Where Does Our Tax Money Go? Breaking Down the 2026 Budget: Where Does Every 100 Baht Go?

The tax filing season has returned, bringing mixed feelings among workers—one side sees it as a duty, while the other harbors lingering questions: “Is the money earned from our hard work truly used to develop the country? Or does it disappear into an unseen system black hole?”? This reflects concerns about transparency and effective use of tax revenue.

Data from the Office of the National Economic and Social Development Council (NESDC) has shown that most Thais perceive the tax system as "unfair," citing legal loopholes that allow some groups to evade taxes and a sense that the taxes paid are not worth the welfare benefits received, which seem distant from a good quality of life.

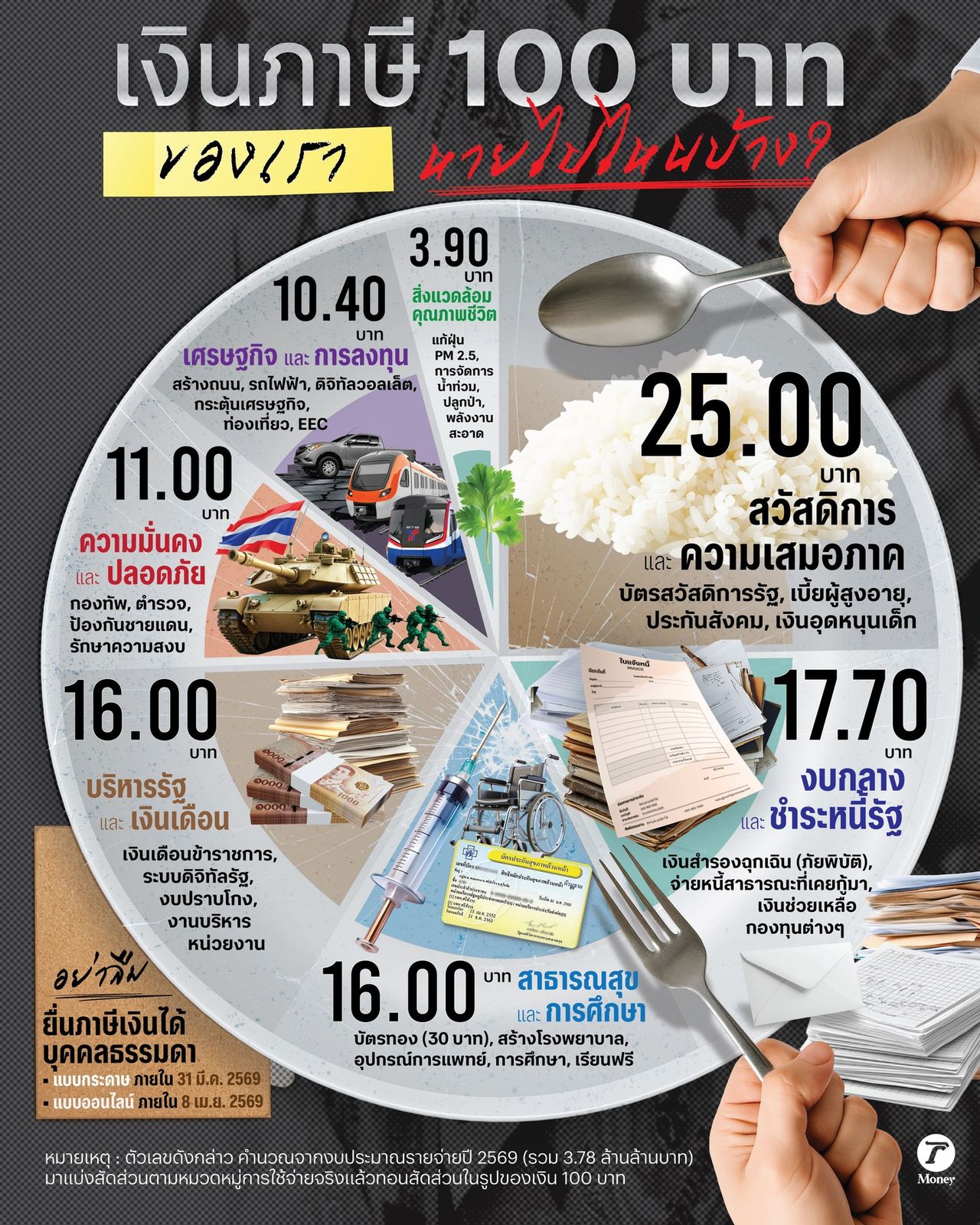

To address these questions, we examined the "2026 Annual Expenditure Budget Bill" amounting to over 3.78 trillion baht. We broke down the proportions simply: if every baht of our tax money equals 100 baht on a plate, where does the government allocate each portion? The breakdown is organized according to the national strategic framework.

Here is the 2026 budget menu compared to the proportion of our 100 baht.

- The largest portion, 942.7 billion baht (about 25 baht), is allocated to creating opportunities and social equity (welfare and equality). This significant portion resembles a "plate of plain rice" that must be distributed among a huge population, covering elderly allowances, state welfare cards, and child subsidies, amid an aging society where this budget is becoming insufficient.

- Government operational costs, including the central budget and debt repayment, total 669.4 billion baht (about 17.70 baht). This serves as a reserve fund for floods and disasters, and "invoices" for interest on past government borrowing, representing a necessary payment to uphold fiscal stability.

- Human resource development (health and education) receives 605.9 billion baht (16 baht), a budget that should be substantial, but many feel they receive "outdated medical equipment" or "old textbooks," despite it being the main funding that supports citizens from birth to death.

- Public administration and government management (administration and salaries) also receive 605.9 billion baht (16 baht). This includes voluminous paperwork and compensation for government machinery, distributed across ministries to keep the bureaucracy functioning.

- Security receives 415.3 billion baht (11 baht), funding the country's protective barriers and personnel including the military, police, and border forces to maintain peace, though sometimes the necessity of certain aspects is questioned.

- Competitiveness (economy and investment) gets 394.6 billion baht (10.40 baht), funding infrastructure like roads, electric trains, and economic stimulus projects aimed at boosting cash flow. The question remains whether this development truly reaches our doorstep.

- Sustainable growth focusing on environmental quality and life quality receives 147.2 billion baht (3.90 baht), the smallest portion, despite ongoing battles with PM 2.5 pollution and annual flooding crises.

This calculation is based on the budget allocation proportions according to the national strategy in the 2026 Annual Expenditure Budget Bill. Each sector’s budget (in trillions) is divided by the total budget (3.78 trillion baht) and multiplied by 100 to present an overview in "baht per 100 baht," a method that clearly reflects the government’s prioritization.

The key question is whether these proportions are appropriate. Is this 100 baht divided fairly and does it truly impact our quality of life? After filing and paying taxes, we should also help monitor the budget's correct and transparent usage.

Meanwhile, the Revenue Department has set deadlines for filing 2025 tax year returns: paper submissions to local offices by 31 Mar 2026, and online submissions via the Revenue Department websitehttps://efiling.rd.go.th/rd-cms/are accepted until 8 Apr 2026.

Sources: NESDC, Budget Bureau