How beneficial would it be if we could choose that the taxes we pay annually go directly to developing our “hometown” or the “city we love”?

Recently, reports indicated that Thailand’s Ministry of Interior is moving forward with drafting a “Hometown Tax” law, which would allow citizens to allocate 10% of their taxes and donate funds for local development, receiving personal income tax deductions and property tax reductions under specified conditions, as proposed earlier by the Senate’s Economic, Financial, and Fiscal Commission.

This has led many to wonder what exactly this system entails and how it might address Thailand’s inequality issues. Thairath Money invites you to understand the concept as follows.

According to the Bank of Thailand, the core of the “Hometown Tax” system is not merely fundraising but addressing deeply rooted fiscal inequalities.

Thailand and Japan face similar challenges of "regional inequality" where working-age populations migrate to major cities for better education and jobs, causing rural areas to see significant declines in income tax revenue.

Although the central government allocates subsidies, documents note these funds often come with limitations such as:

Therefore, the Hometown Tax system is designed as a fiscal tool that grants "autonomy" to localities for greater self-management.

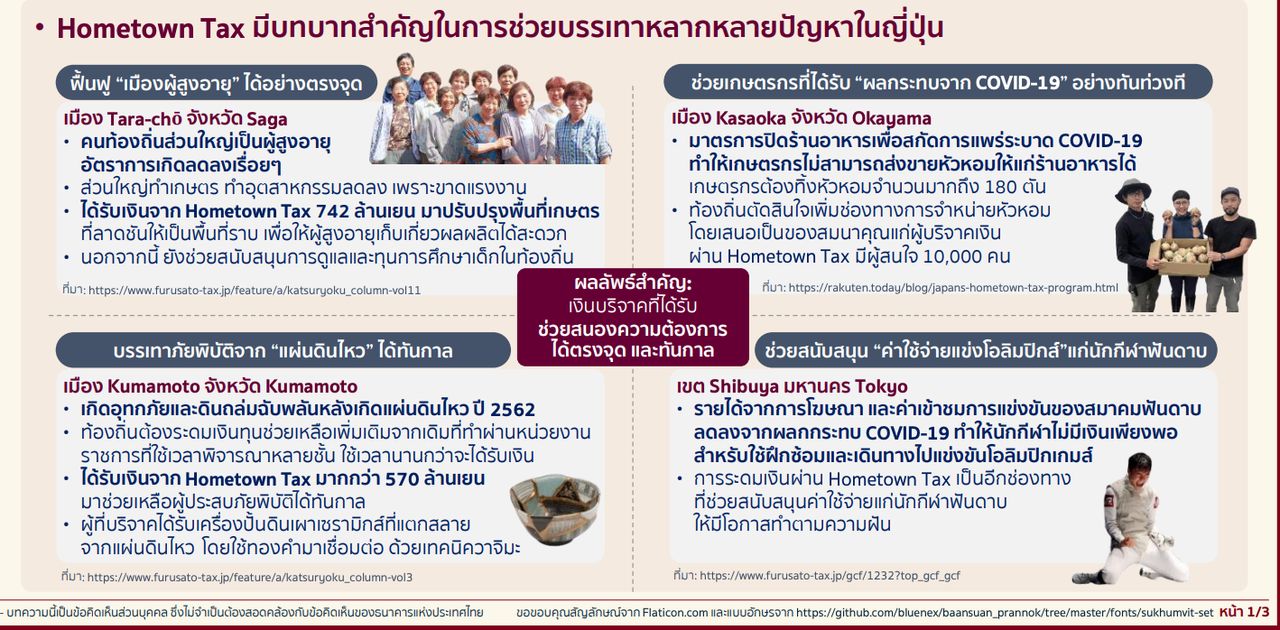

Japan launched this system in 2008 under the name "Furusato Nozei" to involve citizens in revitalizing their hometowns. There are three key success factors Thailand can adapt.

1. Tangible incentives (Thank-you Gifts): Localities receiving donations send regional products as tokens of appreciation, such as local foods or specially restored pottery after earthquakes. The government caps gift value at 30% of the donation to prevent losses from competition.

