The Excise Department is preparing to implement the Fast Track product import declaration system for importing up to 10 liters of wine, expected to be fully operational by May 2026, without affecting local traditional liquors.

For travelers who enjoy sampling beverages from different countries, this information is important.

As the Excise Department advances its digital public service, it is preparing to launch the “Fast Track product import declaration system.” This system enhances convenience and speed for passengers bringing in up to 10 liters of chilled wine from abroad.

Dr. Pornchai Theerawet, Director-General of the Excise Department, visited to inspect and prepare for the implementation of the Fast Track product import declaration system, an important mechanism to upgrade government services and facilitate international passengers wishing to import chilled wine, for personal samples or non-commercial purposes, in amounts not exceeding 10 liters. The inspection also checked readiness for data linkage with the Customs Department at Suvarnabhumi Airport, with plans to extend the system to Don Mueang, Chiang Mai, Phuket, and Hat Yai airports to standardize operations nationwide.

The use of digital technology under the Fast Track system aims to facilitate tax payment, reduce waiting times, improve data accuracy by replacing manual records with digital processing, and verify the correctness of excise stamp application.

The system is expected to be fully operational by early May 2026.

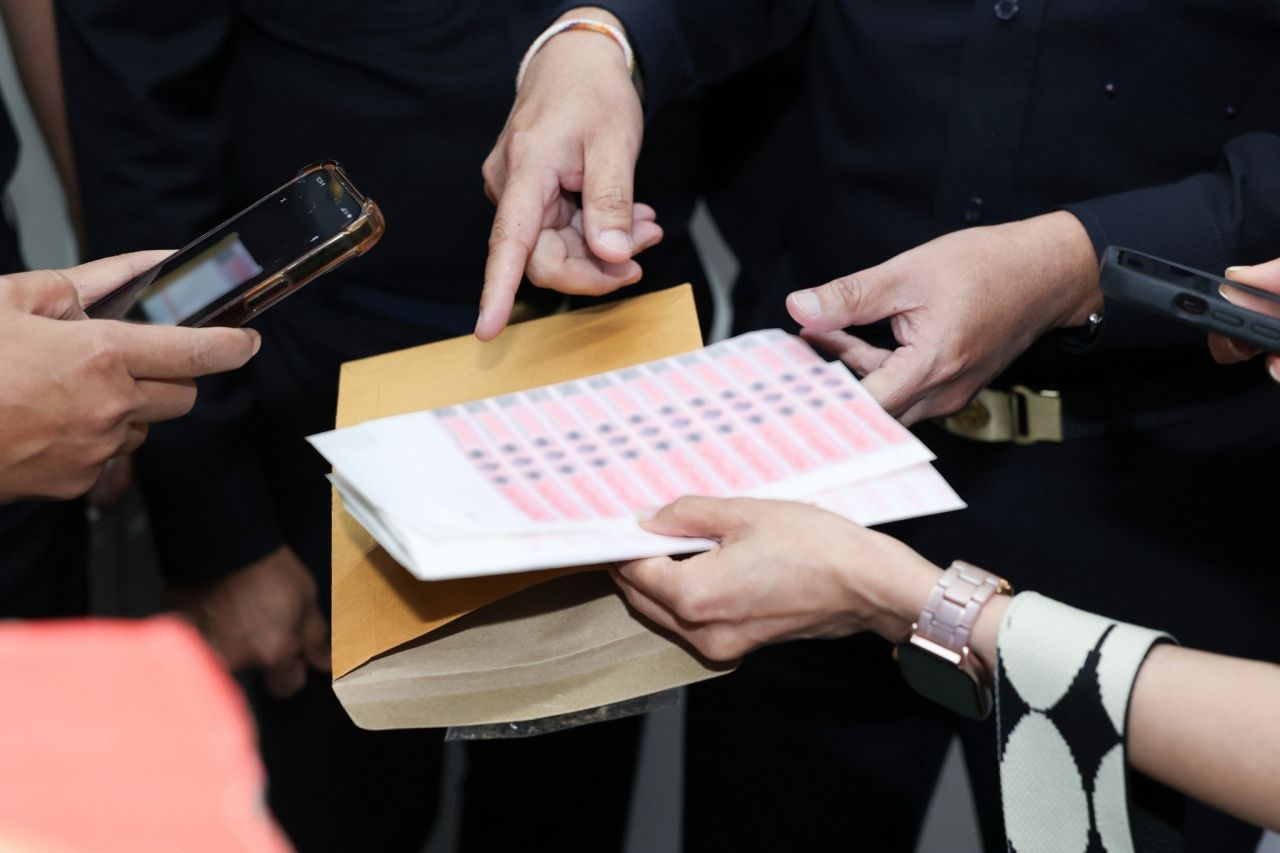

Meanwhile, while the system is still under development, passengers bringing any type of liquor into the country in amounts over 1 liter but not exceeding 10 liters can still declare their imports by filling out forms at the customs declaration counters at international airports to pay excise tax. The Excise Department has prepared paper forms for this purpose. Passengers can complete these and submit them to customs officers at the declaration counters to pay taxes immediately.

What benefits do passengers importing up to 10 liters of chilled wine receive?

They can use the Fast Track system to check preliminary wine value data, excise tax, local taxes, and related fund contributions, and confirm the product details and tax amount payable directly through the system.

1. Passengers can access the system via the Excise Department website (www.excise.go.th) or through a mobile application.

2. Then, customs procedures are conducted in the arrivals hall at the customs declaration (red channel) counters, where officers verify accuracy before issuing excise stamps to be affixed to the wine bottles as legal proof of tax payment.

If passengers bring in any type of liquor purchased abroad in amounts not exceeding 1 liter, they are exempt from duties and may proceed through the green channel (Nothing to Declare).

Once the Fast Track system is operational, international travelers will be able to use it, enhancing convenience, speeding processes, and improving efficiency without impacting local traditional liquors. The system will make tax payment faster, more transparent, and more efficient.

Meanwhile, Ms. Airin Panrit, Deputy Spokesperson for the Prime Minister's Office, warned the public not to fall for fake websites or applications, especially those falsely claiming to offer Fast Track system downloads or installations through unofficial channels. Currently, the system is still under development and is not available for download or use via any website or application. Once the Excise Department completes the system and is ready to launch, an official announcement will be made.