The Office of Trade Policy and Strategy (OTPS) revealed that exports over the first 11 months grew 12.6%, valued at 310 billion USD or over 10.2 trillion baht. This growth was driven by the electronics product cycle, which propelled strong industrial goods growth and a 37.9% surge in the U.S. market. However, agricultural products contracted due to a strong baht and natural disasters. For the whole year 2025, exports are expected to grow between 11.6% and 12.1%, nearly reaching 11 trillion baht, while 2026 forecasts predict a slowdown to growth ranging from -3.3% to 1.1%.

Mr. Nantapong Jiralertpong, director of the Office of Trade Policy and Strategy (OTPS). He disclosed that Thailand's international trade in November 2025 saw exports valued at 27.4456 billion USD or 890.2 billion baht, marking the 17th consecutive month of growth at 7.1% compared to November 2024. Excluding oil-related products, gold, and defense items, exports grew by 11.8%. Imports reached 30.1725 billion USD or 991.2 billion baht, increasing 17.6%, resulting in a trade deficit of 2.7269 billion USD or 101 billion baht. Over the 11 months from January to November 2025, exports totaled 310.7 billion USD or 10.207 trillion baht, growing 12.6% year-on-year, setting a historic record. Excluding gold, oil, and defense products, growth was 13.7%. Imports were 315.7 billion USD or 10.493 trillion baht, up 12.4%, with a trade deficit of 4.956 billion USD or 86.8 billion baht.

