This Valentine's Day 2026, the "right" gift might not always be flowers! With gold prices soaring to 74,000–75,000 baht per baht-weight, giving gold to someone special offers a double benefit: sentimental value plus an asset that can appreciate over time.

Many think buying gold as a gift requires a large sum, but actually, a few thousand baht can buy gold. Thairath Money has compiled ideas for charming gold gifts within a modest budget.

Gold today comes in various forms. With a budget under 5,000 baht, you can buy small "gold sheets" or "gold cards." With up to 10,000 baht, you might purchase half-salung gold jewelry such as rings or pendants. For example:

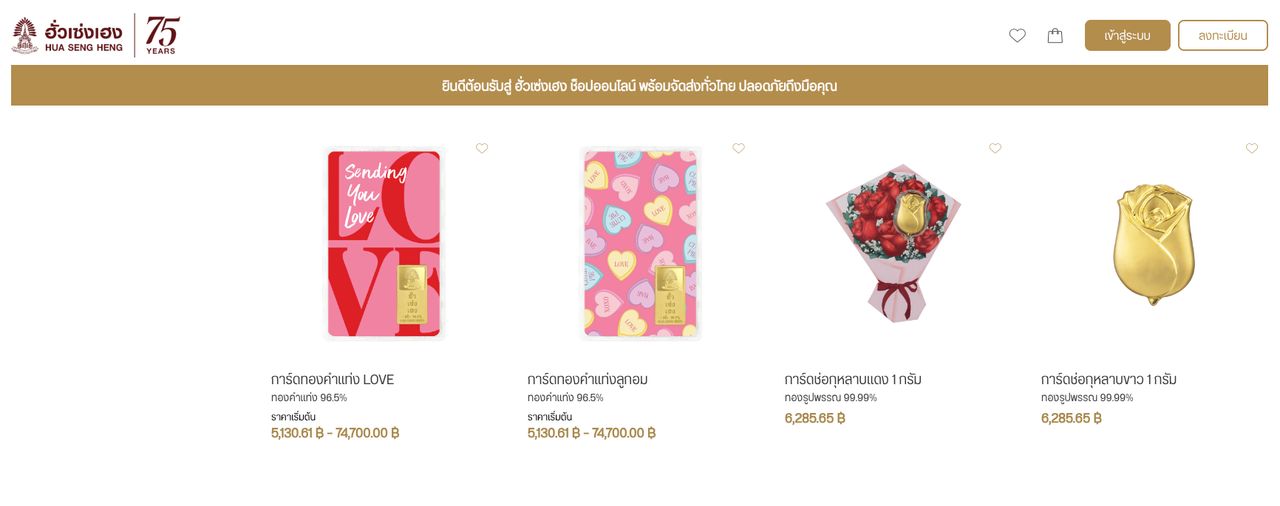

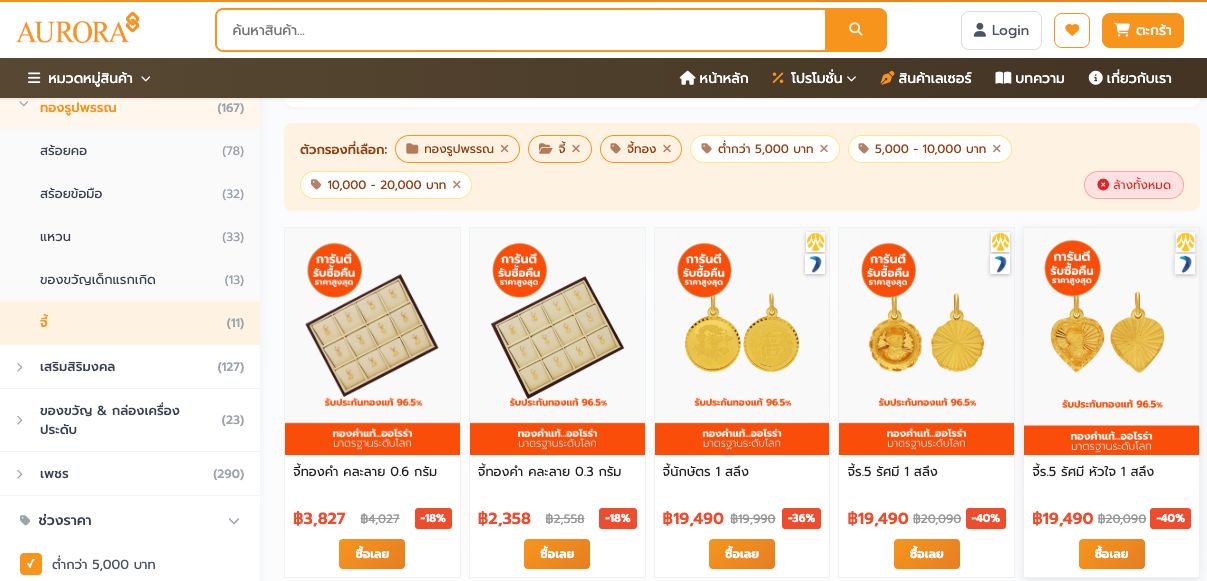

- Greeting cards / 96.5% gold bars Starting at 0.5 grams priced around 2,600–2,700 baht, and 1 gram around 5,200 baht, available at gold shops like Hua Seng Heng, AURORA, Yaowarat Bangkok Gold Shop, etc.

- Half-salung weight gold jewelry Prices are about 9,100–9,300 baht per baht-weight, available at common gold shops. Advantages include many styles like pendants, earrings, rings, etc. However, be cautious as resale value of jewelry is usually significantly lower than gold bars.

With this budget, you can comfortably buy 1 or 2 salung gold pieces, depending on how much you want to spend, for example:

- 1 salung gold piece costs about 18,500 baht

- 2 salung gold piece costs about 37,000 baht

Various gold types are available, from gold cards to full jewelry sets, such as a 1 salung chain and 1 salung ring for around 40,000 baht.

The prices mentioned may fluctuate depending on the domestic gold price on that day, illustrated here with gold prices around 74,000–75,000 baht per baht-weight.

Many believe that buying gold on credit card installments today can yield profit if gold prices rise. While that is possible, if gold prices drop, you may suffer losses on the price difference and pay additional interest. Thus, how to plan gold installments wisely to avoid losses?