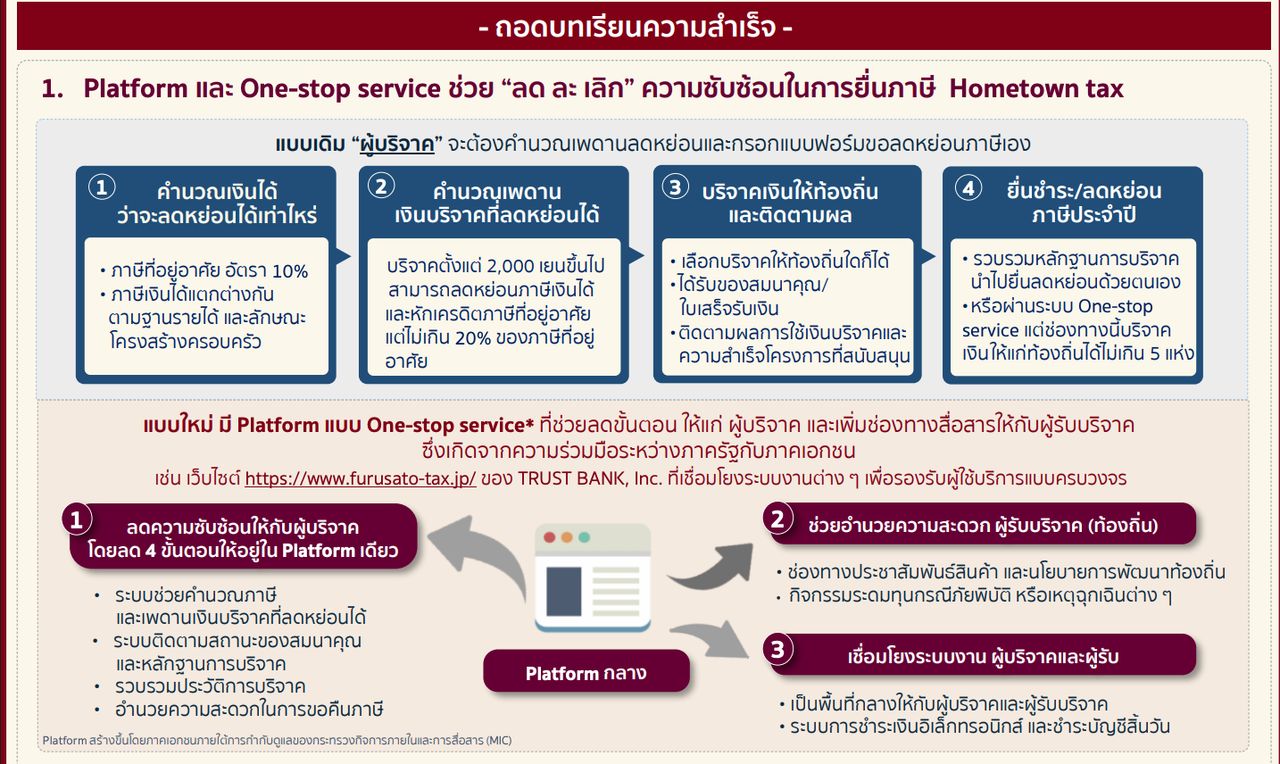

2. Reducing burdens via technology (One-Stop Service): The Japanese government partnered with private sectors to create a centralized platform (e.g., furusato-tax.jp) that simplifies the process—calculating deduction ceilings, tracking gifts, and linking tax refund claims in one place.

3. Expanding deduction ceilings: In 2015, the tax deduction ceiling increased from 10% to 20% of residential tax, causing donation counts to soar from 54,000 in the first year to over 23 million in 2019.

Example of preliminary tax calculation to illustrate how the Hometown Tax system works, featuring a fictional character named “Mr. Furusato.”

Comparison of benefits (traditional system vs. new system).

Japan’s system was improved to encourage more donations by doubling the tax deduction ceiling.

Results of calculations for Mr. Furusato.

The Bank of Thailand’s documents highlight that although there is no official “Hometown Tax” law yet, several Thai localities have already initiated similar efforts through community collaboration with notable success.

For recommendations on implementing this in Thailand sustainably, the Bank of Thailand’s Economic Structure Policy Division suggests the government emphasize “transparency, accountability, and no added burdens,” possibly starting with an e-Donation system for transparency and expanding thank-you tokens beyond products to services like accommodation packages or restaurant discounts to boost local economies and employment.

Initial application of Hometown Tax might be piloted in a sandbox environment to allow close monitoring, problem identification, and resolution before nationwide rollout, for example, targeting the 10 provinces with the lowest per capita income.

Ultimately, promoting Hometown Tax in Thailand is not merely about tax figures but about creating a fiscal ecosystem that keeps migrants connected and engaged with hometown development. The public could also benefit from emergency aid donations, while the government gains from increased voluntary tax participation.

Sources: Ministry of Interior, Regional Letter No. 9/2021, Economic Structure Policy Division, Bank of Thailand.

Read personal finance and financial planning news with Thairath Money to help you achieve “good finances and a better life.”https://www.thairath.co.th/money/personal_finance

Follow the Facebook page: Thairath Money at this link.https:// www.facebook.com/ThairathMoney