The Bank of Thailand is monitoring unusual cash withdrawals reaching up to 250 million baht, with specific demands for 500-baht notes only. It is currently investigating the financial flows and has forwarded the matter to the Anti-Money Laundering Office and the Election Commission. The bank is preparing new regulations to cap withdrawal limits and require inquiries into the purpose of cash usage, aiming to curb illicit funds.

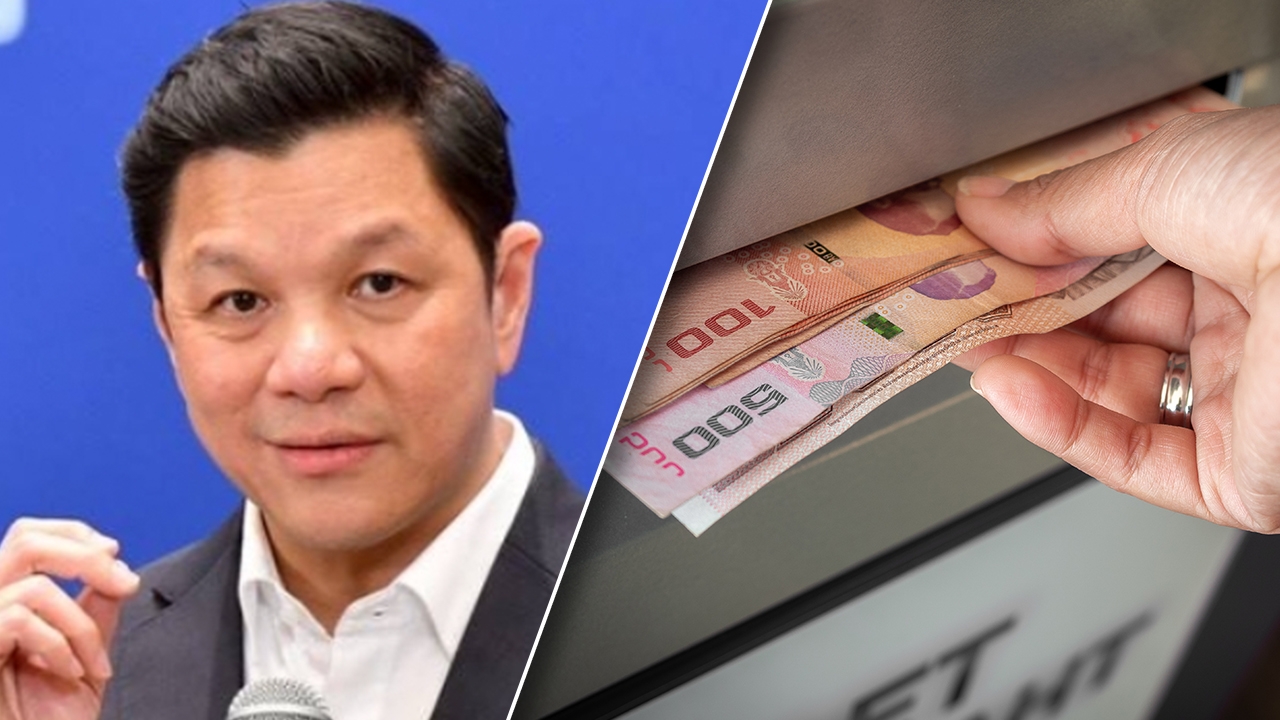

On 28 January 2026, Mr. Vichai Ratanakorn, Governor of the Bank of Thailand, said the bank is accelerating measures to address illicit funds and the informal economy, which significantly impact the country’s economic structure and stability, especially the use of large amounts of cash potentially linked to corruption, bribery, and illegal activities.

As the issuer of banknotes and originator of the monetary system, the Bank of Thailand is directly involved in the circulation of cash in the economy. Although it currently cannot view all money transfer transactions of the public,

it can extract data on suspicious transactions reported by commercial banks and forward this information to legally empowered agencies such as the Anti-Money Laundering Office or the Election Commission.

Mr. Vichai said that over the past 10 days, the Bank of Thailand has requested cooperation from all commercial banks to report abnormal cash withdrawals from around two weeks ago until the end of February initially.

Although the Bank of Thailand does not yet have direct legal authority in this matter, it is exercising indirect supervisory powers to trace financial flows—an authority it held and exercised in the past before pausing for several decades.

Preliminary data shows large cash withdrawals ranging from tens of millions to over 200–250 million baht. In some cases, there were specific requests for only 500-baht banknotes, figures inconsistent with ordinary transactions.

The Bank of Thailand is therefore investigating these financial flows. If irregularities are found, it will forward the data to the Anti-Money Laundering Office, and if election-related, to the Election Commission as well. The bank emphasized that these actions are not politically targeted but aim to resolve issues related to undesirable cash transactions.

In the next two to three months, the Bank of Thailand plans to introduce new regulations setting limits for cash withdrawals exceeding a certain amount, such as 3 million or 5 million baht, with the exact figure still under consideration.

Commercial banks will be required to verify and inquire about the purpose of cash withdrawals and conduct profiling to assess whether the cash use aligns with the customer’s business nature or status.

If the withdrawal is for business purposes that legitimately require cash, transactions can proceed normally. However, for individuals withdrawing large amounts, banks must ask and clearly record the intended use.

"Currently, most asset purchases can be made via transfers or checks, so there is hardly any reason to use large amounts of cash unless absolutely necessary," Mr. Vichai said.

Additionally, the Bank will tighten controls on cash exchanges through money changers by setting limits of no more than 800,000 baht and 200,000 baht in border areas to prevent illegal cash from entering the financial system.

Regarding e-Money and e-Wallet transactions, data will be linked to the CFR system, and transfers must undergo profiling according to KYC levels, matching the customer’s occupation and income. For example, small retailers should not have transfers of several million baht per transaction, as these would be suspicious and subject to investigation. These measures will start in January 2026.

At the same time, the Bank plans to issue guidelines on "gray money patterns" next month, targeting unusual financial transaction patterns inconsistent with profiling, such as high-value or high-frequency transactions.

Mr. Vichai added that regarding digital asset trading like USDT and USDC, suspicious data shows that over 40% of transactions in the Thai market are by foreigners. This raises questions as to why these foreigners do not transact through their own countries’ markets, such as Singapore or Hong Kong.

This may relate to attempts to bypass normal money transfer systems. The Bank has requested additional information from the Securities and Exchange Commission to further investigate these financial flows.