In early 2026, newly established businesses surged to 8,418, highlighting technology, energy, and health sectors as key opportunities. Foreign investors continued to pour funds into Thailand, with initial investments exceeding 33.3 billion baht in the first month.

The Department of Business Development revealed analysis of new business registrations in January 2026, showing 8,418 new businesses—an increase of more than 62% from the previous month—with total registered capital of 24.376 billion baht. The economy started the year brightly, identifying five rising business sectors expected to grow strongly. Meanwhile, foreign investment also expanded, totaling over 33.779 billion baht.

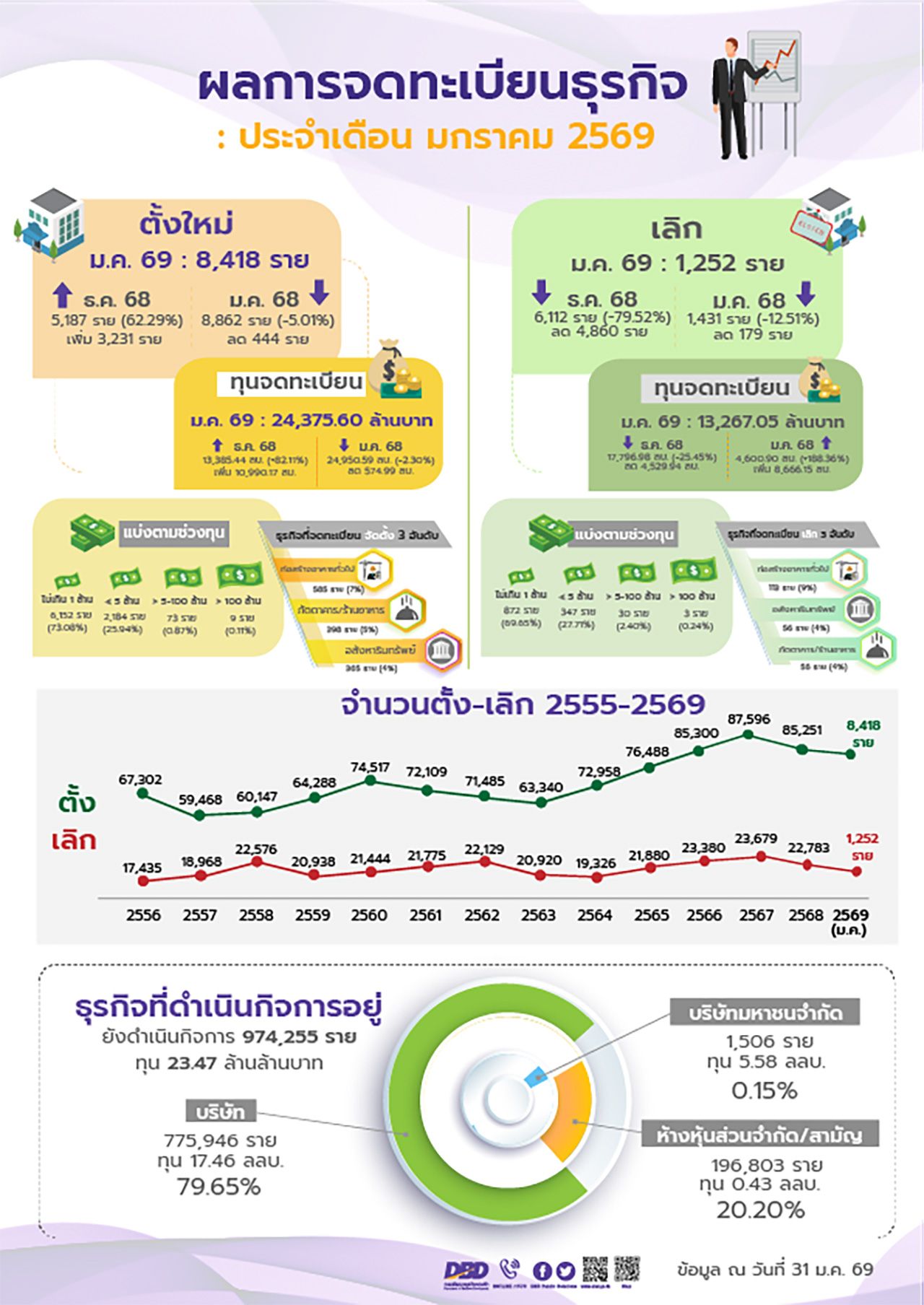

Mr. Poonpong Nainapakorn, Director-General of the Department of Business Development, Ministry of Commerce, disclosed analysis of new business registrations in January 2026. There were 8,418 new businesses, up 3,231 businesses or 62.29% from December 2025 (5,187 businesses). Compared year-on-year to January 2025 (8,862 businesses), there was a decrease of 444 businesses or 5.01%.

Registered capital stood at 24.375 billion baht, an increase of 10.99 billion baht or 82.11% compared to December 2025 (13.385 billion baht). Compared to January 2025 (24.950 billion baht), it decreased by 575 million baht or 2.30%.

There were two legal entities newly established with registered capital exceeding 1 billion baht, totaling 9.05 billion baht: 1) Siam Bioscience Co., Ltd. with 5.05 billion baht in capital, engaged in experimental research and development in biotechnology; and 2) Tawilap 698 Co., Ltd. with 4 billion baht in capital, operating in electricity energy business including trading, delivery, procurement, exploration, development, transformation, and planning.