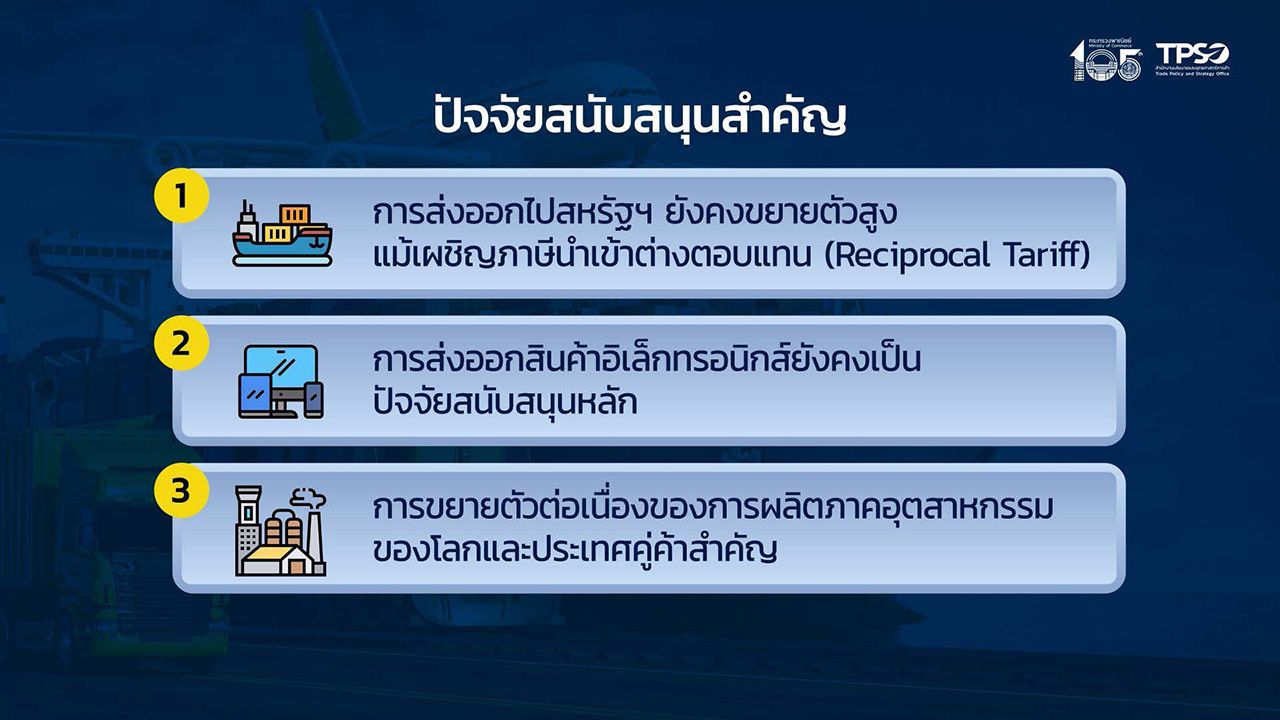

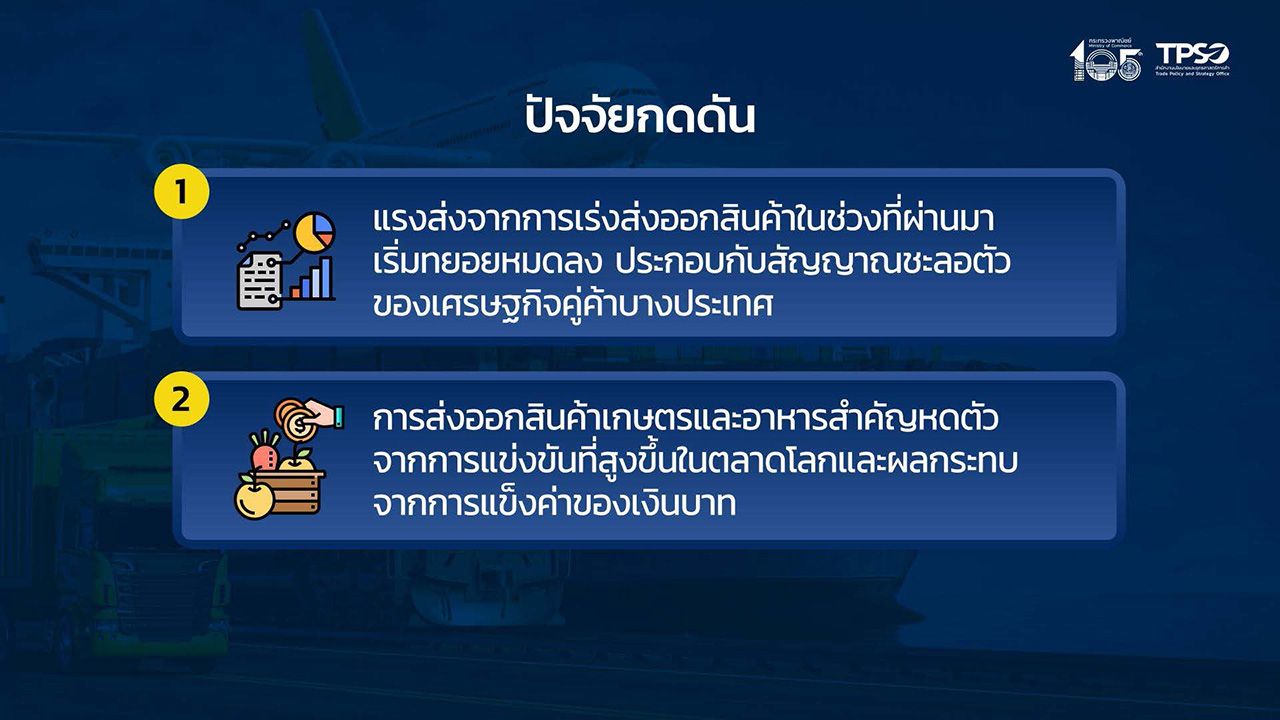

"Exports remain primarily supported by electronics following the upward cycle of computers and growth in modern technologies such as AI. This has led to sustained high expansion in industrial goods overall. However, geopolitical issues continue to create uncertainty for future trade, with signs of slowdown in key markets such as China, Japan, and CLMV (Cambodia, Laos, Myanmar, Vietnam). Meanwhile, Thai agricultural exports continue to contract due to natural disasters, intense global competition, and a strong baht, which hampers agricultural and food product exports."

Regarding November 2025 exports, which grew 7.1%, this was driven by a 12.2% expansion in industrial products, marking 20 consecutive months of growth. Key expanding products included computers, related equipment and components; gems and jewelry (excluding gold); telephones, related equipment and components; and electrical circuit boards. Agricultural and agro-industrial products contracted 9.5% due to decreases in rice, rubber, canned and processed seafood, and fresh, chilled, frozen, and dried fruits.

In export markets, most slowed down: China contracted 7.8%, the first decline in 14 months; Japan declined 8.9%, the first in 3 months; CLMV shrank 18%. However, the U.S. market continued to expand 37.9% for the 26th consecutive month, and the European Union grew 12%. Nevertheless, Thailand continued to run a trade deficit with China, totaling 6.666 billion USD in November and 60.646 billion USD over 11 months. Conversely, Thailand maintained a trade surplus with the U.S., with 4.716 billion USD in November and 46.265 billion USD over 11 months.

Mr. Nantapong further commented on the export outlook for December 2025. He said that if risk factors worsen, including trade wars, geopolitical conflicts, and the electronics product cycle, December exports could reach 25 billion USD, bringing the full-year 2025 export value to 335.707 billion USD or 10.74 trillion baht, growing 11.6%. But if conditions improve in December, exports could reach 26.5 billion USD, with the full year totaling 337.207 billion USD or 10.79 trillion baht, growing as much as 12.1%.

For 2026, OTPS forecasts exports to range from a decline of 3.3% to growth of 1.1%, influenced by the clearer impact of U.S. tax measures, price and strong baht issues affecting competitiveness, ongoing geopolitical tensions, and severe weather affecting agricultural products. Nonetheless, the Ministry of Commerce will focus on accelerating negotiations for retaliatory tax agreements with the U.S., tightening rules on product origin, cracking down on nominee businesses, and advancing free trade agreement (FTA) utilization to gain trade advantages. It will also cooperate with the private sector to push export growth amid weak demand and persistent uncertainties next year.

Read more news " Government Policy " in detail