First, choose a trustworthy gold shop to ensure genuine gold with full weight.

Some buyers purchase gold from shop A but sell to shop B only to find weight missing or price deductions. To avoid this, select gold shops that are members ofthe Gold Traders AssociationYou can check member lists on the website and request a product warranty certificate from the shop.

Second, compare "cash price" versus "installment price".

Before choosing installments, calculate which payment method is more economical or look for 0% interest installment promotions with no hidden conditions. If interest applies, it should be clearly stated, including interest amount, installment period, and any fees such as credit limit withdrawal or card swipe fees.

Third, if you want to pay by installments, ensure affordability.

Installments mean new debt, so monthly payments must be planned. Use a rule of not exceeding 10% of net income to avoid affecting daily life. For example, if you can invest 1,000 baht monthly, to buy 10,000 baht gold you can plan 10-month installments without impacting your lifestyle. For forgetful payers, automatic bank account deductions can help avoid payment delays and interest penalties.

Fourth, gold bought on installments is usually "jewelry gold."

This type carries high making charges, so if prices drop or you sell immediately after paying off installments, you may lose on the price difference.

Thairath Money highlights some gold shops offering installment promotions early 2026:

SourcesHua Seng Heng,Yaowarat Bangkok Gold Shop,YLG Bullion, AURORA

Read personal finance and financial planning news with Thairath Money to help you "achieve good finances and a good life."https://www.thairath.co.th/money/personal_finance

Follow Thairath Money Facebook page athttps://www.facebook.com/ThairathMoney