The SME Credit Guarantee Corporation (SME CGC) reported its 2025 performance, approving guarantees exceeding 40 billion baht and helping over 52,000 SMEs access loans, with 86% being micro-entrepreneurs. A key highlight was expanding guarantees to the "non-bank" sector and digital loans for the first time. Successful debt relief efforts led to a sharp rise in debt write-offs due to proactive measures. Moving into 2026, SME CGC will implement the "Quick Big Win" program with 50 billion baht to stimulate banks to increase lending, while continuing organizational enhancement plans to better support SMEs in all aspects.

Dr. Sithikorn Direksuntorn, director and general manager of the SME Credit Guarantee Corporation (SME CGC), revealed that in 2025, SME CGC approved credit guarantees totaling 40.682 billion baht under two main programs: government measures with 20.682 billion baht (51% of total guarantees) and SME CGC's own initiatives with 20 billion baht (49%). This supported 52,550 SMEs in accessing loans, of which 86% were micro-entrepreneurs, with average guarantees of 200,000 baht each, and 14% were general SMEs with average guarantees of 4.56 million baht each. This generated 52.006 billion baht in institutional loans, preserved 496,517 jobs, and created economic benefits exceeding 168.015 billion baht.

The top three industries receiving the most credit guarantees were: 1. Services sector at 32.6%, 2. Food and beverage at 10.6%, and 3. Agriculture at 8.2%. Together, these three accounted for 51% of total guarantees. The services sector showed notable growth compared to 28.4% in 2024, reflecting its role as a key driver of the country's economy.

In 2025, SME CGC pursued its mission to provide loan guarantees and debt relief for debtors whose claims it paid, through the "SME CGC Ready to Guarantee, Ready to Help" program. Toward the end of 2025, it expanded loan guarantees to non-bank entities (not subsidiaries of financial institutions) in the "nano finance" and "leasing" sectors, including captive financing from automobile companies. This broadened SME CGC's support to cover more micro SMEs. Throughout 2026, SME CGC also prepared over 3 billion baht in guarantees under the "Pick-up Brother, Warehouse Guarantee" initiative, continuously assisting micro SMEs, farmers, and small transport businesses to access pick-up truck hire-purchase loans more easily, with applications accepted until 30 December 2026.

Additionally, last year SME CGC partnered with "Good Money," a subsidiary of Government Savings Bank, to provide Thailand’s first digital lending service with full digital credit guarantee via the Good Money app. This opened access to digital loan guarantees, enabling borrowers to track their loan applications conveniently and quickly. It strengthened support for vulnerable micro SMEs, helping over 3,500 micro-entrepreneurs access loans totaling 68 million baht in guarantees, with an average loan size above 19,000 baht per borrower by the end of 2025. This reflects success in assisting small, vulnerable, self-employed micro SMEs who previously had difficulty accessing formal credit.

Another notable achievement in 2025 was SME CGC’s success in helping debtor SMEs whose claims it paid to restructure debts under the "SME CGC Ready to Help" program, launched in 2020. To date, 24,324 debtors have restructured debts totaling 16.183 billion baht, a historic high in SME CGC’s 34-year history. In 2025 alone, 5,835 debtors restructured 4.311 billion baht of debt, and 992 debtors fully cleared debts worth 125 million baht, nearly 50% of whom were vulnerable groups with principal debts under 200,000 baht. This is a significant improvement over 2024’s 119 debtors cleared, due to more flexible conditions and proactive nationwide outreach.

