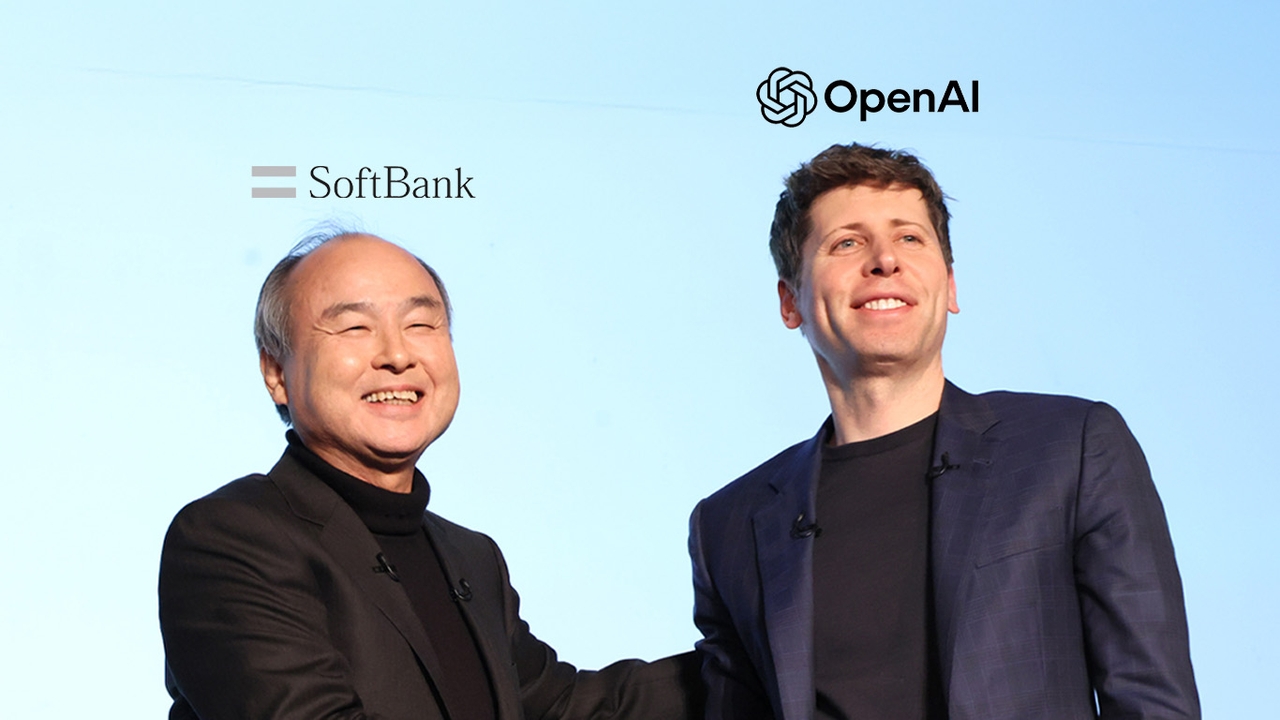

SoftBank Group, a major Japanese conglomerate, is currently in negotiations to invest up to $30 billion more in OpenAI, the developer of ChatGPT. This aligns with the plan of Masayoshi Son, the group's founder and CEO, who aims to be a leading player in the AI market. SoftBank is already one of the largest investors in OpenAI.

According to Bloomberg, SoftBank is considering additional continuous investments in OpenAI. Anonymous sources indicate the maximum investment could reach $30 billion, though this may change. The news caused SoftBank's shares on the Tokyo market to jump about 8.8% after the report was released.

Previously, Masayoshi Son has gradually sold some shares to raise funds for further investment in OpenAI, focusing on integrating AI into various devices. He sold Nvidia shares and suspended a deal to acquire the U.S.-based data center company Switch, redirecting resources to the ChatGPT creator.

SoftBank already owns about 11% of OpenAI after purchasing an additional $22.5 billion in shares last month. The initial investment deal was successfully completed in April 2025, valued at over $7.5 billion. However, SoftBank has not officially confirmed this latest investment news.

Meanwhile, OpenAI is actively seeking further funding. Recently, Sam Altman met with wealthy investors in the Middle East, aiming to raise at least $50 billion in this round, which would value the company at approximately $750 billion to $830 billion.

Although SoftBank was an early investor in AI technology, it nearly missed out on the global investment surge into hardware infrastructure such as semiconductors, rack servers, and AI processing devices. Most investment funds have concentrated on a few chip manufacturers like Nvidia and TSMC.

In recent months, SoftBank acquired Ampere Computing, a U.S. chip design company, for $6.5 billion and announced plans to buy ABB's robotics business for over $5.4 billion.

To cover these expenses, SoftBank sold some T-Mobile US shares, liquidated all its Nvidia shares, and expanded margin loan borrowing using Arm shares, a key portfolio asset, as collateral.

Earlier this month, analysts from S&P Global Ratings warned that SoftBank's heavy AI investments combined with a sharp decline in Arm's stock value late last year are significantly pressuring the company's financial creditworthiness.

Bloomberg Intelligence analysts noted SoftBank could face a credit rating downgrade due to a loan-to-value ratio (LTV) potentially reaching 35% if the OpenAI investment deal proceeds. SoftBank might need to sell assets and borrow at least $15 billion via margin loans to keep LTV below 25%.

At the same time, investment portfolio risk will increase because OpenAI could become SoftBank's largest asset, surpassing Arm, accounting for over 30% of the total portfolio value (based on Arm’s stock price as of 27 January).

Follow the Facebook page: Thairath Money at the link -https://www.facebook.com/ThairathMoney