As the Thai baht continues to show a strong appreciation trend, Deputy Prime Minister and Finance Minister Arkhom Termpittayapaisith has tasked the Permanent Secretary of the Ministry of Finance to confer with the Governor of the Bank of Thailand and the Secretary-General of the Securities and Exchange Commission to monitor the current baht situation and formulate appropriate response measures. The conclusions are as follows.

1. Since early 2025, the baht has appreciated by 9.4% against the US dollar and about 4.2% in the past month. This is due to the weakening of the US dollar after investors adjusted their expectations regarding the US Federal Reserve’s monetary policy and specific factors in Thailand, especially the foreign currency sales by gold companies following record-high gold prices, as well as foreign investors purchasing debt securities at certain times.

Currently, the daily gold trading volume has significantly increased, at times approaching the trading volume of securities on the Stock Exchange of Thailand. This has led gold companies to engage in a much higher proportion of US dollar transactions, sometimes selling net US dollars amounting to 40–50% of the country's total net US dollar sales during those periods. This has directly pressured the baht to appreciate rapidly, surpassing regional currencies and causing volatility inconsistent with economic fundamentals. The Bank of Thailand has encouraged gold trading to be conducted in US dollars to reduce the baht’s impact and has tightened foreign currency transaction regulations for gold companies, requiring major gold traders to report detailed transaction data. Nevertheless, the impact of gold company transactions on the baht remains significant.

2. Regarding management of the baht situation, the following joint conclusions were reached. They are as follows:

2.1 The Revenue Department is to consider requiring providers of investment-style gold trading platforms to submit transaction data to the department, similar to online goods or service platforms that currently report operators’ revenue electronically.

2.2 The Revenue Department is to consider the appropriateness of imposing a special business tax on gold bar sales by jewelry shops through online platforms.

2.3 The Bank of Thailand is to consider regulatory measures on gold transaction volumes, such as setting maximum transaction limits on online gold trading platforms.

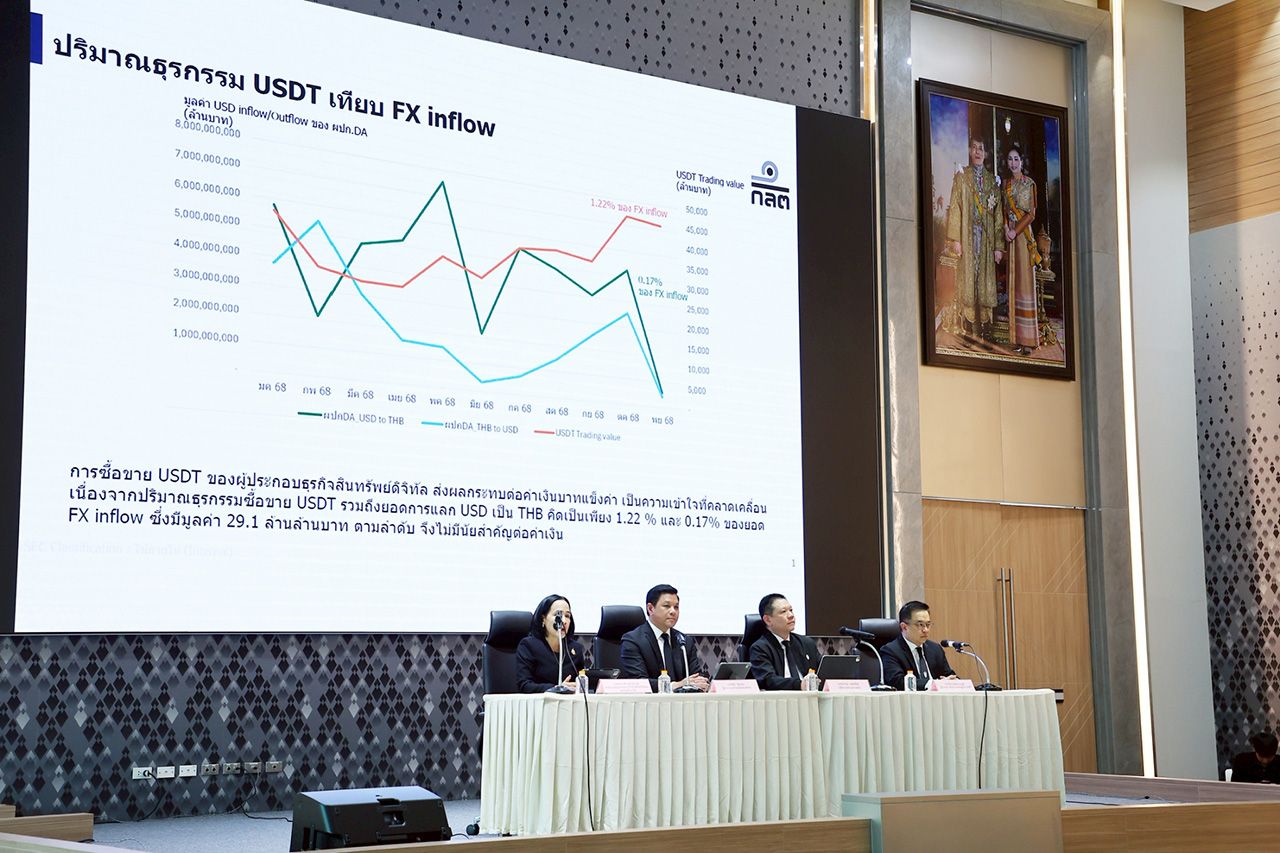

3. Regarding concerns that USDT trading through digital asset businesses affects the baht’s appreciation, the Securities and Exchange Commission clarified this is a misunderstanding. USDT trading volume and the USD to THB exchange by digital asset businesses account for only 1.22% and 0.17% respectively of the total foreign exchange inflow amounting to 29.1 trillion baht, thus having no significant impact on the baht.

Going forward, these three agencies will closely monitor the baht situation to establish suitable management strategies.

Read more news " State Policy " here.