Analyzing growth rates of new business establishments compared year-on-year, three business types showed notable expansion: 1) Other support services not classified elsewhere had 238 businesses, increasing by 195 or 453.49%, with registered capital of 118.30 million baht; 2) Restaurants had 398 businesses, up 62 or 18.45%, with capital of 626.49 million baht; and 3) Accounting and auditing services, including tax consulting, had 177 businesses, up 46 or 35.11%, with capital of 99.15 million baht.

Business registrations for closures in January 2026 totaled 1,252, a decrease of 4,860 or 79.52% from December 2025 (6,112 closures). Compared year-on-year to January 2025 (1,431 closures), there was a reduction of 179 or 12.51%.

Capital for business closures in January 2026 was 13.267 billion baht, down 4.53 billion baht or 25.45% from December 2025 (17.797 billion baht). Compared year-on-year to January 2025 (4.601 billion baht), it increased by 8.666 billion baht or 188.36%.

One legal entity with registered capital exceeding 1 billion baht closed operations: Phitsanulok Big C 2015 Co., Ltd., with registered capital of 10.478 billion baht, operating in discount store and supercenter business.

(Data as of 31 January 2026) There are a total of 2,058,497 registered legal entities with combined registered capital of 31.95 trillion baht. Of these, 974,255 are active businesses with registered capital totaling 23.47 trillion baht. These include 775,946 limited companies (79.65% of active entities) with 17.46 trillion baht capital; 196,803 limited and ordinary partnerships (20.20%) with 0.43 trillion baht capital; and 1,506 public limited companies (0.15%) with 5.58 trillion baht capital.

Among active legal entities, the largest sector by registration is services, with 529,392 businesses and 13.70 trillion baht capital; followed by wholesale/retail trade with 319,154 businesses and 2.62 trillion baht capital; and manufacturing with 125,709 businesses and 7.14 trillion baht capital—accounting for 54.34%, 32.76%, and 12.90% respectively of active entities.

In 2026, despite ongoing volatility in the Thai and global economy, the Department identifies five business sectors with strong market opportunities, consumer demand, and long-term growth potential:

1) Technology and Digital Transformation businesses show continuously rising registrations, aligning with organizations adopting artificial intelligence (AI) to enhance efficiency. The expansion of data centers and cloud computing positions Thailand as a strategic investment destination. Cybersecurity, with its complex requirements, is also growing to protect large-scale data.

2) Renewable energy businesses, solar power, and energy storage systems are expanding. The green electricity market now includes direct power purchase agreements (Direct PPA). Solar cell businesses have shifted from reducing electricity costs to exporting under the Carbon Border Adjustment Mechanism (CBAM), effective 1 January 2026. Battery Energy Storage Systems (BESS) help store power for peak times or low production periods, with AI optimizing energy management.

3) Health and pharmaceutical businesses benefit from societal aging and increased consumer health awareness, driving growth. Companies must adapt to market needs, offering affordable products or supplementary services that connect consumers to their offerings, encouraging trials and loyalty.

4) Tourism and recreation remain key drivers of Thailand’s economy. Thai operators can capitalize on experiential tourism that leaves lasting impressions, encouraging word-of-mouth and repeat visits. Comprehensive wellness services—such as spas, health rehabilitation, nutrition, preventive rest programs, and family- and elder-friendly services—are strengths. Flexible packages and service reviews can build global customer trust and attract visitors.

5) Smart agriculture and high-value, safe food sectors show outstanding growth potential. Smart agriculture reduces costs and climate risks through precise water, fertilizer, and pest management, boosting yields and stabilizing income. High-value food grows with health trends, aging populations, and niche demands such as alternative proteins, supplements, and personalized nutrition. Products emphasize quality and traceability over low cost, offering Thai producers a chance to enter premium global markets.

Foreign investment in Thailand in January 2026

Under the Foreign Business Act B.E. 2542 (1999), which regulates foreign business operations in Thailand, 113 foreign business permits were granted in January 2026. This includes 24 licenses issued under the foreign business permit scheme and 89 certificates of foreign business operation granted through investment promotion laws, industrial estate regulations, or international treaties. Total investment amounted to 33.779 billion baht.

In January 2026, permit approvals increased by 10 businesses (10%) compared to January 2025 (103 businesses), and investment value rose by 10.619 billion baht (46%) from January 2025 (23.160 billion baht).

The top five investing countries in Thailand are: 1) China with 26 businesses (23% of foreign businesses) investing 5.390 billion baht; 2) Japan with 25 businesses (22%) investing 15.315 billion baht; 3) the United States with 16 businesses (14%) investing 420 million baht; 4) Singapore with 12 businesses (11%) investing 5.513 billion baht; and 5) Hong Kong with 10 businesses (9%) investing 587 million baht. Other countries account for 24 businesses (21%) investing 6.554 billion baht.

Investment in the Eastern Economic Corridor (EEC) under the Foreign Business Act in January 2026 involved 38 businesses, representing 34% of foreign investors in Thailand. This is an increase of 9 businesses (31%) compared to January 2025 (29 businesses). Investment in the EEC totaled 14.637 billion baht, or 43% of total foreign investment. Investors include 19 from China (5.293 billion baht), 5 from Singapore (4.310 billion baht), 5 from Japan (1.306 billion baht), and 9 from other countries (3.728 billion baht).

Read more news " Government Policy " updates