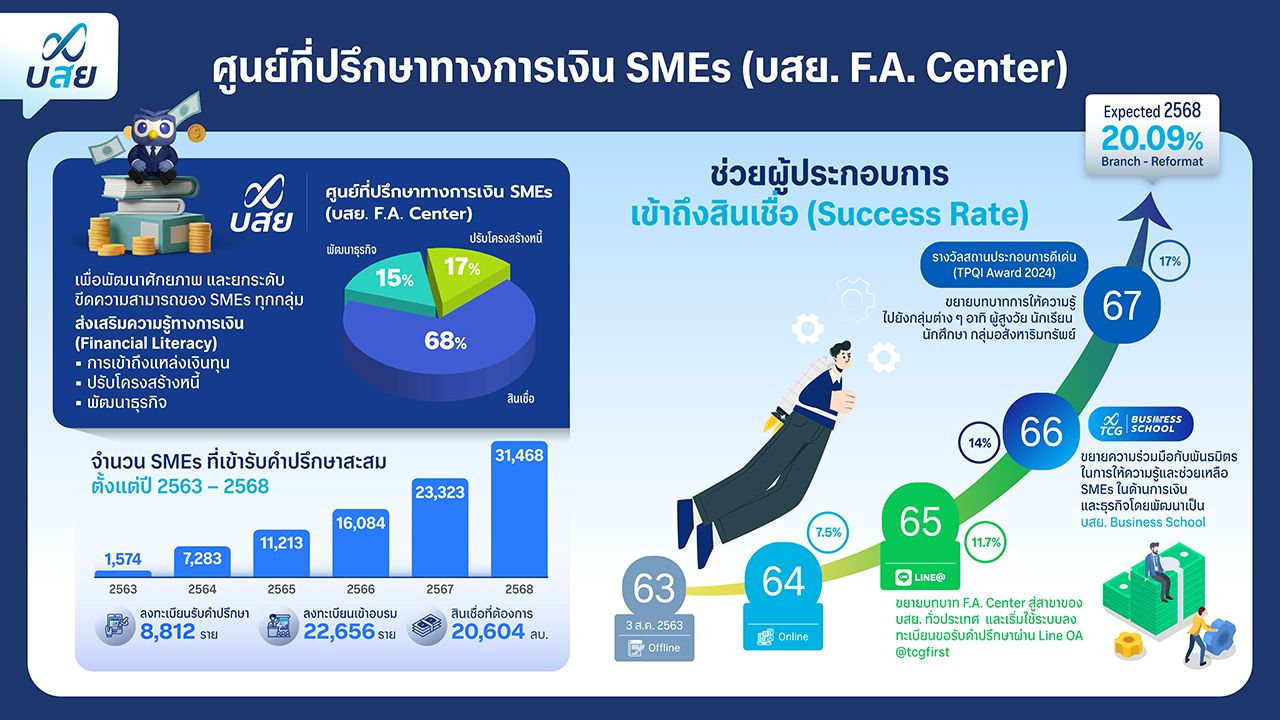

Furthermore, SME CGC emphasized enhancing SME capacities for sustainable growth through the SME Financial Advisory Center (SME CGC F.A. Center), which aims to increase SME access to formal credit. Since opening in August 2020 through 31 December 2025, the center provided financial education to 31,468 SMEs, including consultations to 8,812 and training to 22,656, with total loan demand of 20.604 billion baht. It achieved a loan success rate exceeding 20%.

In mid-December 2025, SME CGC launched the "Quick Big Win" credit guarantee program with 50 billion baht, approved by the Cabinet on 2 December 2025, to stimulate the grassroots economy and unlock SME access to formal credit. Since opening for applications in mid-December, the program achieved remarkable success, approving guarantees worth 10 billion baht by 2 February 2026—just 48 days later. This demonstrates SME CGC’s guarantee mechanism effectively increases loan approval rates, especially for micro SMEs lacking collateral or guarantors, facilitating easier credit access. SME CGC plans to continue supporting SMEs with this program throughout 2026.

"The Quick Big Win program is a special measure amid economic fluctuations to encourage financial institutions to lend by offering higher claim payments compared to other guarantee schemes. It absorbs credit cost risks and enhances credit opportunities for both SMEs and lenders, reducing loan rejection rates and boosting lender confidence to extend credit to SMEs," said Dr. Sithikorn.

Moreover, SME CGC operates the "SMEs Credit Boost Guarantee Mechanism" project, launched on 15 January 2026. SME CGC acts as a central coordinator linking financial institutions and SMEs, leveraging its 34 years of experience and expertise in SME credit guarantees to implement the project effectively.

." Government Policy Additional