“How will I pay my debts by the end of this month?”

“How can I have enough money to cover my expenses each month?”

These questions frequently appear on social media, especially during periods when Thailand’s economy shows little growth and seems to be in decline. However, the root of the problem goes deeper: even more than a decade ago, Thai people faced the issue of "income not keeping pace with expenses," which has become the source of today's chronic household debt.

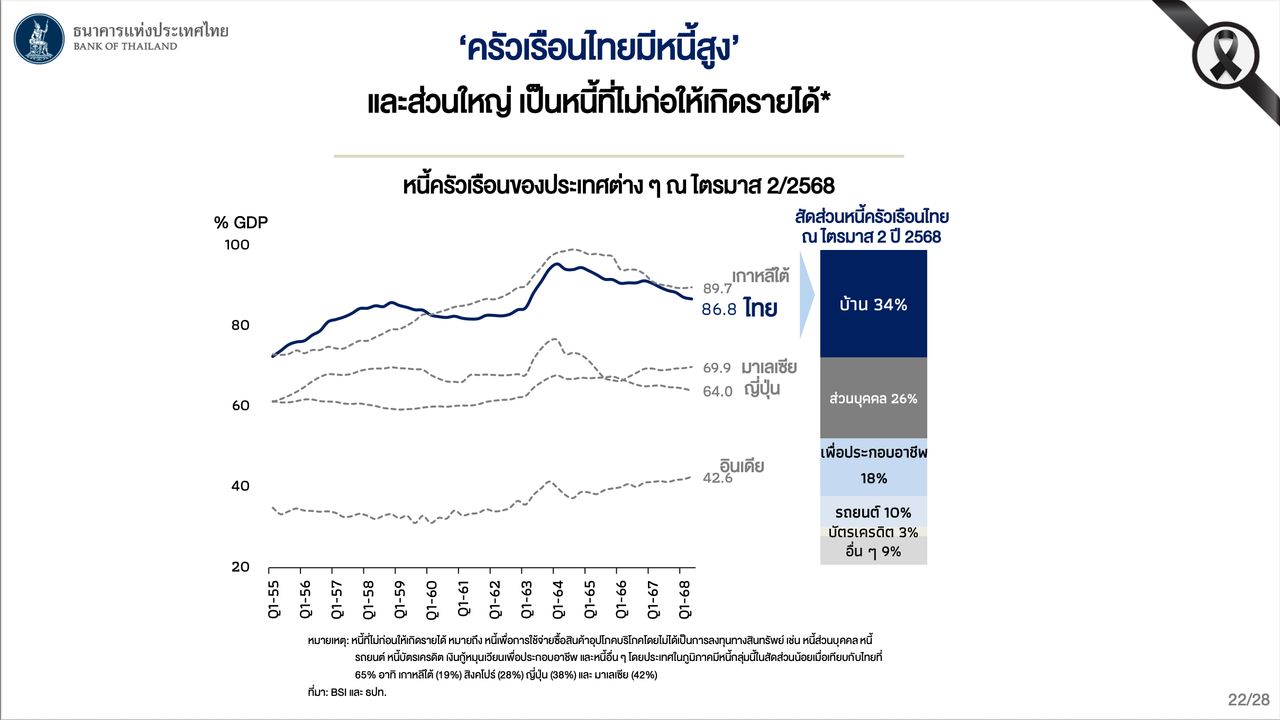

Chayawadee Chai-anun, Assistant Governor for Corporate Communications and Spokesperson of the Bank of Thailand (BOT). She presented clear figures showing that Thai households have consistently had expenses exceeding income. In 2023, average monthly household expenses were 18,691 baht, while income averaged only 16,817 baht per month.

This problem has been persistent. Looking back to 2013 data, average income was 13,504 baht per month, with expenses at 14,124 baht per month. When expenses exceed income, debt accumulation often follows. This aligns with data indicating that over 30% of Thai household debt is consumer credit, such as credit cards and personal loans.

The debt issue also raises concerns about younger people or first-time jobbers, who accumulate non-performing loans quickly and risk carrying debt into retirement. Data shows that among 29-year-olds, one in five already has non-performing loans. Overall, Thai people are carrying debt longer; for example, those aged 60-69 have an average debt of 453,438 baht per person, and those aged 70-79 have an average debt of 287,932 baht per person.

Thus, the problem for Thais is not just "earning enough to cover expenses," but also how to plan and manage money to improve life quality and be prepared against financial fraud and risks in various forms.

Financial education needs to be comprehensive, easily accessible, understandable, and practically applicable. Dr. Pornpichaya Kuwalairat, Associate Dean for Academic Affairs, Faculty of Commerce and Accountancy, Chulalongkorn University. She explained that the university has partnered with the Bank of Thailand to launch a new course titled “Financial Planning for Life” to enhance comprehensive financial resilience and enable life-cycle financial planning through knowledge in various areas including:

Currently, this course is very popular at Chulalongkorn University, with 480 students from various faculties enrolled. However, financial planning and debt management knowledge is essential for everyone. Recently, the university opened enrollment to the public through the lifelong learning platform Chula XL.

Participants canregister and study for free.Learning outcomes are clearly assessed, and the online format allows unlimited access to the lessons at any time.

Finally, financial knowledge and debt management may sound complex, but by starting small, gradually understanding personal spending habits, and incrementally applying knowledge in each area to plan finances appropriately, one's life will certainly improve.

Read personal finance news and financial planning with Thairath Money to help you achieve “Good Finances, Good Life.”https://www.thairath.co.th/money/personal_finance

Follow the Facebook page: Thairath Money at this linkhttps://www.facebook.com/ThairathMoney