life"https://www.thairath.co.th/money/personal_finance

Follow the Facebook page: Thairath Money at this linkhttps://www.facebook.com/ThairathMoney