The Government Pension Fund (GPF) is advancing legal discussions to enable "contracted management of investment funds for external agencies," with a conclusion expected by the end of this year.

Mr. Songpol Chevapanyaroj, Secretary-General of the Government Pension Fund (GPF). He revealed that currently, the law does not permit GPF to co-manage other funds, but acknowledged that there is a concept to proceed with "contracted investment management." This is now under comprehensive discussion, including reviewing new laws to enhance fund management efficiency, and considering whether GPF can assist in managing funds for other government agencies that are not GPF members. Clarity and key points of the draft law are expected by year-end, after which it will be submitted for parliamentary consideration.

To date, several government agencies have contacted GPF requesting assistance in fund management. Regarding proposals for GPF to help manage investments for the Social Security Office, no contact has been made yet. However, if approached, GPF will wait for legal readiness before considering proceeding.

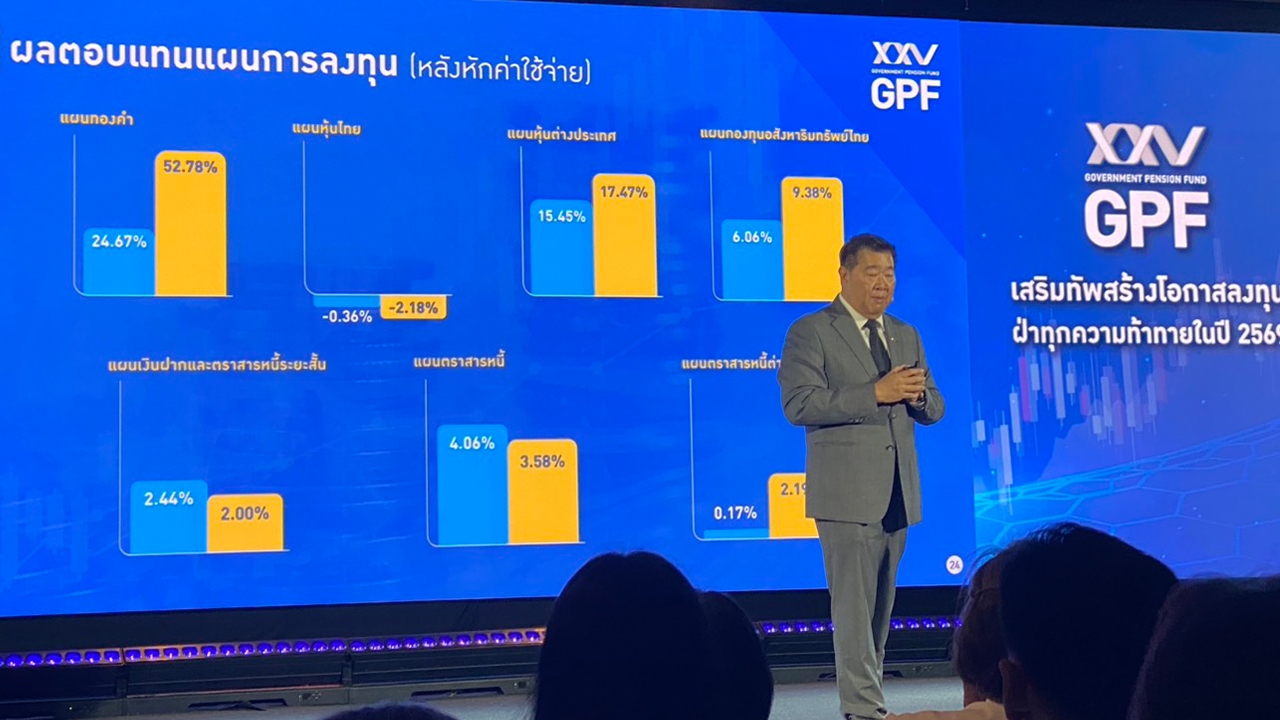

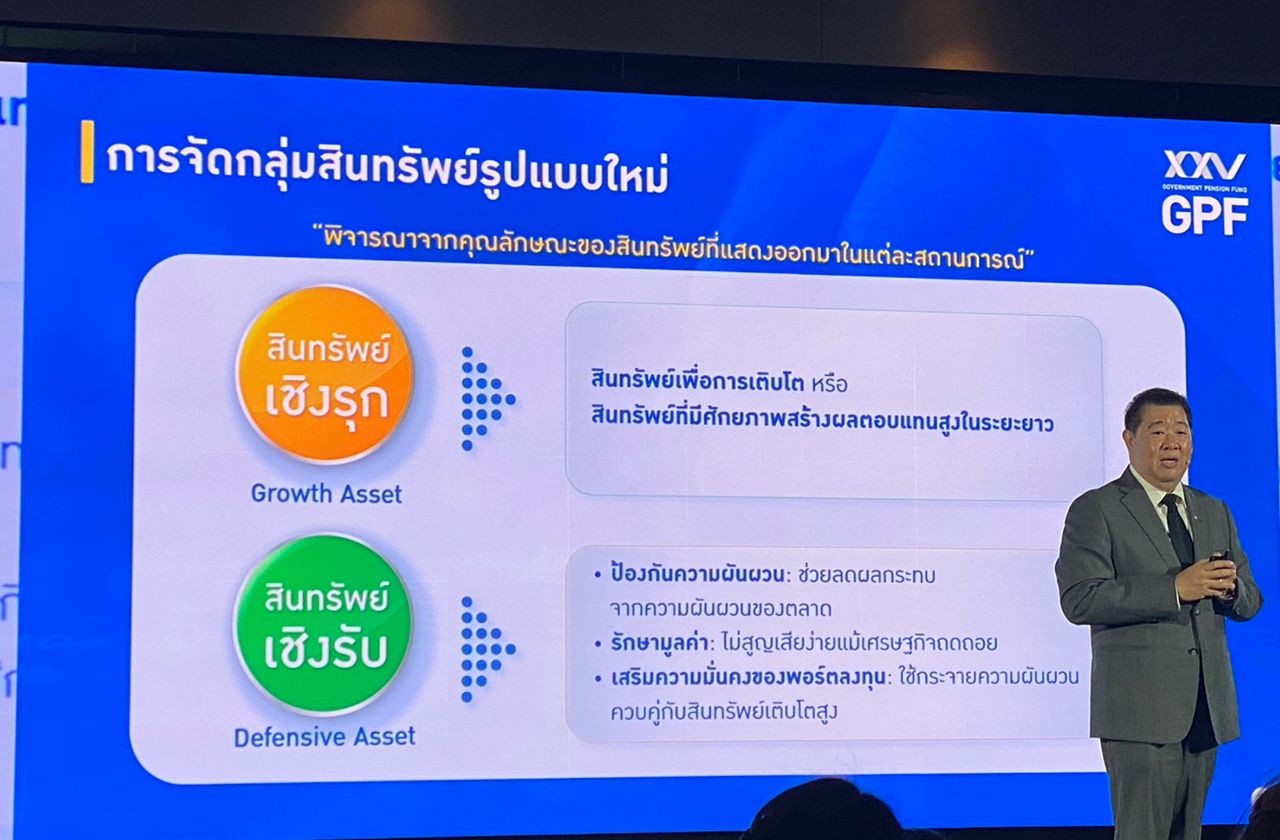

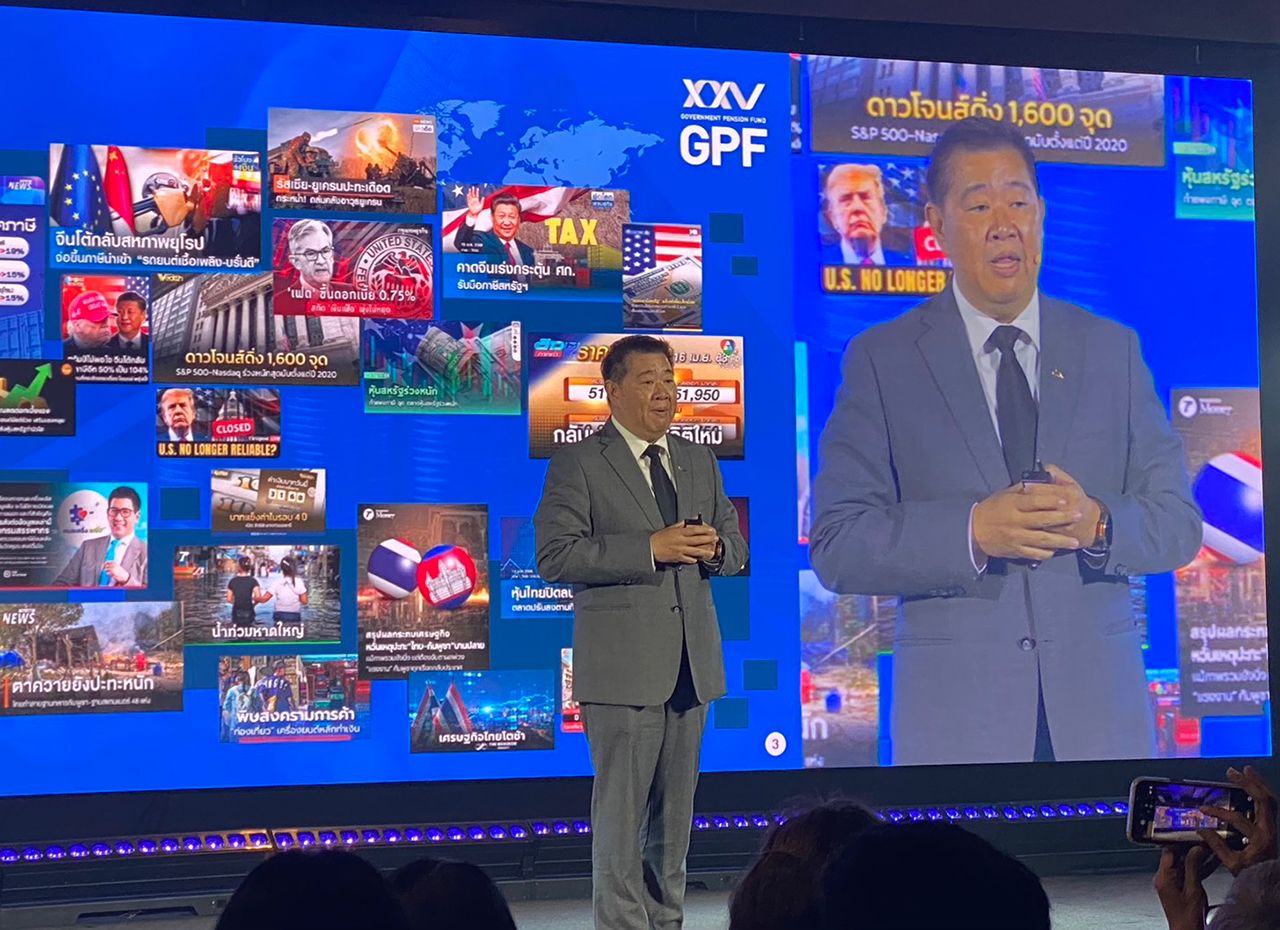

In 2025, GPF achieved an average overall member return of 5.18%, a significant increase compared to 3.91% in 2024. This resulted from adjusting plans and redefining asset structures into proactive assets focusing on economic growth and long-term returns, and defensive assets aimed at volatility protection and principal preservation. Although 2026's investment outlook presents increased challenges, GPF remains committed to developing strategies to generate returns that exceed the average 10-year inflation rate by 2-3%, aligning with member goals to strengthen financial security after retirement.

." Government policy " further