As 2026 begins, many people start planning their lives and finances, deciding what to do each month. However, looking back at the past year, some who planned well still missed their targets because they encountered scammers or criminals who took advantage to steal their savings.

Therefore, to maintain good finances and a good life throughout the year, Thairath Money has compiled nine financial scams as warnings to help you avoid falling victim to criminals, no matter what form they take.

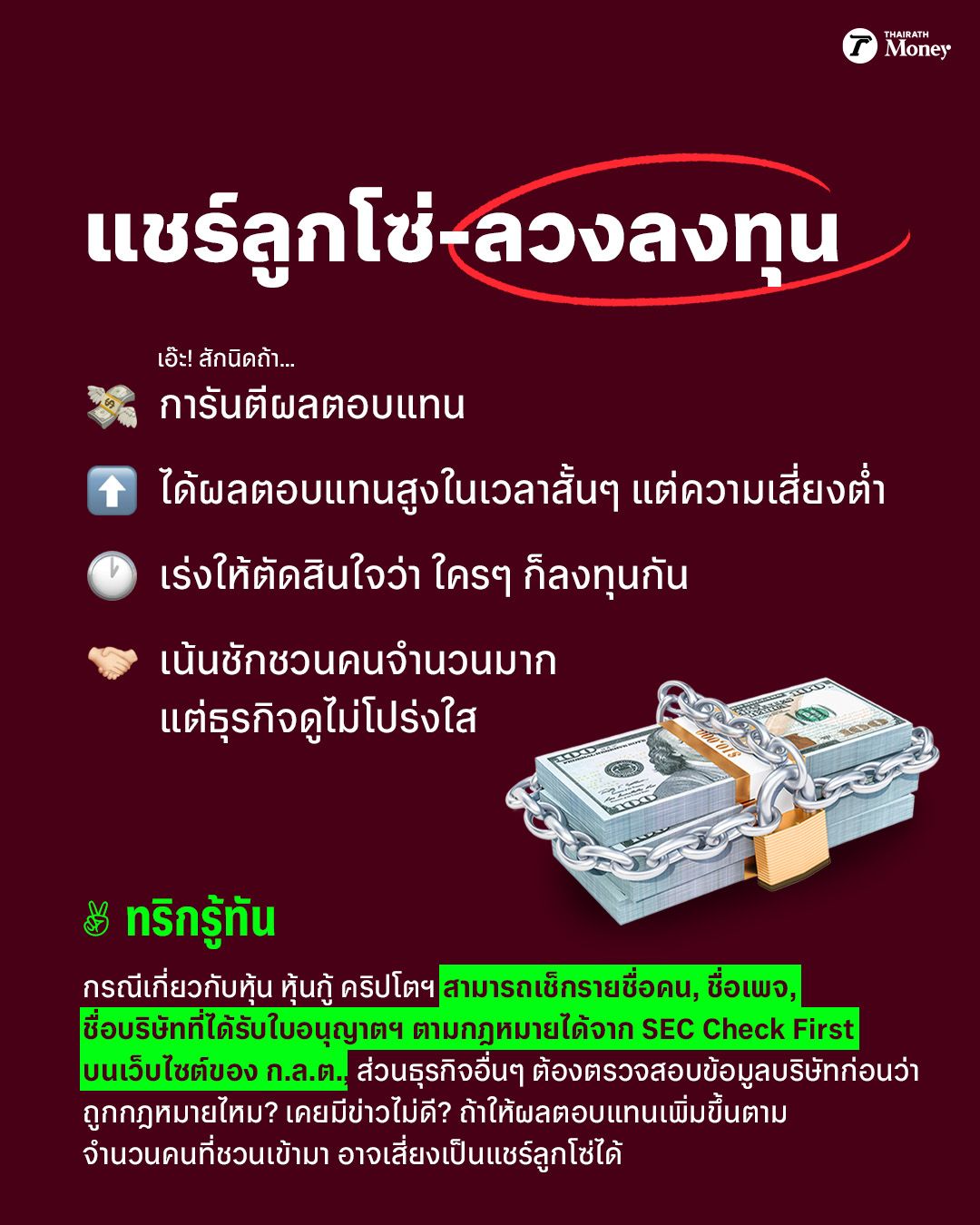

1. Pyramid Schemes – Investment Scams

Tips to recognize: For stocks, bonds, and cryptocurrencies, you can verify names of individuals, pages, or companies licensed by law via the SEC Check First service on the SEC website. For other businesses, check whether the company is legal and if there have been any negative reports. If returns increase according to the number of people recruited, it may be a pyramid scheme risk.

2. Call Center Scams – Intimidation Tactics

Tips to recognize: Don’t rush! Stay calm and do not give out personal information. First, check whether the incoming phone number has been reported as fraudulent. Consult trusted contacts or hang up and verify with the relevant agency if the matter is true and how to respond.

