Nowadays, prices are rising everywhere, with expenses possibly exceeding monthly income. In 2026, another item expected to get more expensive is "cars." From 1 Jan 2026, Thailand will implement a new excise tax rate on new cars, especially gasoline and hybrid models, where some may face tax increases up to 50% if purchased this year.

Although Thailand is one of the world's top car producers, car prices are still not as low as in other countries, partly due to higher taxes, which will increase further. Starting 1 Jan 2026, Thailand will restructure excise tax on new cars, adding CO2 emissions as a criterion alongside engine size (cc). Cars with higher pollution will face harsher taxes with a maximum rate capped at 50%.

Therefore, vehicles using fuel, such as internal combustion engine (ICE) cars or hybrids (HEV), will see their selling prices increase.

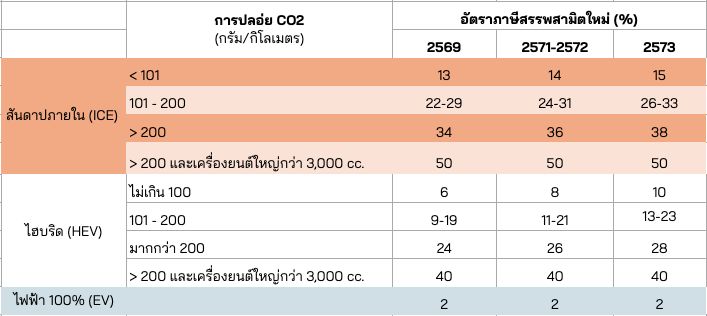

Importantly, the excise tax structure for new cars will undergo two more hikes in 2028-2029 and 2030, with only electric vehicles (EV) maintaining a low tax level at 2% (down from about 8% previously).

In summary, to see how much tax new gasoline cars will face, refer to the table below (based on data from Kasikorn Research Center).

Though the tax restructuring means buyers won't pay extra taxes separately, as tax is included in the car price, Thairath Money provides examples of car types, prices, and new tax impacts for clearer understanding (prices and details may vary; the following are examples only).

1. Eco Car group: small gasoline cars emitting less than 100 grams of CO2 per kilometer. Previously taxed at 12%, in 2026 it rises to 13%. For example, the Honda City, originally priced around 590,000 baht, will see an approximate price increase of 5,900 baht due to the 1% tax hike.

2. Larger gasoline vehicles like SUVs and PPVs emitting over 200 grams of CO2 per kilometer will see their tax rate increase from 35-40% to 34-50% (an increase of about 10%).

For example, the Toyota Fortuner, originally priced at 1.2 million baht, may increase by about 112,000 baht under the new tax structure.

3. Hybrid (HEV) group: cars using both fuel and electricity, emitting between 101-120 grams of CO2 per kilometer, will face tax rates between 9-19%.

Example: a popular SUV priced near one million baht might see a price increase of about 25,000 to 30,000 baht depending on the model and CO2 emissions.

4. Luxury and supercars (engines over 3.0 liters) emitting more than 200 grams of CO2 per kilometer will face the highest tax rate of 50%. For instance, a Ferrari V8 priced at 30 million baht could see a tax increase of 15%, adding about 4.5 million baht to the price.

Although buyers won't pay taxes separately, new car prices in 2026—especially for gasoline vehicles—will definitely be higher. So, how should we plan our new car purchase?

Car prices in 2026 may rise compared to previous years, but if a vehicle is necessary, careful financial planning is essential. Here are three points to consider before deciding to buy a new car this year.

Check promotions carefully: Car prices are determined by manufacturers and dealerships, so check discounts, purchase fees, and vehicle details thoroughly. Some may wait for prices at the Motor Show held in March-April or the Motor Expo in December. Nowadays, social media helps access information easily—posting in car enthusiast groups may prompt dealers to offer promotions (but beware of scams).

Compare loans and interest rates: As cars get more expensive, financed amounts rise too. It's advised to compare interest rates from multiple lenders, since even a 0.5% difference over 72 installments can cost more than the increased tax.

Plan your finances precisely before buying: Cars are worthwhile if used, but buying and leaving them unused leads to depreciation. Carefully assess your need for a car before purchasing. Also, car loans often span more than 3-5 years, during which unexpected events like unemployment or illness may occur. Therefore, keep a reserve fund of about 3-5 months’ payments to cover installments if income stops.

References: Kasikorn Research Center, Excise Department, mitsurma.

Read personal finance and financial planning news with Thairath Money to help you achieve "Good Finances, Good Life."https://www.thairath.co.th/money/personal_finance

Follow the Facebook page: Thairath Money at this linkhttps://www.facebook.com/ThairathMoney