The government encourages income earners to file personal income tax forms Por Ngor Dor 90/91. Late filings will incur fines plus surcharges. If intentional tax evasion is found, penalties include imprisonment of up to 1 year, fines up to 200,000 baht, or both. A warning has also been issued to watch out for scammers impersonating tax officials.

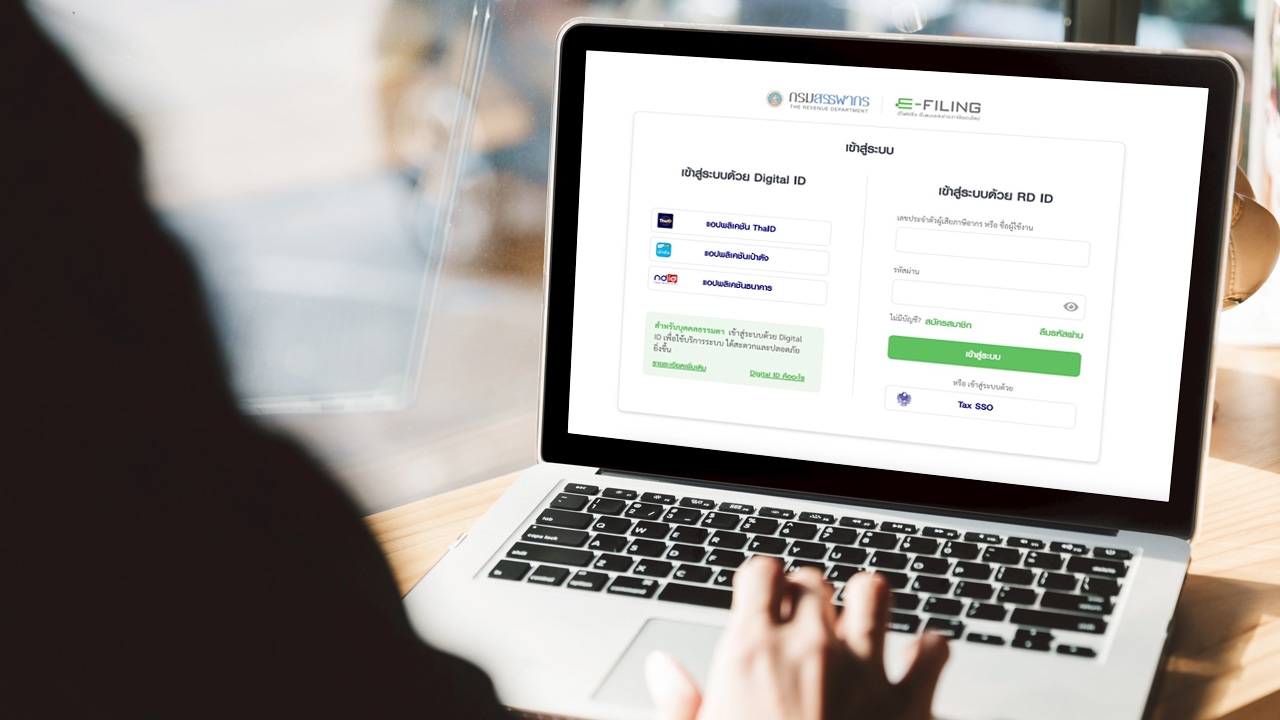

On 26 Jan 2026, Ms. Airin Panrit, Deputy Spokesperson of the Prime Minister's Office, announced that the government invites entrepreneurs, online vendors, YouTubers, and influencers with income in 2025 to file their Por Ngor Dor 90/91 tax returns. Those filing via the Revenue Department's website can use the e-Filing and D-MyTax (Digital MyTax) systems, which enhance service quality and allow electronic submissions from now until 8 April 2026. Paper filings can be submitted until 31 March 2026.

Taxpayers owing 3,000 baht or more may apply for installment payments in three parts. If taxes are not filed by the deadline, the taxpayer must pay the tax plus a 1.5% monthly surcharge or fraction thereof, along with fines. Penalties for evading filing or providing false information are as follows:

1. Failure to file or pay taxes on time results in a fine up to 2,000 baht plus a 1.5% monthly surcharge.

2. Intentional tax evasion may result in imprisonment up to 1 year, a fine up to 200,000 baht, or both.

3. Providing false information carries penalties of imprisonment from 3 months to 7 years and fines ranging from 2,000 to 200,000 baht.

“Paying taxes is a duty of individuals to the state under the Constitution, providing revenue for national development and creating opportunities for underprivileged and other members of society. We emphasize that those who intentionally fail to pay taxes face both civil and criminal penalties. The government invites income earners to file Por Ngor Dor 90/91 tax returns from now until 31 March 2026. Online filings via D-MyTax or e-Filing are accepted until 8 April 2026.”

Those with questions can contact any Revenue Department office nationwide or the Revenue Department Intelligence Center at phone number 1161. All salaried individuals are obligated to file tax returns with the Revenue Department. Failure to file may result in criminal fines. The public is urged to be cautious as scammers impersonating the Revenue Department have been sending emails claiming tax relief programs and requesting users to confirm their rights by entering usernames, passwords, or personal information to steal sensitive data. Citizens should not be deceived, should not click links or enter information.