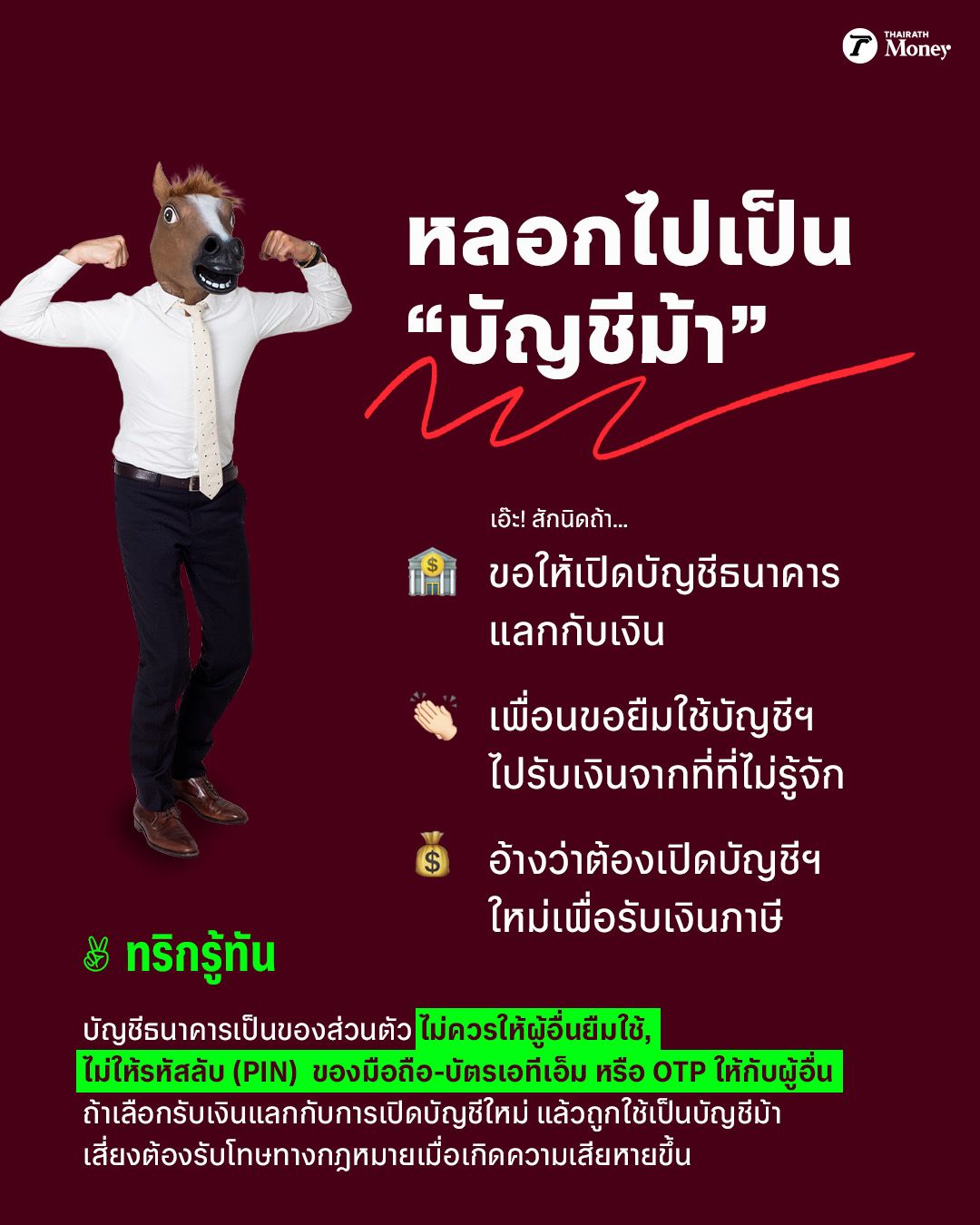

3. Being Tricked into Becoming a “Mule Account”

Tips to recognize: A bank account is personal and should not be lent to others. Never share your mobile PIN, ATM card PIN, or OTP with anyone. If you accept money in exchange for opening a new account and it is used as a mule account, you risk legal penalties if damages occur.

4. Romance Scam – "Love You, Please Transfer Money"

Tips to recognize: Verify whether the person actually exists, check if the recipient account has been reported as fraudulent or linked to scam gangs, and consider consulting family before deciding to transfer money to someone you don’t know.

5. Friends Who Deceive

Tips to recognize: Before agreeing to help, lend money, or invest together, always have a clear contract and verify the information provided.

6. Selling False Job Opportunities

Tips to recognize: Check the company, page, or individual contacting you to see if they have a history of fraud or scamming. Verify the interview location; if it’s a private condominium, beware of risks such as kidnapping or human trafficking.

7. Personal Data Theft

Tips to recognize: Scammers send fake links to trick you into entering personal data or downloading money-draining apps. Always verify links received via email, SMS, or chat to confirm they come from legitimate organizations. On mobile phones, consider disabling installation of apps from unknown sources.

8. Online Loans – If It’s Too Easy, It Could Be a Rogue App or Predatory Lender

Tips to recognize: Always check the lender before borrowing money online. Do not borrow from unknown individuals or companies. Verify licensed financial institutions via the Bank of Thailand’s website. Also, regularly review which apps have access to your smartphone data via "App Permission Settings."

9. Fake Accommodation or Travel Bookings

Tips to recognize: Verify the page’s authenticity by checking the "About" section and page transparency. Confirm through multiple channels that the hotel or service provider is legitimate (e.g., official website phone numbers). Before transferring money, confirm the bank account matches the hotel or company name.

Read personal finance and financial planning news with Thairath Money to help you "achieve good finances and a good life."https://www.thairath.co.th/money/personal_finance

Follow the Facebook page: Thairath Money at this linkhttps://www.facebook.com/ThairathMoney